Buy Trican Well Services (TCW.T)

One of my top three investment stories for 2018 is the continued recovery I see in oil prices. Just to quickly review my thesis a combination of OPEC cutbacks, lack of investment in new oil fields, shrinking inventories, and continued robust demand growth will lead to higher oil prices next year.

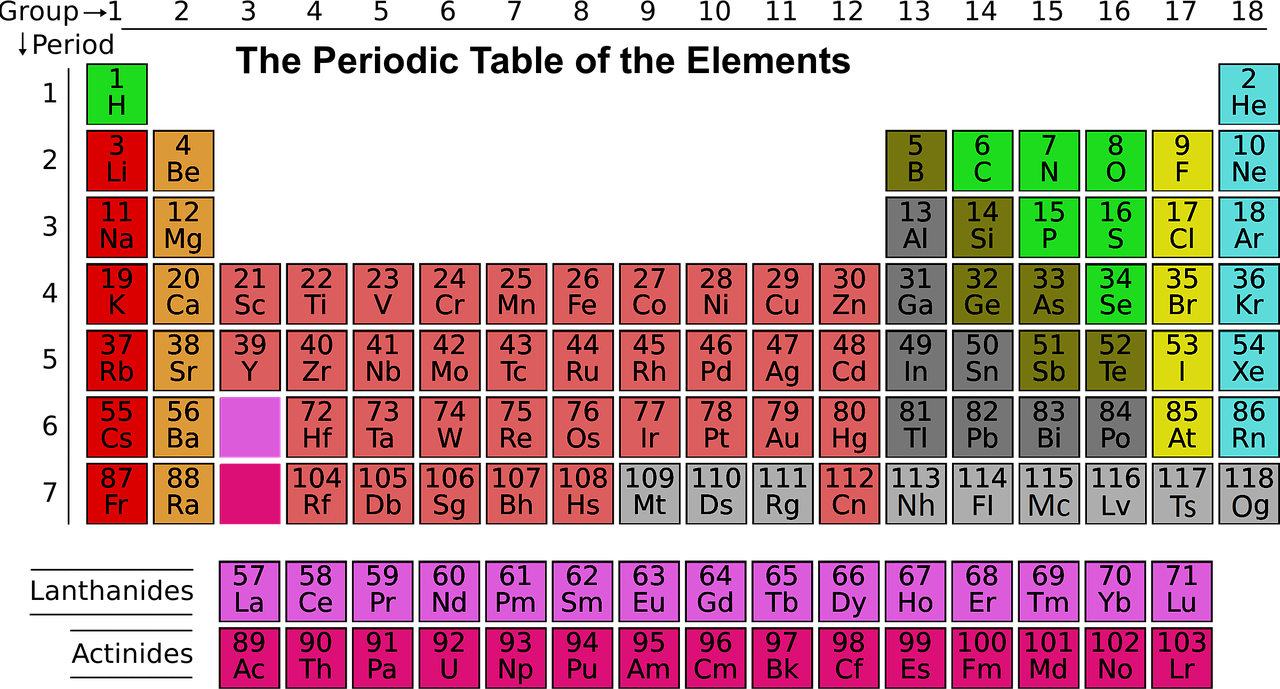

The data that I am following is centered on comparative inventories. As inventories come in we see the correspondent rise in oil prices. Excellent work on projecting the oil price based on comparative inventories has been done by Art Berman and Goehring & Rozencwajg Associates. Look at the chart above, the blue line represents the five year average liquids inventory. The green line represents the current year inventories. When we compare the two we can plot this on a dot plot and infer from previous data points where the oil price has traded in the past. The tweet below from Art Berman shows this comparison.

Comparative inventory fell -10.4 mmb this week during early product re-stocking period.

Main factors were -6.5 mmb crude decrease & +4.5 mmb consumption increase. Gasoline & distillate C.I. both decreased.

#OOTT #oilandgas #oil #WTI #CrudeOil pic.twitter.com/2YkxXIVjFY— Art Berman (@aeberman12) December 20, 2017

As can be seen from the dot plot that I have included from Art Berman, as the comparative inventory of liquids falls you can see how the price goes up. By comparative inventory I mean the current liquids inventory as it relates to the five year average inventory.

Ok I briefly showed you why I think oil prices are going higher. The question is how is this actionable? Normally when oil prices head higher capital would be attracted to the sector and we would expect to see oil and oil service stocks moving higher. We are not really seeing this so far.

The reason I think oily stocks are not moving concurrently higher with the oil price is because the downturn in oil prices was so profound and for so long that it is a once bitten twice shy scenario for quite a few money managers and investors. However, this is perfect setup for speculators as we can step in and take advantage of the mispricing that I believe currently exists.

I already own two oil services companies TMK Group and Ensco. I am adding another oil services company to the portfolio. I like oil services because as the oil industry recovers I get to supply the tools and services to the industry rather than trying to determine which oil company has the best geologists, management, or properties. If a well gets drilled and serviced I get paid regardless if the well produces a profit.

The company I am adding is Trican Well Services (TCW.T). The company is based in Canada where it has most of its operations. Trican is primarily a pressure pumping company and provides fracking services to oil and gas companies.

Like other oil service companies Trican took a shellacking during the oil price collapse the past several years. However recent financial performance indicates Trican has turned the corner financially and is currently profitable and is generating growing cash flow.

It is my view that investors are ignoring the improvement in Trican’s business and as the price of oil has risen the stock price of Trican has lagged. This presents a very nice opportunity. If the oil price were to rise or even just stay where it at than Trican has substantial upside potential.

Trican’s business is already turning around as can be seen from the latest quarterly earnings report.

As I stated above the share price is not necessarily reflecting the recovery in the oil price or in Trican’s business. Currently Trican is expected to grow cashflow as its business projects to be growing in 2018 and management expects pricing for it’s services to stay firm or grow slightly.

The management of Trican recognizes the undervaluation of the company shares and back in September 2017 instituted a normal course issuer bid for the purchase of up to 10% of its own stock. From the company press release:

(skip)

“The Bid has been put in place because the Company believes that the Common Shares are a good investment for the Company in the context of equity market conditions and preferable to reinvestment of excess cash flow into additional equipment. All Common Shares purchased through the Bid will be returned to treasury for cancellation.

As at September 21, 2017, there were 346,585,368 Common Shares issued and outstanding. The number of Common Shares which may be purchased during the period of the Bid will not exceed 34,274,375 Common Shares, which is approximately 10% of the public float for the Common Shares. The public float for the Company’s Common Shares as at September 21, 2017 was 342,743,746. Except as permitted under the TSX rules, the Company will not purchase on any given trading day under the Bid more than 458,628 Common Shares, being 25% of the average daily trading volume of the Common Shares on the TSX for the six calendar months ended August 31, 2017 of 1,834,515 Common Shares.”

This will have the added benefit of raising the earnings per share of the company. If you want to track the Trican’s process on buying back shares you can go to the “Canadian Insider” website and type in Trican and information will come back showing the history of buybacks and the number of shares.

Also check out this interview with Eric Nutall who is a fund manager in Canada. He has some interesting things to say on the oil market and Trican in particular.

I am long Trican Well Services (TCW.T)