Editors note: This article was written in January of 2018. I have added updates in the article as new information has become available.

Part 1 Uranium

My number one top stock idea for 2018 is uranium. I will admit that I have been early in recommending uranium as a speculative idea. However, with recent industry news I now believe sufficient catalysts are in place to propel uranium and uranium stocks higher in 2018.

Is The Bear Market Over?

Uranium has been in a severe bear market for over six years. This is the direct result of the nuclear accident which occurred at the Fukishima Diachi reactors on 3/11/2011. After the accident the Japanese basically turned off all 54 of their reactors pending review of engineering and safety standards.

This sudden shutdown of the Japanese reactor fleet, which supplied 30% of Japans electricity, caused an oversupply in the market for uranium. Obviously if uranium is not being used in Japanese reactors it begins to pile up. A glut was created.

Originally the Japanese continued to honor long term purchase agreements but soon decided to cancel continued purchases of uranium.

This oversupply coupled with the leading producer, Kazakhstan continuing to increase production into an oversupplied market put further downward pressure on prices over the last few years.

Further pressuring prices was the Obama administration’s decision to sell off the Department of Energy uranium stockpile. Another government brilliant move selling at the bottom of a market.

As time passed the price continued to drop. In fact, the price dropped to a low of $18 per pound late last year.

Update 9/2/2018: Japan has nine reactors operating and intends to bring on additional reactors as they pass safety inspections.

Low Prices Cure Low Prices Always

As expected low prices are the cure for low prices and the seeds for the next bull market have been planted. For example:

Low uranium prices have bankrupted several uranium mining companies i.e. Paladin Energy.

Update 9/2/2018: Paladin emerged from bankruptcy recently and trades on the ASX. The company has its Langer-Heinrich mine in Namibia on care and maintenance.

In early 2017 Kazatomprom, the government agency responsible for uranium production in Kazakhstan declared it would cut production of uranium by 10%. In a statement the CEO said the following:

“While the outlook for nuclear energy growth continues as strong as it has been for many years, the realities of the near-term uranium market remain in oversupply,” Zhumagaliyev said. “KazAtomProm and its joint venture partners have had to make responsible decisions in light of these market challenges. These strategic Kazakh mineral assets are far more valuable to our shareholders and stakeholders being left in the ground for the time being, rather than adding to the current oversupply situation. Their greater value will instead be realized when produced into improved markets in the coming years.”

Update 12/4/17:

Kazatomprom announces additional production cuts

Kazakhstan’s state-owned uranium producer Kazatomprom said it will cut production by 20 per cent over the next three years, as the market struggles with oversupply of the nuclear fuel.

The cuts will amount to 11,000 tonnes of uranium and will start in January, the company said. The reduced output next year will be equivalent to around 7.5 per cent of total global supply, the world’s largest producer said.

(skip)

Galymzhan Piramatov, chairman of the management board at Kazatomprom, said: Given the challenging market conditions, and in light of continued oversupply in the uranium market, we have taken the strategic decision to reduce production in order to better align our production levels with market demand. We believe that these measures strongly underline our commitment to ensuring the long-term sustainability of uranium mining; a critical component in the generation of clean, carbon free electricity around the globe.

After the election of Donald Trump, his Energy Secretary Rick Perry, rolled back a large chunk of the planned Obama Administration uranium sales from the Energy Department stockpiles.

The Big Catalyst

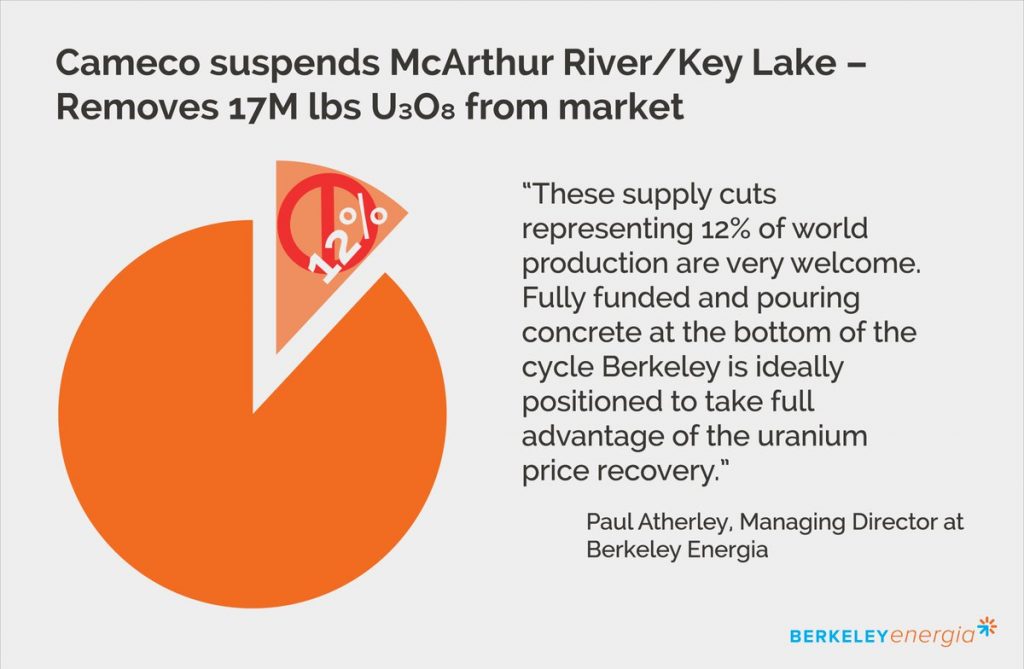

However, the biggest news on the supply front was the recent announcement by Cameco, which is one of the largest nuclear fuel producers in the world, that it would be shutting down production at its McArthur River and Key Lake uranium facilities for at least ten months.

This is a big deal as the production from these facilities is around 14-15 million pounds per year. The CEO of Cameco said the following;

“With the continued state of oversupply in the uranium market and no expectation of change on the immediate horizon, it does not make economic sense for us to continue producing at McArthur River and Key Lake when we are holding a large inventory, or paying dividends out of proportion with our earnings,”

This shutdown represents almost 12% of the world supply of uranium. What would happen if OPEC announced they were cutting production sufficiently to remove 12% of oil production from world markets? I would suggest the price of oil would soar!

Update 9/2/2018: On 7/25/18 Cameco announced the suspension of operations at the McArthur River Mine and placed the mine on care and maintenance.

An Industry In Liquidation

To summarize the supply side situation of uranium; the price is now so low that even the lowest cost producers cannot make money. The industry is now being rational and shutting down production. This will eventually cure the low price environment as excess supply is taken off market.

In addition, uranium mining is a depleting asset. Every pound that is mined must be replaced in order for the mining company to stay in business. At these low prices there is no new supply being developed. The industry is basically in liquidation.

It has been estimated that in order for new supply to be developed that a sustained uranium price of $60-70 per pound would have occur in order to attract sufficient capital to the industry to meet future demand.

What About Demand?

The supply side story looks excellent for uranium but what about the demand side? Let’s start with Japan. As was noted above the Japanese government ordered all nuclear reactors to shutdown after the Fukishima incident.

Since than the Japanese nuclear regulatory authority was overhauled. New regulations and standards were announced and nine Japanese reactors have been restarted.

The recent re-election of Prime Minister Abe, who is a supporter of nuclear energy, ensures that Japan will be starting up even more reactors. In fact, twenty one reactors currently have applications for restarts pending. Several reactors will be restarting in early 2018.

From the bad press that ensued after the Fukishima accident you would think that nuclear energy would be shrinking and on its way to extinction. Even German Chancellor Anglea Merkel announced that Germany would be phasing out its nuclear fleet (Germany is burning more dirty lignite coal than at any time since 1990).

Nuclear Power Is A Growth Industry

I think most people would be surprised to know that the number of reactors operating worldwide is growing. There are currently (447) reactors operating worldwide which is four more reactors than were operating prior to the Fukishima shutdowns. (56) reactors are currently under construction with most of those in China (20), Russia (7), and India (6). This year saw the most nuclear generating capacity come online in the last twenty five years.

One hundred sixty reactors are on order or in planning, and over three hundred reactors are being proposed for construction. I expect this number to increase as nuclear base load power is the cheapest, safest, most reliable base load power available.

To tie this all together we have growing demand for this essential reactor fuel due to increased nuclear generating capacity intersecting with declining supply due to low prices. This means that prices will have to rise in order that sufficient supply is made available.

There is no bull market like a uranium bull market

For the average investor the best way to play this is to just buy Cameco (CCJ) which is at recent all-time lows. During the last uranium bull market last decade the stock ripped from $1.72 on 3/31/2000 to $55.60 on 6/15/2007. Another option is to buy the Global X Uranium ETF (URA). Cameco is a large component of this ETF but you will also achieve diversification.

I expect this bull market to give me really get rip your face off returns. Good management, good projects, and sufficient capital are the key here. Some names that I hold in this space include; Fission Uranium (FCUUF), Energy Fuels (UUUU); Uranium Energy Corp (UEC), and Denison Mines (DNN).

In conclusion I believe sufficient catalysts are now in place for a recovery in the uranium price which will lead to higher uranium mining company share prices and life changing wealth for the investors and speculators who position themselves now. Click on Part 2 and Part 3.

Update 9/2/2018: Yellowcake IPO debuts in London on 7/5/18. I wrote an artilce about this event which can be accessed here.

I think that you can now see why I am so bullish on uranium and uranium mining stocks in 2018-2020 period.

Check out my YouTube videos where I update the uranium markets.

Interested in knowing how I make huge profits in the financial markets? Try a subscription to my paid newsletter “Actionable Intelligence Alert”. You can check it out by going to:

actionableintelligencealert.com/subscribe

I have started up a Patreon account for those that wish to help support my work. Check it out here:

https://www.patreon.com/JohnPolomny

If you pledge at least $5.00 I will send you the current months stock pick. This way you can sample the “Actionable Intelligence Alert” newsletter and see if it is for you.