Equity crowdfunding is a relatively new and unique trend in the funding of new businesses. It combines the reach of the internet, along with the power of the crowd to allow entrepreneurs to come into contact with investors who are interested, willing, and able to fund new ventures. This is a sector that is growing very quickly and one which I think serious investors should at least try and get familiar with.

I have been dabbling in this new subset of investing over the last year. There is not a lot of information on the internet that talks about what equity crowd funding is and what people should do to educate themselves before deciding if it is something they should pursue.

As with all types of investing there can be rewards and this is what most people focus on. However, as in all other types of investing there can be pitfalls especially in the equity crowdfunding sphere. In fact, I will tell you right now that if you decide to get involved with investing in new businesses via crowdfunding most of your investments will lose money.

If losing 95-99% of the money that you put into an investment sounds like a bad deal then you may be asking yourself why would anyone get involved with equity crowdfunding? Because once in a while one of these businesses actually ends up working out and the upside ends up being tremendous for investors involved. In fact, the upside can be so big that just one hit can pay for all the losses and still yield enough of a return that beats traditional investing.

Another reason that people get into equity crowdfunding is that you get to be involved in really cool businesses, being started by some super smart people, who are creating super neat products and services. Some of these ideas literally have the opportunity to disrupt and change the world.

One of the main reasons that I am involved is that I believe that the world is rapidly automating. Advancements in artificial intelligence, robotics, and technology are going to have profound impacts on our world. Most people have no idea (me included) what the world will look like in 5, 10, or even 20 years.

However, one thing I can guarantee is that technology is changing faster than most people can adapt to it. Many people have no clue that technology will make their job obsolete in just a few years. For example, the largest employer of men in the US is truck driving.

With the rapid advances taking place in artificial intelligence and robotics how long before self-driving trucks are the norm? What are those people going to do when their job disappears? One of my goals as an investor is to make sure I am knowledgeable about what is happening and how the world is changing. I intend on participating in the change and not being victimized by it. That is one of the biggest reasons why I am involved in equity crowdfunding.

I am not going to rely on underfunded government or corporate pensions schemes and certainily not a welfare program like Social Security for the provision of my family and my retirement.

What Is Equity Crowdfunding?

What is equity crowdfunding and how did it come about? After the financial crisis in 2008 small business in this country had suffered greatly. Many small businesses shut and information gathered by economists showed that fewer and fewer small businesses were opening. This was troubling because small businesses are the engine for job creation in the US.

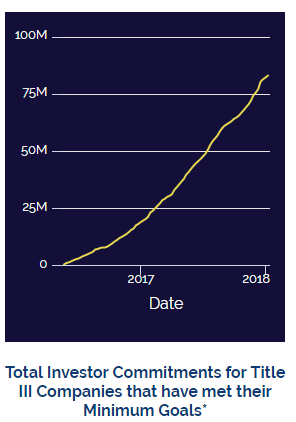

Bi-partisan legislation called the JOBS Act (Jumpstart Our Business Startups Act) was passed in 2012. The part of the act that this article is concerned with is Title 3 also known as the Crowdfund Act. “Title II went into effect on September 23, 2013 and on October 30, 2015, the SEC adopted final rules allowing Title III equity crowd funding. These rules went into effect on May 16, 2016.” (Wikipedia)

Prior to the JOBS act only accredited investors, defined as those with over $1 million in assets (not including residence) or those demonstrating an income exceeding $200k for the previous two years could participate in early stage investing. This excluded smaller investors and especially younger investors from investing in these startups.

It was assumed by the SEC and others in government that having these income thresholds for investing in startups would ensure only “sophisticated investors” would be able to participate. It was assumed that these sophisticated investors would fully understand risk and act accordingly.

The problem is that many sophisticated investors are “idiot savants”. Most successful people have started a business and grown it to the point that they have become wealthy. They may have made their money in real estate or the markets. Regardless, that does not necessarily mean they have expertise in other fields especially disruptive technologies and new businesses in rapidily changing industries.

Charlie Munger is one of the greatest business minds ever and is a billionaire because of it. However, I doubt he would invest in any of these startup businesses based on a slide deck and a conversation with a founder. Money was just not flowing to new and small businesses so the JOBS ACT was passed in response.

Title 3 of the JOBS Act opened up access to investing in new businesses to small investors. Many younger investors may not meet the threshold of qualifying as an accredited investor but they have the technological education and knowledge to determine if a business has potential or not.

For the purposes of this discussion regarding equity crowd funding the new regulations for small investors are covered on Regulation A of the act. This excerpt from Wikipedia helps to explain RE A and Reg CF;

“Regulation A offerings places limits on the value of securities issuer may offer and individuals can invest through crowdfunding intermediaries. An issuer may sell up to $1,000,000 of its securities per 12 months, and, depending upon their net worth and income, investors will be permitted to invest up to $100,000 in crowdfunding issues per 12 months. An independent financial statement review by a CPA firm is required for raises $100,000–500,000 and an independent financial statement audit by a CPA firm is required for raises over $500,000.

Regulation CF offerings would prescribe rules governing the offer and sale of securities under new Section 4(a)(6) of the Securities Act of 1933. Individual investments in a 12-month period are limited to the greater of $2,000 or 5 percent of annual income or net worth, if annual income or net worth of the investor is less than $100,000; and 10% of annual income or net worth (not to exceed an amount sold of $100,000), if both annual income and net worth of the investor is $100,000 or more (these amounts are to be adjusted for inflation at least every five years); and transactions must be conducted through an intermediary that either is registered as a broker or is registered as a new type of entity called a “funding portal.”

This is quite a bit of legal jargon but the gist is that these equity crowd funding offerings must be done on an approved crowdfunding platform and are limited in the amount of money that can be raised. The equity crowd funding platforms that I use and am familiar with do an excellent job of explaining the offerings and who may and may not invest in each one.

Equity Crowd Funding: The Basics

Now that we understand the basics of what equity crowdfunding is and why it came about it is time to explain how to actually invest in these startups. As mentioned above small investors (non-accredited) must access these deals via an approved crowdfunding platform. There are many and I have listed the ones that I have either used or that I frequently browse.

Wefundr https://wefunder.com/

SeedInvest https://www.seedinvest.com/

StartEngine https://www.startengine.com/

Next Seed https://www.nextseed.com/

These are just a few of the sites out there and the ones I frequent the most. Full disclosure I have participated in the recent StartEngine equity offering. There is a more complete list on this Wikipedia page.

Before You Invest One Dollar In Equity Crowd Funding

If I was going to get involved in equity crowdfunding there are some things I would do before investing one dollar. The first is to read the book “Angel: How to Invest in Technology Startups—Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000” by Jason Calacanis. Equity crowdfunding has many similarities with Angel investing and Calacanis is one of the best and most connected Angel investors.

Another thing I would do is to begin listening to Jason Calacanis’s podcast “This Week In Startups” and his new podcast “Angel” both of which are available on itunes. He is so plugged in that on just about every podcast he has top Angel investors and founders of tech companies on his show. I have to give the guy credit because he asks really great questions and drills down into real detail.

After listening to these various podcasts you will note that many of these investors have Twitter feeds or blogs. Some of these other angel investors do their own podcasts. Go and listen to them, follow them on Twitter and look them up on LinkedIn, read their material. If you want to be successful in a field don’t try and do it yourself (no one is that smart) follow the successful as they have been where you are going.

Ok so I know everybody just wants to jump into the deep end of the pool because that is where all the fun is. Really though you should be educating yourself so that you can minimize making mistakes. This is real money after all and as I have emphasized before most of your equity crowdfunding investments are not going to work out. Educating yourself on what works and understanding how top Angel investors evaluate companies will give you better odds of success.

I approach equity crowdfunding in a very methodical well thought out way. I went to the majority of the larger crowd funding sites and registered. That gets me on their mailing list and they will begin sending you emails when new deals come along. I also go onto the sites on a regular basis and peruse the various deals. I am going to tell you right now that the majority of the deals that you will see are not worth investing in.

The Risks Involved In Equity Crowdfunding

One of the things you need to know and will realize after reading the Calacanis book is that the best deals are done in Silicon Valley. In fact Chapter 5 of Calacanis’s book is titled “Do You Need To Be In Silicon Valley To Be A Great Angel Investor?” The chapter has one word in it, “Yes”. That is where all the big name people are and where all the founders flock. Quite a few of the deals you will see on the crowd funding sites were already shopped to Angel investors and were not able to get interest from the pros.

I think this is beginning to change for several reason. The equity crowdfunding area, along with available platforms, is now growing very quickly. Founders are now able to get exposure to more and more people than just the same Angel investors in Silicon Valley.

Let’s be honest, founders of companies would rather spend their time working on their business than going to meeting after meeting with potential investors. Equity crowdfunding allows another avenue for founders to raise money as most of the people investing are not sophisticated and will make a decision just based on the slide deck and presentation that is seen on the crowdfunding site.

This is good for them but potentially bad for you. The Angel investors that are successful know the questions to ask and how to root out whether a founder is serious and is going to stick with the business when times get tough. They have the experience to determine if the potential business is a real business and more importantly can it scale.

Another thing you will notice is that you are going to see quite a few businesses that I consider vanity projects. I am talking about some new kind of vodka, coffee café (we need more of these?), or a restaurant in a toney part of a large city.

I just bypass these types of businesses for one main reason, they do not scale. Making a premium whiskey, based on grandpa’s moonshine recipe, in an old warehouse in Wheeling, WV sounds like a great story to tell friends at the golf course but will this ever be a $100 million or billion dollar business? More than likely not.

Remember this is a business and we are trying to make money. With the success rate being very low we need to stay focused on businesses that can disrupt a current paradigm or can scale to a large size. Vanity projects and flying cars do not meet that criteria.

Do Your Due Diligence

When considering an investment in a crowd funded business understand that you can and should ask the questions of these founders that they would get asked by professional Angel investor. Calacanis lists the type of questions he asks in his book and on his podcasts.

I ask questions like why this business and why now? What is the money that is raised going be used for? What are the current sales? How many employees (helps to estimate cash burn rate) do you have and plan on hiring? What is the burn rate of this company? There are more but there is a forum to ask these questions and you should make a list. If the founder has not answered these in the various presentations or is unwilling to answer on the forums than pass on the investment.

Understand that because this is a low success type of business you can’t just invest in one company. Your chances of being correct on that one business is too high and more than likely you will lose all of your money.

Equity Crowdfunding Is A Long Term Business

Most successful Angel investors adopt a portfolio strategy over a period of years. They are constantly evaluating, studying, and making investments in new companies. From the interviews and reading I have done most of these investors have 50-100 companies in a portfolio that have been accumulated over a period of around ten years. Yes, this is a long term commitment.

One great thing about equity crowdfunding is that the financial commitment for each investment can be as low as $500 or less per investment. This allows people of average means to participate and I actually encourage investors to keep their investment low.

One of the big mistakes even some Angel investors admit to when first beginning their startup investing career is hearing about a great idea and then putting in a large amount of money into just one company. Better to understand how much you can afford to invest and then break it into small amounts and invest in multiple companies equally. Remember most of your investments will not work out.

As I alluded to earlier in this post, this is a long term investment along with a long term time commitment. The average time from initial investment to exit or payoff (if there is one) is seven years. Obviously, there could be a company that achieves an exit before or later than seven years. Nevertheless, understand that you will have to wait for a period of years for any payoff.

I am not sure this type of investing is for everyone but I think over time we will see more and more companies availing themselves of the equity crowdfunding model. The web and low cost communication allows for us to meet and collaborate with anyone in the world.

I expect that harnessing the infinite number of ideas that the worlds smartest people will generate will require capital. Equity crowdfunding will become more and more popular as a way to fund all of these budding entrepreneurs.

There is tremendous opportunity for investors willing to do the work and invest the time. However this is a high risk business that will punish those that are lazy or do not understand what they are doing. Please do your own due diligence as you are responsible for your own decisions and it is your money.

Here are some videos that may help in your education: