It appears so.

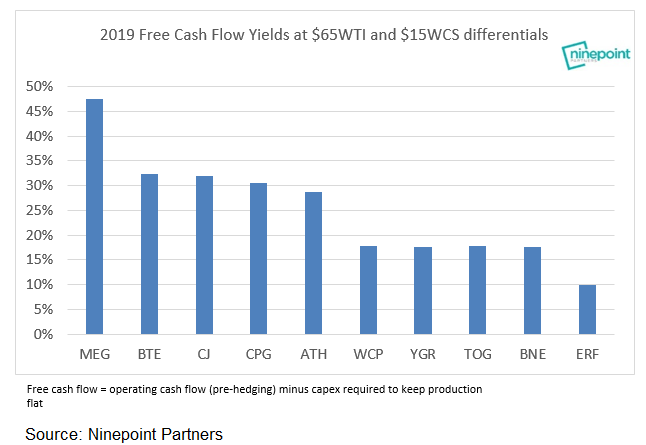

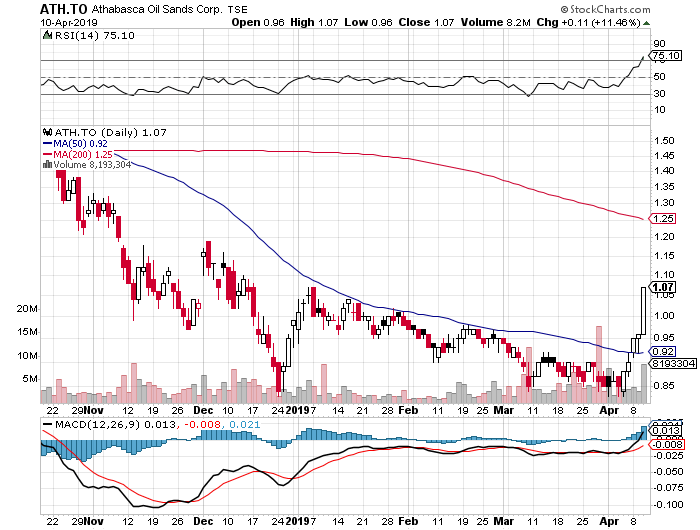

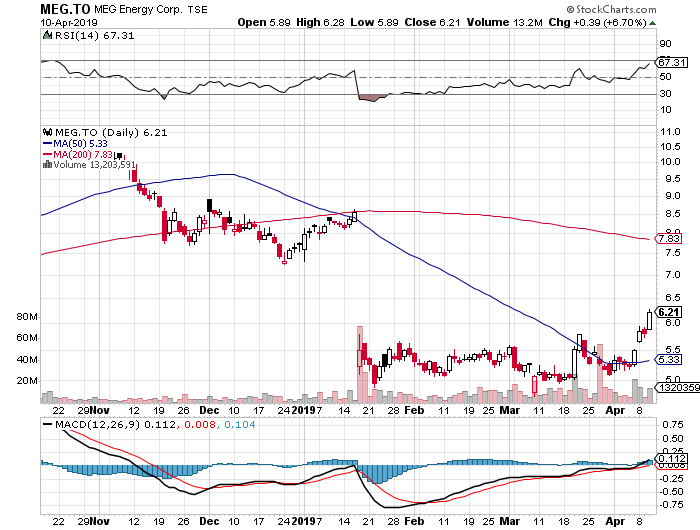

This a chart from Eric Nutall at Ninepoint Partners. It shows the free cash yield of various Canadian oil and gas companies. With the recent rise in oil prices these guys are gushing cash. This is translating into breakout moves in soem of these stocks.

We dont need the oil price to go back to $100 per barrel. We just need oil to stay in this range or move higher and because sentiment is so bad with these companies eventually they get well as value investors eventually take notice.

What we are seeing is a classic playing out of one of my most powerful speculative ideas. A washed out sector going from “terrible to less terrible”. These are the type of stocks I specualte in and recommend to my subscribers in the “Actionable Intelligence Alert”.

In the current month’s issue I discuss why Canadian Oil and Gas stocks are going to move higher.

If these type of ideas grab your interest than you can check out my newsletter by clicking here.