I made a new video where I discuss the current situation in the energy markets specific to oil and uranium. You can check it out here.

To summarize the video I covered the following topics:

Oil

- OPEC meeting was a disappointment as the market was expecting the cartel to increase production by 1,000,000 bbls/day and it looks like we are only getting 600,000 bbls/day.

- Continued decline in Venezuelan production. At some point will Venezuela exports drop to zero? A quote from the article, “Crude oil production in Venezuela is practically falling at an average of 10% every quarter and has been since mid-2017. A scenario with oil production in the country losing at least another 500,000 barrels per day by the end of the year is not unrealistic. Having full additional sanctions imposed would certainly send a strong geopolitical message from the U.S. at the risk of generating more instability in the world supply markets.”

- Rystad report indicated that “New facilities worth more than US$110 billion have been approved for development since the beginning of 2017, versus only US$50 billion in 2016.”

Uranium

- Demand for uranium is growing; (57) reactors currently under construction. (153) reactors in the planning stage. China, China, China!

- Pollution, particularly particulate from coal burning, is a big problem in developing countries. China is choking on pollution.

- Japan has now restarted (9) reactors. (17) more plants have applied for restart. News article suggested Japanese are considering building more reactors.

- Supply cuts from Kazatomprom, Cameco, Paladin, and Orano. More to come if the price does not begin to go up.

- Yellowcake IPO next week will raise $170 million to buy 8 million pounds from Kazatomprom. $100 million a year for the next nine years. More investment and speculative money will move into physical uranium purchases.

There is still considerable pessimism and bearishness in the oil market. People still think that there is huge cornucopia of oil in West Texas that is going to flood the world with oil. Unfortunately, there are pipeline takeaway capacity issues that will preclude this, at least until well into next year.

Demand from emerging markets is relentless and the IEA has consistently had to raise its demand forecasts as demand continues to impress. I think we are looking at $100 barrel oil by early next year. Of course a recession or financial event could throttle that demand.

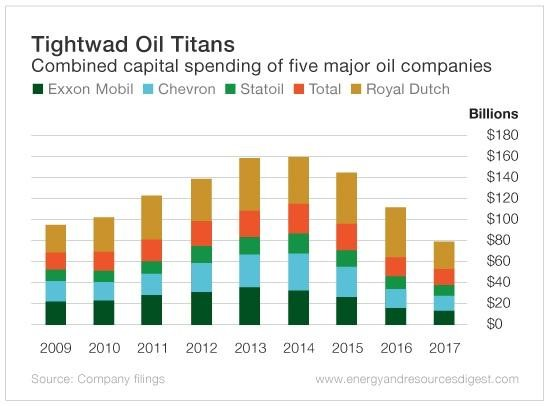

There simply has not been enough investment in new oil resources. This was due to the recent bear market in oil prices which constricted oil exploration.

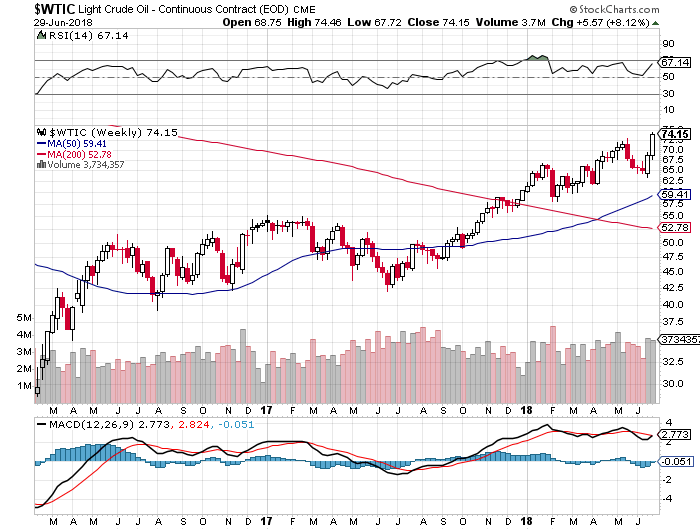

The oil price chart shows a relentless bull market that continues to climb a wall of worry.

If you are curious to understand more about my oil and uranium thesis you can check out my original articles I published late last year.

If you are interested in how I am playing these investment ideas you can subscribe to my newsletter “Actionable Intelligence Alert”.