Uranium ETF

Not much to report here except to say that my thesis of waiting on the announced supply reductions by Cameco and Kazatomprom to take effect on the uranium price might take some time. However that is the lot of the contrarian investor.

The uranium price must go higher as the number of reactors being built continues to grow but the mine supply of uranium continues to shrink. You can check out this page at WNA website which shows the reactors under construction.

With the price of uranium at around $23/lb the industry is liquidating. There is no new development of uranium mines at these low prices. That will eventually result in a supply deficit which will propel the uranium price to new highs.

Everyone knows this and the big question is when will prices recover? As famous stock trader Jesse Livermore said, it was never my thinking that made me rich it was my waiting. Be right and sit tight. It is hard to do but when dealing with uranium that is what will lead to the big profits. Original writeup here.

I continue to add to my uranium positions on weakness

TMK Group

The company reported fourth quarter earnings. Sales were up 32% year over year and EBITDA was up 14%. The company noted that activity is picking up in North America. Pipe sales in Russia were down a bit. The company had its debt upgraded by Moodys from negative to stable.

This company is a pipe manufacturer for the oil and gas industry based in Russia. If oil goes up and drilling increases they should do well. Original writeup here.

Operations and financials continue to improve and it is a buy.

Ensco

The company reported fourth quarter and yearend earnings. The offshore drilling industry was decimated during the fall in oil prices the last several years. However as oil prices have recovered the industry has consolidated and we are seeing the beginning of a recovery. I post the following charts from the Ensco presentation that show why I am bullish on the company.

The offshore oil industry is highly cyclical. Therefore it is a must that one buys at the bottom and sells at the top. That is the contrarian method guys!

Oil is a depleting asset. To stay in business you have to replace the barrels you produced with new found barrels. That requires exploration and money. As oil prices have increased to over $60/barrel oil companies now have sufficient capital to begin investing again. This is paint by the numbers folks and is easy money as long as the oil price does not collapse again.

Again I keep harping on depletion because it is real and is one half of the supply/demand discussion that few discuss.

If the oil price stays at $60 or goes higher (I think it is going higher) than it is just a matter of waiting for rig utilization to increase. As supply tightens for rigs than prices for rates increases along with cashflow and earnings. Stock price to follow. Again sit and wait.

I am buying more on the recent weakness.

Altius Minerals

The best natural resource management team in the business in my view. They are now seeing the rewards of buying royalties from mining companies during the last downturn. As long as resource markets are up they will do well. They also have a habit of spinning out new companies like the zinc company they are working on. This has worked out well for shareholders in the past. It is up 35% already but still has more upside in my view. Original writeup here.

Jericho Oil

Bought prospective properties from distressed operators during the last downturn. They are now developing these properties in a rising oil price environment. I think it gets bought out in this cycle. Properties are in Oklahoma STACK play, which is an emerging low cost shale play in Oklahoma.

Egypt ETF

Economic reforms continue to bear fruit after the devaluation the currency last year. Huge natural gas reserves coming online will alleviate energy crisis. Tourism coming back after terror attacks a couple of years ago. Economic growth forecasted to be above 5% this year and next. I am up 20% with the ETF and we should see more as long as reforms continue. Original writeup here

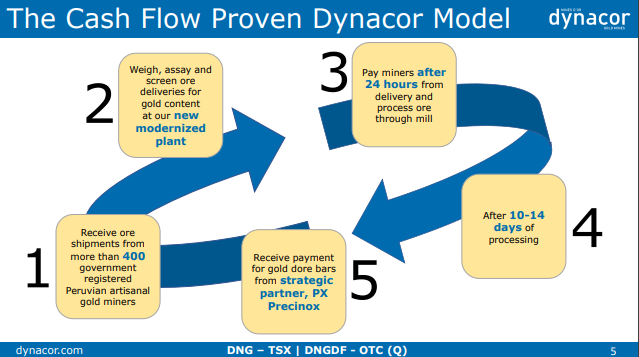

Dynacor Gold

Peruvian gold toll milling operations. Artisanal miners forced by government law to sell ore to licensed processor (Dynacor) in order to cut down on the use of cyanide and mercury for gold separation. Company has a plan to more than double production over the next 3-5 years. Nice cashflow business. Undervalued based on cashflow. Still a buy. Original writeup here.

That is the update for early 2018. My best picks are reserved for the subscribers of the “Actionable Intelligence Alert”. The newsletter is $79 per year for 12 issues of contrarian and underfollowed ideas. If interested you can check out my subscribe page here.