Altius Minerals (ALS.T) just came out with its most recent earnings report yesterday and from what I can see the management’s focus on buying assets during downturns and then making hay during the subsequent commodity market recovery is now coming to fruition.

Let’s take a look at a chart from the most quarterly report presentation:

As can be seen from the chart revenue year over year is up 81% and 19% from last quarter. EBITDA is up 116% from last year and 16% from last quarter. This is exactly what management said would happen, and what I expected, as their contrarian strategy played out over the full commodity market cycle.

The outlook going forward is for the company to exceed previous announced guidance. From the MD&A:

In light of the strong first half performance, with $33,000,000 in attributable royalty revenue, Altius expects to significantly exceed its original guidance of $55,000,000 on an annual basis. However, as a result of the previously announced change in the fiscal year end to December 31, this year will be an 8-month period with new guidance to be issued in January for the newly coinciding 2018 fiscal and calendar year.

The company also raised the dividend and now pays $.04 CAD per quarter and has also said that they will continue to buy back shares opportunistically.

The company has plenty of cash to take advantage of deals that come along. The management has also begun to drawdown funds form the partnership with Prem Watsa’s Fairfax Financial Corp.

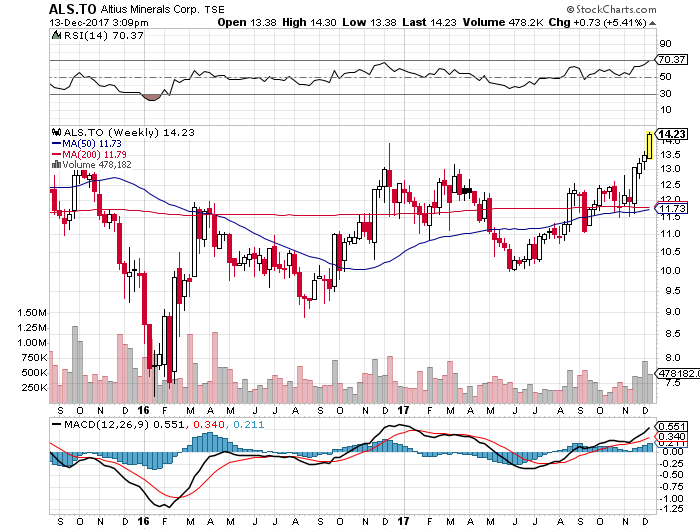

This news has finally got the stock moving and it has now broken out from its recent trading range.

I think that the stock is going to be heading higher over time. Global PMI’s indicate coordinated global growth and that means increased demand for commodities.

In addition, we are now exiting a five or six year bear market in commodities which means supply will be constrained in many commodities due to underinvestment in new supply due to a weak market. As long as global growth continues the commodity market can recover and this will be bullish for Altius Minerals.