The Electric Car Revolution

I am sure by now most people have become aware of the media reports about the impending transition to an all-electric economy. Will a supply shortage of cobalt jeopardize this plan?

We are told that this will be an economy based on solar and wind power coupled with battery storage to store all the solar power produced during the day so that it can be used at night or when the sky is cloudy or the wind is still.

We will all drive electric cars, or better yet share them (no discussion on what happens when the car shows up with puke or a loaded baby diaper in the back seat), with 300 mile plus ranges and that can be recharged in minutes at ubiquitous charging stations conveniently located wherever we need them.

Electricity will become so cheap that it will almost become free. This cheap power will unleash economic growth yet unseen to this point in human existence.

A New Economy?

All of these changes will happen at a rate far faster than any energy transition in history. Most of these proclamations are uttered by Gen-X and Millennial entrepreneurs in Silicon Valley who are convinced that their ideas will change the world and save it from impending disasters like climate change and endemic poverty. They will not own or have to maintain anything and are driven by the creation of a “sharing economy”.

Recent headlines by the media seem to confirm this impending transportation transformation as France, the UK have set dates when they will ban gasoline powered cars.

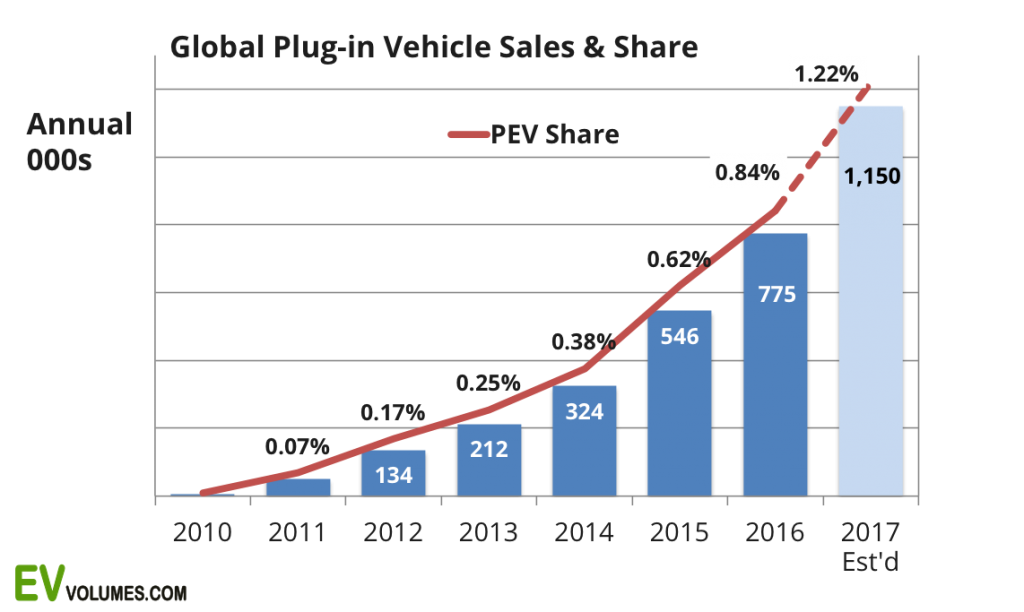

So it seems that the world governments, the media, universities, corporate leadership, along with the average Joe on the street are all aligned with moving forward to an all-electric transportation future. The chart below shows this trend to be accelerating albeit from a small base.

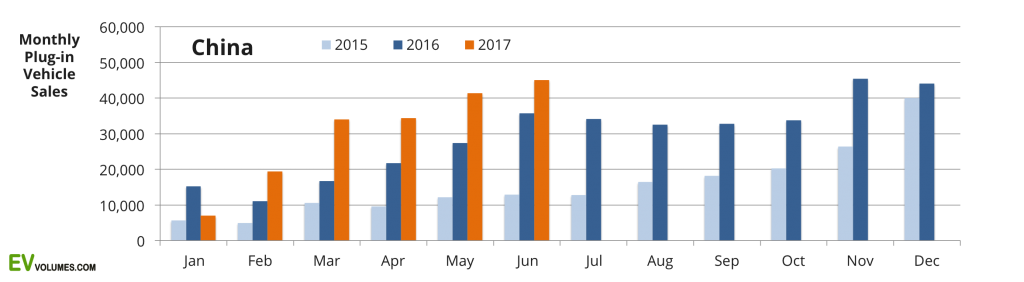

Electric Vehicle growth in China is going gangbusters:

The Chinese are extremely motivated to clean up their air quality. The terrible air pollution is contributing to all kinds of health issues and at some point will threaten the viability of the Chinese government if it does not deal with this issue.

An Overlooked Issue

There is a big problem that almost everyone overlooked. Where will all the raw materials that are required going to come from to build this new future? How many millions of tons of various raw materials are going to be necessary in order to build all of these new battery powered cars, trucks, trains, and even airplanes?

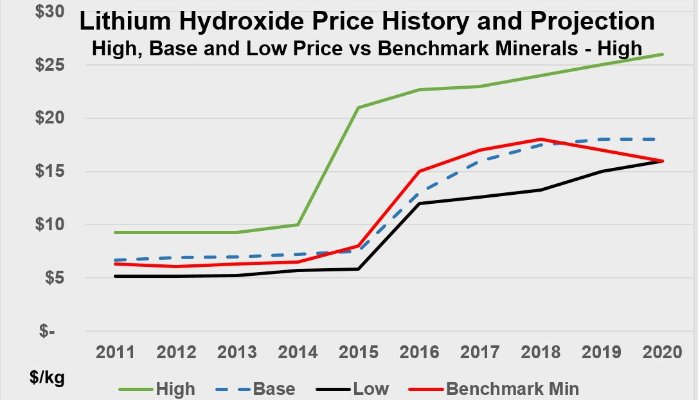

Lithium has been in the news recently and some investment newsletter writers and even Goldman Sachs have called it the new gasoline as it will power this all electric future. However, lithium has never been demanded in the quantities that are currently required not to mention the predicted future demand. The price has responded accordingly.

I have no doubt that if the price goes high enough that sufficient lithium production will come online to meet the required demand. The USGS estimates that there are 185 years of known lithium reserves. The problem is that there are not enough mines or processing capacity online currently to bring enough material to market.

Again, I have no doubt that with a high enough price eventually supply will overwhelm demand. Economics does in fact work and the cure for high prices is high prices as sustained higher prices will properly incentivize miners to deploy sufficient capital to correct the supply deficit.

I recognized this several years ago and was able to buy stock in companies like Albemarle and Galaxy Resources at cheap prices and reaped triple digit returns in the case of Galaxy Resources.

Mining, Hated But Necessary

People have really got jazzed up about getting rid of internal combustion engines. What most people forgot or never knew is that unlike a software program of smartphone app it takes years to discover, permit, build, and commission a new mine. You can’t just stay up all night and code it into existence on a computer.

Currently, with all the government regulation and interference from NGO busy bodies, it can take anywhere from 10-20 years to get a mine through the permitting and construction process to production. After the gauntlet of red tape has been waded through and you have built the mine you actually have to run the mine correctly which requires a high level of expertise, money, and luck to just breakeven.

The lithium supply will be fine.

Impending Cobalt Shortage

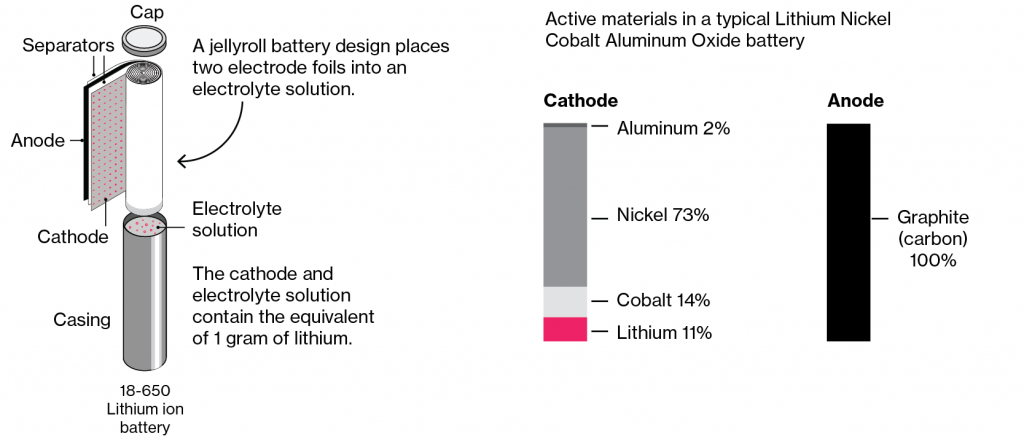

However, I am not so sanguine about another material that is essential in battery production. That metal is cobalt. Cobalt is used in the cathode section of the battery as can be seen in the picture below.

A close inspection of the cathode section of the battery shows that cobalt makes up 14% of the cathode section of the battery. This is in fact larger than the amount of lithium in the battery. However, there has been much less discussion on the supply/demand fundamentals of this element.

Cobalt Supply Not So Secure

When one investigates the cobalt fundamentals one finds an essential material that has a very tenuous supply dynamic.

Ninety percent of all cobalt production is the result of primary nickel and copper mining. What this means is that cobalt is a by-product metal and not mined directly. The reason for this is that there are simply not many primary cobalt deposits. They do exist but to this point the price of cobalt has not warranted their development.

Sixty five percent of the world’s cobalt currently comes from the Democratic Republic of Congo (DRC). The DRC is not one of the most stable places on earth. It is ranked at the bottom of most country rankings for stability and ease of doing business. In fact, there have been several civil wars in the DRC dating back to the 1960’s. These have resulted in millions of people being killed.

The point being that if you intend to build all of these electric cars is it really prudent to rely on a place like the DRC for your supply of cobalt? Evidently that is what the plan seems to be.

A Few Problems

A couple of problems I see with this plan; the current President of the DRC, Joseph Kabila has decided he does not want to step down from power. Presidents not wanting to give up power have been the cause of conflict in the Congo in the past. A civil war in the DRC would lead to severe disruption of the supply of cobalt.

Another big problem is that around twenty percent of cobalt being mined in the DRC is done by artisanal miners. Unfortunately, many of these artisanal miners are under age children who are forced to work in unsafe and slave like conditions. I am amazed that the SJW’s, liberals, and neo-Marxists have not caught on to this and put up a big stink. It has been reported in the Washington Post.

At some point this will be a problem as companies like Apple, Tesla, and other consumers of cobalt cannot be seen making their products on the backs of dirty, rag wearing, African children toiling away in dystopian conditions. The optics are as the PR people say, “not consistent with our values.”

The other bad news is that China has already figured out what I am telling you about cobalt a few years ago and has been systematically consolidating their position in the DRC to ensure a sufficient supply of this strategic material for their own use.

They could care less about any human rights issues. Watch the movie “Empire of Dust” to see what Chinese people think of Africans. BLM would not be happy to say the least.

Cobalt Is More Than Batteries

I have not even discussed the other demands that exist for cobalt. I wrote about this two years ago on my old blog, Actionable Intelligence Alert:

Global jet aircraft sales are poised to grow massively over the next few years. According to a presentation by Airbus 32,585 passenger jet aircraft worth $4.9 trillion will be sold over the next twenty years. That is a lot of jet engines that will require quite a bit of cobalt.

As stated earlier another big use of cobalt is in gas turbines used in power generation. As the world continues to industrialize the demand for electricity will increase. One of the big beneficiaries has been gas turbine electric generation due to lower emissions from natural gas.

The question seems to ask itself; if the EV makers are getting ready to ramp production of electric cars and the batteries in the cars require cobalt for the cathode, where will all the cobalt come from? I have already pointed out the supply issues with cobalt.

There could be a huge bidding war for cobalt supplies. GE, Siemens, Westinghouse, Pratt Whitney, etc… have billions of dollars invested in plant and equipment to manufacture jet engines and gas turbines. I doubt that they will shutdown production so that Tesla can meet their orders for Model 3 cars.

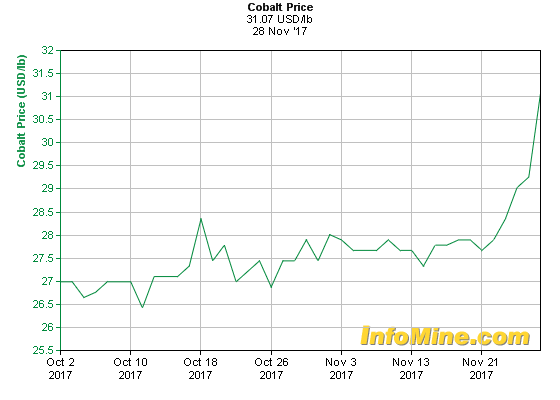

Nevertheless, the dream of an all-electric future continues and as battery production for electric vehicles has ramped up demand for cobalt has also increased. Supply has tightened and the price has responded accordingly.

As can be seen in the chart above the cobalt price has moved over $30 per pound and I suspect it will be moving a whole lot higher. No copper or nickel miner is going to increase the production of primary ore just to get the cobalt by-product. It just is not economical.

So Where Will The Cobalt Supply Come From?

So we are back to asking the question of how to supply the demand for cobalt?

There are undeveloped primary cobalt properties in areas of Australia and Canada. However, the price of cobalt has not risen to a sufficient level to incentivize miners to take on the risk of developing these into mines. I believe they will as the price of cobalt sky rockets. I am not the only one that thinks this. Billionaire mining magnate Robert Friedland discussed this exact issue at a mining conference in South Africa last year.

“Elon came to me because we have a nickel sulphate and cobalt sulphate operation in Australia, not the Congo,” he said. “And Elon said ‘I’ve got the world’s biggest battery factory, so I want to buy your nickel and your cobalt at the current metal price for 10 years, because I’m the biggest buyer.’ “

So we told Elon Musk, you know, Elon, that’s interesting. We’ll think about it. And then two months later we went back to him and said “Elon, you’re totally screwed. The Germans are building a gigafactory twice as big as yours, the Chinese are building four of them bigger than yours, the Japanese are building two and the Koreans are building one. So unless you’re willing to pay to buy our cobalt and our nickel at whatever the price may be in the future, you’re not going to be able to build any batteries in your own gigafactory and your whole company is going out of business, and we’re going to make money shorting your stock.”

So people who are serially successful in mining actually understand the problem and intend to take full advantage. That is my plan also but the problem is that there are not a lot of legit publicly traded cobalt mining or development companies.

I Like Cobalt 27 Capital Corp.

There are quite a few wanna be’s with moose pasture in Saskatchewan that were marketing the same land as a uranium play way back when uranium was $140 per pound. All of a sudden this land is now prospective for cobalt? They have a saying in Vancouver where many penny mining stocks are birthed, “when the ducks quack, feed them.” Doyle Brunson, the famous poker player, said about poker that if you sit down and after 20 minutes you don’t know who the sucker is it’s you.

We want to be the winners and not the suckers. I am currently holding shares in Cobalt 27 Capital. Cobalt Capital is being run as a royalty company. That means that they will provide financing to potential cobalt mining companies and in return will receive a royalty on any production that is generated by the company.

The company also has taken physical delivery of 2160 tonnes of physical cobalt which they intend on just sitting on as the price of cobalt continues to appreciate.

High Risk and High Reward

The management has a former executive of Sandstrom Gold which is a gold royalty and streaming company. Cobalt 27 Capital has the expertise to properly structure royalty and streaming contracts because they have done it before in another mineral sector.

I consider this a high risk speculation as many things could go wrong including the EV revolution not materializing as anticipated, new battery technology that displaces the need for cobalt, mismanagement of the company, insufficient investment opportunities among many others.

Nevertheless, buying Cobalt 27 Capital allows me more of a portfolio approach. It does not require me to wade through analyzing each and every single cobalt development company. Most of which never will find much less mine even one pound of cobalt. The management of Cobalt 27 will be doing that for me as they deploy capital into various developers with actual prospects.

Conclusion; Cobalt Is Going Higher

In conclusion I do not know if the EV revolution will take off or if it does how fast it will grow. I do know that government policy around the world is shifting to the elimination of internal combustion engines. The current zeitgeist among the populations in the west is climate change is an issue that needs to be dealt with now. To my mind that means a big push forward for this EV effort.

It will not happen without sufficient supplies of cobalt (at least with current battery technologies). There are supply constraints on the cobalt supply so that means higher prices. This is the opportunity and this is how I am currently playing it.

Cobalt 27 Capital recent corporate presentation

Click here to read Top Three Stock Picks For 2018 Part 1

If you find my writing interesting I encourage you to susbscribe to my newsletter “Actionable Intelligence Alert”. In every issue I discuss various ways to capitalize on contrarian and overlooked investment ideas. Check it out by clicking here.