Why Make Predictions?

Making predictions is usually a mugs game in that the world is so complicated that it is very difficult to anticipate every event that could have an effect on our investments and speculations. Nevertheless, as we do have money at risk in the markets we have to make an attempt to put forth a well thought out thesis and then course correct as necessary throughout the year if new information, events, or circumstances present.

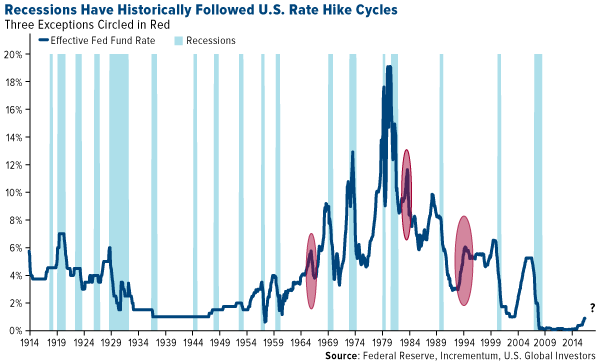

The current situation in the US is to my mind one of the riskiest I have seen in many years. We are at historic valuations for stocks and are very long in the tooth regarding the US economic expansion. In addition the Federal Reserve is now reversing its previous easy money policies. The Fed is simultaneously raising interest rates while at the same time reversing its policy of bond buying.

Central Bank Induced Bubble

My view on the stock market over the last eight years is that quite a bit of its rise can be directly attributed to the amount of liquidity created by not only the FED’s easy money activities but all other major central banks easy money activities. This tsunami of liquidity has had the insidious effect of making virtually every asset class overpriced.

I would go even one step further and suggest that things have been so distorted by central bank largesse that it is almost impossible to know what proper valuations actually are appropriate. It is akin to a pilot who is qualified only for visual flight flying into bad weather and having to fly by instruments and not being able to. He is flying blind and at risk of a crash.

If my view is correct that valuations have been distorted on the upside by central banks and that the US is now reversing its largesse than it should not be too big of a stretch of thinking to say that we could see asset prices being risky.

I am middle age and have seen this act by the FED before during previous market cycles. I am not one who is enamored or impressed by the central planners at the FED that think economic policy can be fine-tuned by use of price fixing via interest rates.

My view is that the FED will continue to raise rates and drain liquidity until they break something like the economy or stock market. That is what we have witnessed in the past and this is what I expect, although it may not occur in 2018.

The fact that we have seen a massive corporate tax cut at the end of a business cycle along with a huge amount of continued deregulation may be sufficient to extend the business cycle for some time. In fact that is what I expect in 2018.

Central Bankers Are Central Planners

I would remind readers that in the Soviet Union there was a large entity in Moscow named Gosplan. That state planning agency was staffed by a thousand PhDs and although they were just as smart as Greenspan, Bernanke, and Yellen they were no more successful in planning toothbrush or shoelace production in the USSR as the members of the FED are in trying to fine tune a large and complex economy like the US.

We laugh and scoff at the Soviets feeble and ultimately unsuccessful attempts at central planning but we bow down to the perceived demi-god like abilities of our own central planners.

One caveat that I would throw in here is that the other central banks like the ECB and the Japanese are only now just discussing tightening and are still in the middle of very loose policy. This may to a certain extent mitigate what the FED is doing. However, as I believe we will see a resurgence of inflation I think we will see the ECB and the Japanese move towards tightening of monetary policy in 2018.

Rising rates are ultimately not good for stock market valuations in the long term. Nevertheless, as stated earlier we are in unchartered territory with our vision obscured. Although the US stock market is overvalued it can get more overvalued. The recent tax cuts will encourage companies to repatriate some of the trillions that are currently overseas. I can see an increase in stock buybacks and merger and acquisition activity making things more overvalued in the US stock market.

US Stockmarket Is Overvalued

As for stock market valuation I like using the CAPE ratio as a tool for measuring over or under valuation of a particular market or sector.

For those of you not familiar with the CAPE ratio I offer the following definition; “The cyclically adjusted price-to-earnings ratio, commonly known as CAPE, Shiller P/E, or P/E 10ratio, is a valuation measure usually applied to the US S&P 500 equity market. It is defined as price divided by the average of ten years of earnings (moving average), adjusted for inflation.” (Wikipedia)

I like this tool because of the research that I read by Meb Faber which you can read here. I include the abstract of his paper;

“Over seventy years ago Benjamin Graham and David Dodd proposed valuing securities with earnings smoothed across multiple years. Robert Shiller popularized this method with his version of the cyclically adjusted price-to-earnings ratio (CAPE) in the late 1990s, and issued a timely warning of poor stock returns to follow in the coming years. We apply this valuation metric across more than thirty foreign markets and find it both practical and useful. Indeed, we witness even greater examples of bubbles and busts abroad than in the United States. We then create a trading system to build global stock portfolios based on valuation, and find significant outperformance by selecting markets based on relative and absolute valuation.”

The paper is not very long but the historical precedents outlined in the paper is fully understandable and applicable. Many people knock the CAPE ratio because as it has continued upward into areas that indicate historical overvaluation and therefore lower future returns the US stock market itself has continued upward making new highs. However, Faber and others have consistently noted that the ratio is not a market timing tool.

At the current CAPE of 31 the US market has only been more overvalued twice before, September 1929 and December 1999. The first episode was of course right before the Great Depression and the second was right before the Tech bubble blew up.

I have been steadily reducing exposure to the US stock market and some of the more speculative areas I have been operating in during the last year.

Every time the market makes a new high the overvaluation continues to increase along with the risk. At this point the big asymmetric opportunity in my mind is to the downside. I currently am only short, via long term puts, one company that being Tesla (TSLA). However I am watching the high yield junk bond market and am considering shorting that sector. Rising rates are not good for junk bonds.

I like the strategy of noted short fund manager Bill Fleckenstein. He said in an interview that although the markets are extremely overvalued he is not putting on very many big short positions yet. He agrees that although overvaluation exists things can and probably will get more overvalued. Better to wait and let things roll over and then as he said “come in and shoot these things in the back”.

If one is going to continue to try and ride the US market than I would suggest using some protections such as hedging via options and or following prudent position sizing and stoploss rules.

There Is Always A Bull Market Somewhere

Just because I think that the US stock market is overvalued does not mean I am not seeing opportunity. Commodities have been in a bear market for six to seven years depending on which market you are looking at. In fact commodities in relation to the S&P 500 Index are the cheapest they have been in 50 years.

I am seeing famous money managers come out and note the same undervaluation regarding commodities. A couple of things to note regarding commodity and resource speculating. The first and most important is that resource and commodity markets are cyclical in nature.

Many people have learned the hard way that these things are burning matches and not family heirlooms. They are not buy and hold investments. You buy resource and commodity producers to take advantage of their cyclicality (buy low sell high). As billionaire resource financier Rick Rule says regarding resource stocks, “you are either a contrarian or a victim.”

I wrote three reports on my three top resource market speculations for 2018; uranium, cobalt, and oil. Read them by clicking on the links.

I think oil is going much higher in 2018 than most people currently presume. As we come to the end of the year we see that West Texas Intermediate is slightly above $60 per barrel and Brent crude is $66 per barrel. There is an opportunity here as most oil stocks and oil service stocks have not kept up with the oil price. I think that resolves with oil stocks and oil service stocks playing catchup regardless of whether the oil price heads higher.

Bitcoin and crypto currencies

I get asked about bitcoin and crypto currencies all the time. The questions come from very inexperienced investors that are getting caught up in the emotion of the bubble that exists in these markets. For the record I bought bitcoin when it was under $600 and sold at around $1800. I do have some legacy contract mining still producing bitcoin for me. Nevertheless I think this is a bubble.

One of the first things I ask someone when they ask my opinion on bitcoin is how do you value bitcoin? No one that I have talked to has been able to answer this question. That is strike one for a bubble. If you cannot put a value on an asset class how do you know if it is overvalued or undervalued?

What you are really doing is gambling and hoping to sell your bitcoin to someone else at a higher price than you paid. This is known as the greater fool theory. Now I do not have a problem with people doing this as long as they understand they are gambling and that they can lose all their money.

I was riding in an Uber the other day and the driver broached the subject of bitcoin and asked me what I thought because he was considering buying some. I asked him if he had read the bitcoin white paper by Satoshi Nakamoto?

Of course he did not know who Satoshi Nakamoto was or what a white paper is. Ughh! I told him it may be prudent to maybe understand what he was getting ready to put his money into before he actually did it. I could tell his FOMO (fear of missing out) was fully engrained and that he was not going to listen to reason. Strike two for a bubble.

It has been my experience that when the chislers and sharpies down on Wall Street see a way to fleece the retail investors they simply can’t resist. What is done many time is to introduce an ETF product or some type of derivative product that the sharpies can use to make money.

It has been difficult for large institutional money managers to take advantage of the rise of bitcoin and cryptos. This is mainly because the charters and rules of various funds and institutions will not allow them to buy an asset class that does not have a clear chain of custody or a recognized and validated clearing mechanism.

I mean seriously no limited partners of a hedge fund are going to be ok with the general partner buying millions of dollars of bitcoin and then storing the key on a slip of paper or on a cold storage device that he holds. Some of these guys would just get too cute and take off to Bali or Paraguay with all the coins never to be seen again.

The market for cryptos is so large now that Wall Street has to find an angle. This was done by recently introducing futures contracts on the Chicago Mercantile Exchange. Now large Wall Street trading firms can go long or short bitcoin. Interesting to note that unlike most futures contracts there is no need to settle these contracts with actual bitcoin as they are financially settled.

Most futures contracts are used by producers and consumers of commodities to hedge their costs or potential revenue in advance. These bitcoin futures are pure ways for large financial institutions to gamble on bitcoin. There is no net economic benefit in this trading.

Don’t Worry Wall Street Will Make Money on Crypto

Let’s try this scenario out just for fun. Say some big Wall Street firm was to build a nice short position in bitcoin via these futures. Then let’s say they were to call one of their former colleagues in the Treasury or SEC and suggest that maybe it would be time to crack down on some of the wild west activities of some of these crypto “entrepreneurs”.

So the government decides to make an example of some of these crypto guys and perp walks a few of them in front of the cameras for morons watching at home. They will couch it in some stupid class warfare rhetoric about how some 23 year old made $20 million and did not do his patriotic duty and pay taxes properly or some other made up reason such as “we need to protect the public, and ensure a fair market for all investors”.

They may even go back to their old favorite, “drug dealers and terrorists use crypto currencies”! Hurry get me to the fainting couch.

The average retail investor now gets scared and begins to sell or worse yet a whale begins to sell and the price begins to drop quickly. Now sentiment begins to turn from euphoria to concern and then panic. Oh but now the retail schlub finds out that Coinbase or whoever they are storing their coins with is limiting the amount of bitcoin he can sell per day. In addition the network slows down and transactions back up. That is already happening if you go on Hashflare or Coinbase. They are both claiming this at the time of this article.

However if you are Wall Street shorting the market on the CME and settling in cash instead of bitcoin you have no worries. As the price crashes Wall Street captures another windfall and bitcoin ends up relegated to the clearance bin at Biglots with beanie babies and baseball cards. Another financial bubble will have burst and pundits and wags will be on television wondering how come no one saw this coming. Strike three you are out!

If you have money or are considering putting money into these cryptos then at least understand what you are getting involved in and also educate yourself on other episodes of mass hysteria and famous bubbles. Read Charles Mackay’s book “Extraordinary Popular Delusions and the Madness of Crowds”. I believe bitcoin is crashing and will finish 2018 substantially lower.

In conclusion the central banks have created many bubbles and turned normally prudent people into speculators. Central Banks are now beginning to reverse these easy money policies. This could lead to severe distortions and corrections in many markets. I am not suggesting to buy bullets and beans but one must remain on guard and vigilant. We are not in a buy and hold environment.

I think a quote from the before mentioned Charles Mackay is appropriate; “Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.”

Good luck in the new year and I wish all readers a happy, healthy, prosperous 2018. Thank you so much for reading my work.