A new year is upon us, so it is time to write my annual forecast article. Last year was a big year for the Actionable Intelligence Alert. I kicked off the newsletter and weekly Youtube videos and people have been very receptive to my contrarian way of thinking and investing.

Last year when I wrote this update article, I was bullish on three themes; uranium, oil, and cobalt. I am still a big believer in uranium, short and medium term cautious on oil, and a long term bull on battery metals.

Uranium

On the supply side we saw the closure of Cameco’s McArthur River mine back in January. We also saw Paladin Energy suspend operations at its Langer-Heinrich mine in Namibia.

I am still bullish on uranium. The supply/demand fundamentals have gotten better in my view.

On the demand side nuclear power continued grow worldwide; (9) new reactors came online 10,400 MW, (3) reactors shutdown 1827 MW, (5) reactors started construction, (4) Japanese reactors came back online.

Kazatomprom, the state-controlled uranium miner in Kazakhstan also came public via an initial public offering of 15% of its stock in mid-November. This is important in my view because now that a portion of the company is public the company will now be under scrutiny by the financial markets.

In the past Kazatomprom was following the old Soviet mentality of producing more uranium regardless of price. The government and management now realize that the country’s uranium endowment should be managed for maximum benefit.

Kazatomprom has changed its strategy and has a new mission statement: to sustainably develop its uranium deposits and their value-chain components in order to create long-term value for all its stakeholders. It has identified new strategic goals to enable it to fulfil that mission.

To be more market-centric, the company will adjust production levels to meet market forecasts, he said. In December 2017 Kazatomprom announced it would cut uranium production by 20% over a three-year period beginning in January. For 2018 alone, this means more than 5500 tU less coming into the market. The company is looking at opportunities for earlier closure of older mines. It also now views uranium as an asset to be managed, rather than a resource to be used, he said.

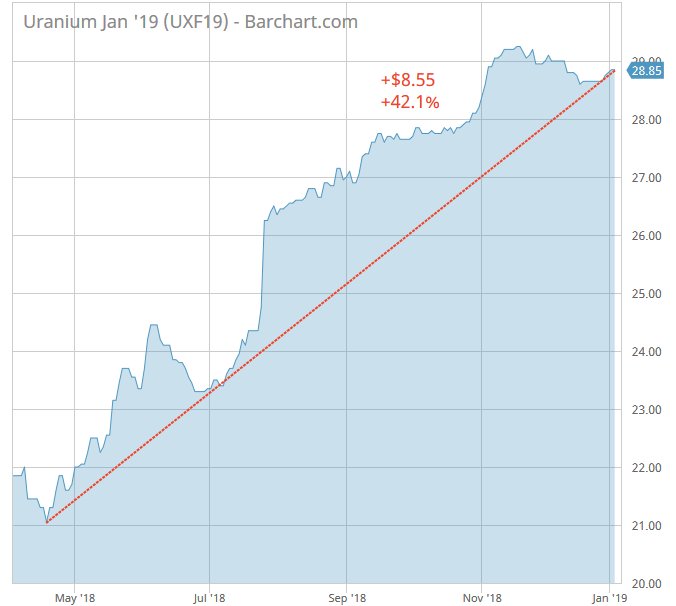

The spot price of uranium bottomed in April 2018 around $18/lb. Since then the spot price has rallied over 40% to a recent $29/lb.

My view for 2019 is that the uranium spot price will continue to move higher. This will be due to several factors; Cameco buying material in the spot market to fullfill customer contracts (cheaper to buy in spot market than mine the material). Cameco has indicated that they will purchase approximately 10-12 million pounds of uranium in the spot market during 2019.

A second factor that I believe will cause the spot market price of uranium to continue higher is the continued entry of private equity and hedge fund money into the market. Last year saw the initial public offering of Yellowcake PLC which is buying physical uranium and holding it for price appreciation.

Currently the uranium story is still under the radar of most generalist investors. I expect that to continue into 2019. I expect we will see the uranium spot price creep higher as the year goes by. I don’t expect a big push higher this year. I think uranium equities will struggle as the overall stock market will struggle.

During the recent market turmoil there were opportunities to buy physical uranium below net asset value. I still think accumulating physical uranium when the cost drops below net asset value is prudent.

The all-in cost to mine uranium is $60/lb. With the spot price at $29/lb. you have 100% upside just holding spot uranium and you have an excellent chance of the thesis working out regardless of what happens in the rest of the economy.

Oil

The oil market was a wild ride in 2018. We started the year down and then steadily rallied until the first part of October. The price of oil topped out at around $75/bbl and then basically crashed through November and December where it ended up at $45/bbl.

This crash was the consequence of several factors but to my mind was the Trump double crossing of the Saudis as it relates to the Iran sanctions. The Trump administration threw out the Obama administration’s nuclear deal with Iran.

Trump announced that beginning in November 2018 that sanctions would be put back on Iran that would constrict their ability to export oil by 1-2 million/bopd. This got factored into the oil price and contributed to the price rise over the summer.

Saudi Arabia and several other OPEC countries agreed to increase production to replace the lost Iranian barrels. Then various countries complained to the US that the sanctions were going to cause undue hardship to their economies because of the higher cost of oil. In addition, a contentious US mid-term election took place in November. Trump did not want high gasoline prices going into the mid-term elections.

Trump then announced waivers for eight different countries which meant that the market went from slightly under supplied to over supplied. As the price of oil reacted to the downside algos and programmed traders jumped in exacerbated the move downward.

Couple the above with a larger than normal refinery turnaround season, and the unwinding of the long oil short natural gas trade by some hedge funds and oil crashed.

The oil and oil service stocks dropped even more than oil and some oil stocks were trading at levels that they had not seen since 2015 when oil traded at $26/bbl. To my mind this represents an opportunity.

I have been able to find companies that have dividend yields of 8-15% that can cashflow sufficiently at these low oil price levels that they can continue to pay their dividends.

I also hold to my longer-term thesis that insufficient investment has been made in new reserves and production. Oil demand continues to grow, especially in the emerging markets, yet we are not investing enough to meet that demand.

Some of the oil service stocks in the AIA portfolio are trading at all time lows. I have bought additional tranches at these levels. At some point in the future we will have an oil supply crisis and prices will surge.

The question in the interim is will a global economic slowdown cause oil prices to decline or remain at these low levels. My view is that low prices will just further cement the lack of investment thesis.

I would note that the OPEC with Russia has already announced 1.2 million/bopd in production cuts. If necessary, I believe they will cut more if needed. The Saudis need oil at around $80/bbl in order to finance the transition of the economy away from a dependence on oil.

The oil market will necessitate extreme vigilance in 2019.

Emerging Markets

I am becoming increasing bullish on certain emerging markets. In particular India and Myanmar.

India is growing well over 7% per year. The country seems to have transitioned out of the turmoil caused by the removal of cash from the system to curtail the black market along with implementation of the GST tax.

The Modi government continues to modernize and streamline the economy. In my view, India is where China was around 15-20 years ago. The country continues to build out infrastructure and that includes bringing electricity to all villages and building out the nations transport system. This will have a compounding effect on productivity over time.

India has potential similar to China, but India’s transformation will take longer as it is a democracy and will advance in fits and starts. In the end if the economy compounds at 7% per year you will see tremendous wealth created in a ten to twenty-year time frame.

I like a company like Fairfax India Holdings. This is a company that is focused on acquiring businesses in India that will benefit from the long-term growth of the Indian economy.

It is run by Prem Watsa who, is the Warren Buffet of Canada. He runs Fairfax Financial Holdings in Canada and he has achieved a 17% compounded return over the last twenty years.

Myanmar

Myanmar is one of the last big growth stories in the world and even though it has had some issues over the last few years; lack of leadership on economy, Rakhine crisis, internal politics the government is waking up and making changes.

The government has relaxed regulations on various foreign companies in banking and insurance. The government is seeking to move ahead with Chinese Belt and Road projects. International pressure is forcing the Myanmar government to deal with the Rakhine crisis.

Through all of the problems the economy is growing 6% per year. All they really must do is build roads and electrify the country and the place will grow just because it is starting from such a low base.

This is another one where you find a vehicle to play it and just put it away for ten years and you will be fine.

I like Yoma Strategic Holdings which is a company that trades on the Singapore stock exchange. The company is following the conglomerate method and is involved in a ton of businesses mostly focused in the consumer sector.

On of their businesses, Wave Money, is a mobile phone-based payment system that is growing massively. Myanmar is country where most people do not have a bank account, so this platform is stepping into the void to facilitate payment between consumers and businesses and other consumers.

In summary, global liquidity is contracting as central banks begin to withdraw liquidity from the markets. If you are of the view that central bank liquidity facilitated the bull market you need to be concerned with what will happen as they withdraw liquidity. Expect more volatility and possible market dislocations.

I think there will be opportunity in the corporate bond market as it will show cracks in 2019 and possibly enter a bear market. I recently made a video on this subject which you can watch by going here.

There is always a bull market or short opportunity somewhere and I will be constantly looking for them.

Stay safe out there!