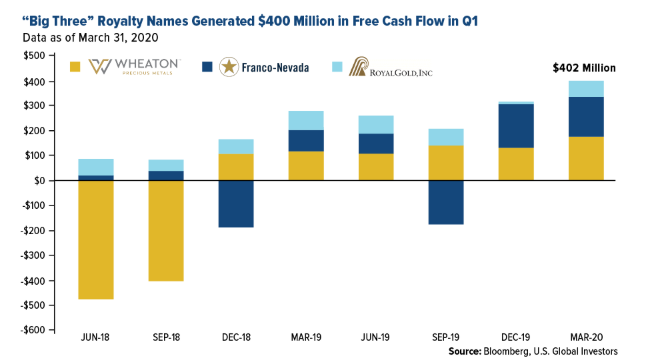

Take a look at the chart below:

What you are looking at is the Q1 2020 free cash flow for the three largest gold mining royalty companies.

Total free cash flow at just these three companies was $403 million for just the first quarter of 2020!

What is my point?

The gold price has traded above $1700/oz for some period of time now. As all in sustaining costs for many miners is around $1000/oz tremendous amounts of cashflow are being generated by many gold producers.

The cashflow generation is even more pronounced at the royalty companies because they do not have all the costs of the miners.

Recall that royalty companies provide capital to mining companies and in return get a royalty interest in the production. They do not hire miners, pay fuel costs, engage in regulatory approvals, etc.…

As I expect precious metal prices to head higher now may be the time to take a look at the gold mining industry.

Typically, tremendous moves can happen in gold mining shares well in excess of any moves in the gold price as mines typically have operating leverage to the gold price.

There is a time and place for everything. It seems gold mining shares, especially royalty companies, are poised to take advantage of a rising gold price.

How To Profit

Interested in knowing how I translate the information in these articles into investment ideas?

Consider a subscription to my paid newsletter “Actionable Intelligence Alert”. You can check it out by going to:

actionableintelligencealert.com/subscribe

I have started up a Patreon account for those that wish to help support my work. Check it out here:

https://www.patreon.com/JohnPolomny

If you pledge at least $5.00 I will send you the current months stock pick. This way you can sample the “Actionable Intelligence Alert” newsletter and see if it is for you.