Charlie Munger has said that creating a lattice work of knowledge is critical to his investment success. The only way to obtain this knowledge is to read. He was once asked during a Q&A session with graduating MBA students what advice he would give for business success. He replied that he would recommend reading six hundred pages per day.

His partner at Berkshire Hathaway, Warren Buffett, has said that most of his day is spent sitting in his office and reading and contemplating what he has read.

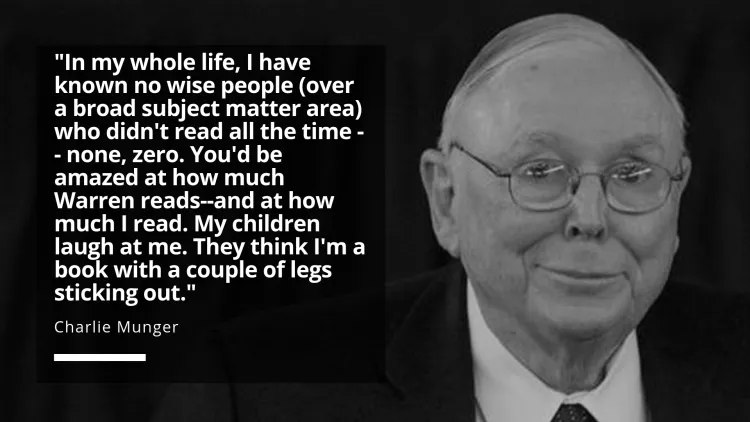

Now I am not suggesting that every investor has the time to sit and read all day long. Nevertheless, as Munger says in the above quote he has never met a wise person who did not read.

I had to learn this lesson early in my career. I did not study or read about any of the great investors and how they created their wealth. Once I understood that most of the great investors have written books or even today write annual or quarterly letters, it became a mission of mine to increase my knowledge base by reading their books and letters.

I not only read great investors but also great businessmen and women from history. It is important to understand that success leaves clues. You do not have to reinvent the wheel to be successful in this business. This is a big hack into accelerating investment success by learning from the successful and avoiding mistakes that cut returns and sabotage compounding.

I have been asked many times to provide a list of recommended reading material that I have found useful.

Here is a link to the reading list. It is a work in progress and I will be building this out over time. The list is hyperlinked to Amazon pages where you can find the books for your convenience.

Like wealth can be compounded over time, knowledge can compound over time. I can guarantee if you consistently gain knowledge over time you will begin to notice how you start understanding things easier and how knowledge in one discipline can carry over into others.

Gain knowledge to gain an advantage.