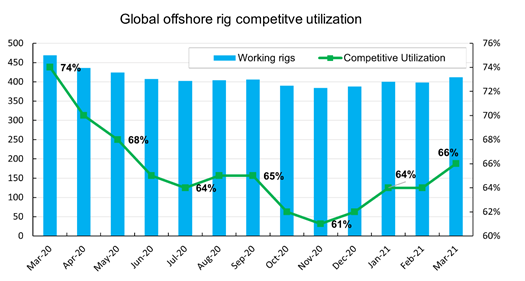

Despite continued significant challenges in the offshore rig market, there has now been an increase in offshore rig demand for three consecutive months, rising by 15 rigs between December 2020 and March 2021 (see Figure 1). Competitive[1] utilization has climbed from its lowest point over the past year of 61%, which was recorded during December 2020, to 66% in early March 2021.

This rise in utilization has been sparked by higher commodity prices, increasing rig demand as contracts are reinstated or awarded following deferrals in 2020, and a leaner competitive fleet due to increased attrition and a number of rigs being long-term cold stacked.

There has been insufficient investment in new oil and gas reserves over the last few years. This has been masked by the “shale revolution” in the US and by demand destruction due to Covid-19.

Nevertheless, demand for oil and gas is going to increase as the emerging markets continue to urbanize and industrialize. As oil is an extractive industry reserves prodcued must be replaced. This requires tremndous investment.

The recent rationialization of the offshore drilling industry via bankruptcy is, in my view, setting up the industry for a tremendous bull market in the next several years.