Back in December, we started discussing a gradual return to normal in China as I thought the CCP would gradually over time loosen Covid lockdowns.

I am not sure anyone anticipated that the government in China would just change policy in the span of ten seconds. Nevertheless, this is what they decided to do. We are now seeing Chinese travel activity picking up fairly quickly.

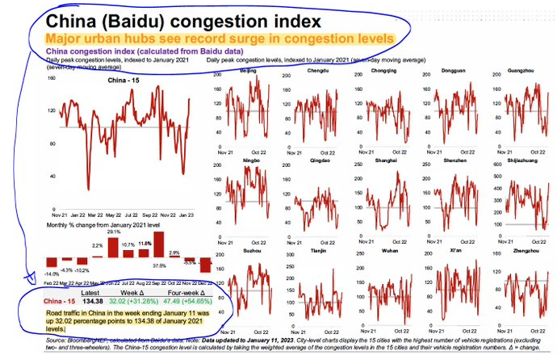

Traffic congestion is picking up rapidly in the top 15 cities in China.

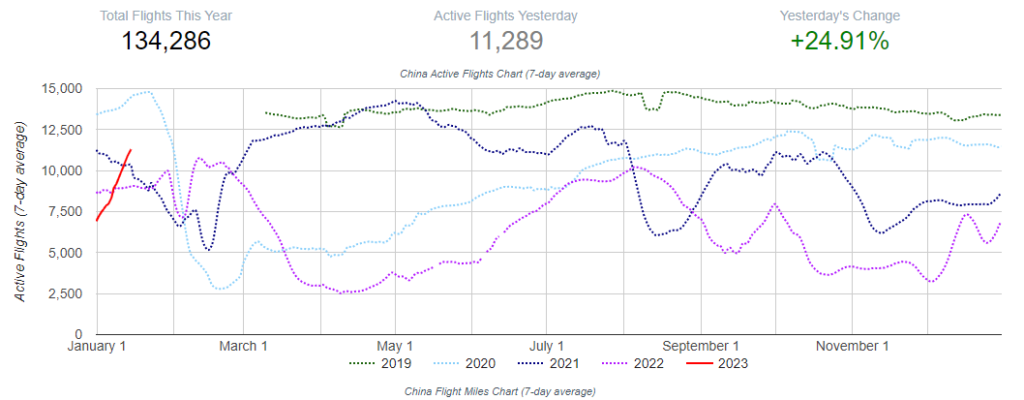

Flight data is showing a rapid return in internal flight demand in China.

This information indicates that Chinese consumers, who were locked up for three years in China’s bid to control the spread of Covid, are now reacting like other consumers in the world when they exited lockdowns.

I suspect that we will see what we saw everywhere else in the world. Chinese consumers will go on a spending spree and will be looking to get out of their houses and apartments and travel and spend money.

I would also add that the PBOC injected around $250 billion in liquidity into the market during December. I suspect this was done in an attempt to jump-start the economic recovery.

How is this actionable?

I think as we see the Chinese economy recover we could see the return of 2-3 million barrels of demand return to the market. With an already tight oil market, I have the view that this returning demand along with the end of the SPR releases could lead to higher oil prices as we move through 2023. I am long select oil producers and oilfield service providers.