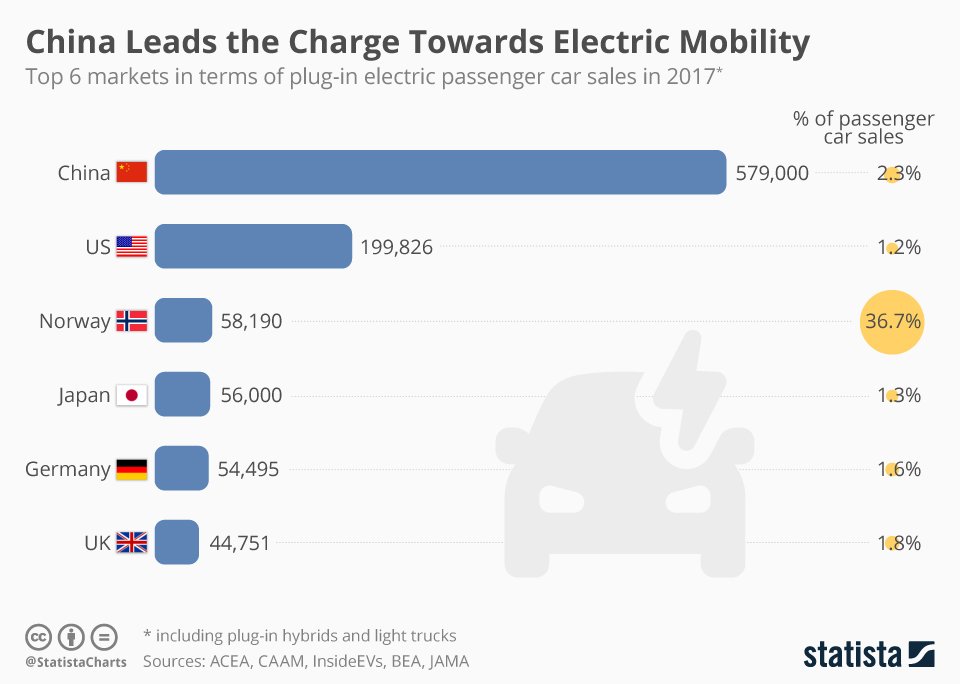

A few pictures and charts with regards to why cobalt is so important;

Cobalt continues to make new price highs. Is it still a compelling speculation?

The Chinese government understands it must deal with this pollution problem or it’s very existence will come into question. A government, even a communist one, still has to have the overall support of the governed or it will lose power.

People in China do not have a large social services net like in the west. They rely on their children to take care of them when they become old. They do not want these children poisoned and dying prematurely from car exhaust and coal power plant emissions.

I have discussed nuclear power elsewhere. I expect it to be pursued aggressively by China as a way to eliminate particulate emissions from coal fired power plants. China is also making a big push into electric vehicles. Today I discuss electric vehicles and a primary component of electric vehicle batteries, cobalt.

The thing to understand about China is that the Communist Party calls the shots. After all it is still a bastion of central planning. If the party decides a policy is going to be put into place than that policy is implemented without debate or objection. The other thing to understand is that China plans out its policies very methodically.

Automobile emissions contribute about 30% of the pollution in Chinese cities. Therefore, the Chinese have decided that they need to really reduce internal combustion engines and pursue electric vehicles. That means both cars and buses.

We have been over the whole construction of EV batteries and that cobalt is the key element along with nickel and lithium. The Chinese have spent time and money ensuring that they will have ample amounts of cobalt for their plans.

That was the headline from a recent Reuters article. Excerpt from the article:

According to the filing, GEM and its subsidiaries will purchase 13,800 tonnes of cobalt hydroxide from Glencore in 2018. They will buy 18,000 tonnes in 2019 and 21,000 tonnes in 2020.

Glencore, whose cobalt is mined as a byproduct from its copper and nickel mines in the Democratic Republic of Congo, Canada and Australia, expects to produce around 39,000 tonnes of cobalt in 2018 – equal to about 35 percent of estimated global production.

Glencore expects its cobalt production to rise to 65,000 tonnes in 2019 and dip to 63,000 tonnes in 2020.

When the Chinese go in they go in big. The party wants more EV’s on the road in China so there will be more EV’s on the road. If it requires buying up a third of Glencore’s production than so be it.

And check out this Bloomberg article:

The article says the following:

“It tells us once again that it is China rather than the western world who properly understands the raw material requirements and value of global vehicle electrification,” Paul Gait, an analyst at Sanford C. Bernstein Ltd. in London, said in a note. “They clearly get it; the West doesn’t seem to at the moment.”

This comes on top of the recent announcement by Volkswagon that they will be plowing $25 billion and up to $60 billion into electric vehicle supplies, technology, and production.

Volkswagen announced Tuesday that it had secured about $25 billion in battery supplies and technology, a sum it plans to scale up to $60 billion as it looks to expand electric-vehicle manufacturing.

Things continue to heat up in the race to secure sufficent raw materials to build out the electric vehicle revolution. This is being reflected in the price of cobalt.

I am not going to make a prediction on how high I think the price of cobalt is going to go. I will say that the previous high of $50 is easily going to be surpassed. I think a run to $100/lb could be possible.

There are many junior miners out there that one can speculate on. However, I continue to like Cobalt 27 Capital. They are holding a large position in physical cobalt and are now signing up various royalty and streaming deals.

I am also looking at a beaten down nickel and cobalt producer that appears to be turning around at just the right time. I will be profiling that company for subscribers of the Actionable Intelligence Newsletter.

Cobalt is on the move due to the worldwide push for electric vehicles (and we have not even discussed it’s other uses which are growing). The supply is constricted and is mostly from politically unstable areas of the world. Make no mistake if the price goes high enough miners will find and bring online suffcient cobalt. The question is what is that market clearing price and how long will it take. I would suggest it is much higher than the current price.

Read my original cobalt investment article here

Read why Elon Musk has a cobalt problem here

Guys I have been writing about this impending cobalt shortage for almost two years. This is the type of information I provide to my readers every month. I get you ahead of the trends and ahead of the crowds. Consider a subscription to the Actionable Intelligence Alert if market beating returns are what you are looking for.