Commodities & Market Rotation into Value

By Taylor Collins

Commodity prices and performance of many resource-related stocks have been picking up recently. In addition to this, many of the wildly popular, most-talked about tech/growth stocks now seem to be going sideways and/or sputtering altogether. If we go back just a few months to July of this year, NASDAQ was up almost 20% YTD, and we’ve all probably heard about the record IPO filings and insane valuations on many of those stocks (something we’ve discussed previously).

It appears that we are witnessing a market rotation out of tech/growth and into value, and I believe this is just getting started.

There is a great saying from the historian James Grant, “Progress is cumulative in science and engineering, but cyclical in finance.” We will revisit this idea later, but for now let’s take a look at a few indicators of commodity prices since the COVID correction back in March.

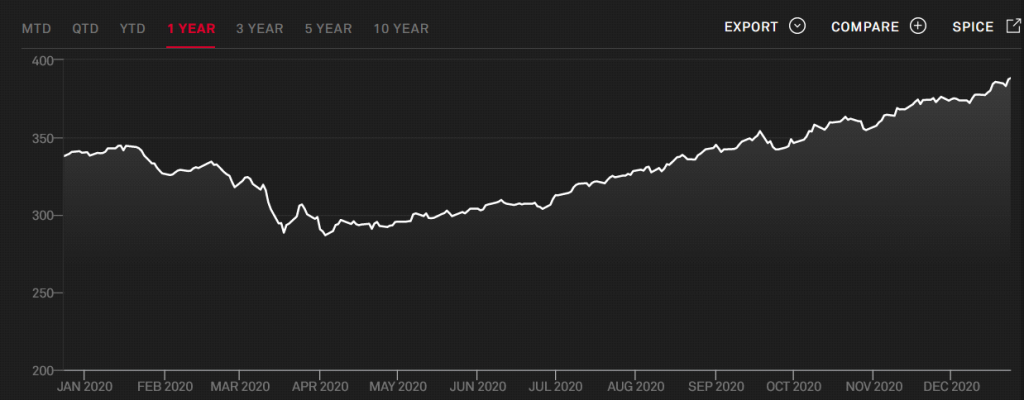

If you look at the 1-year chart for the Goldman Sachs Commodity Index (composite index consisting of 24 different commodities), you can see that although commodity sector returns have been trending upwards in the past 8 months, we are still nowhere near the pre-COVID levels:

Chart Source: https://tradingeconomics.com/commodity/gsci

The world as we know it is different than it was just a year ago, but I have to imagine that with the COVID vaccines being deployed and economic activity beginning to pick back up, there has to be a lot of room for commodity prices to continue their run up (this is without taking into account the monetary policy of central banks all across the globe injecting additional currency units into the economy).

That Goldman Sachs Commodity index is heavy on energy, so it can be helpful to view some other commidity indicators for a more complete picture.

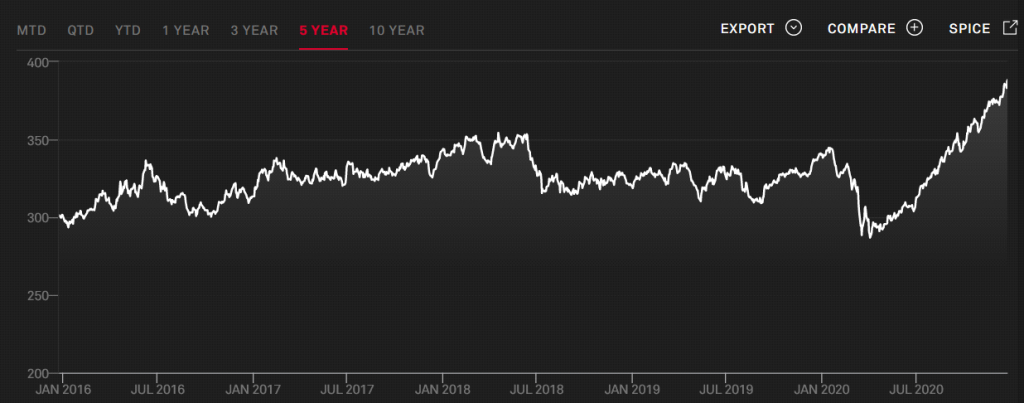

The S & P GSCI Non-Energy Index also illustrates broad commodity sector performance, but excludes all commodities from the energy sub-index. Here is the 1-year chart:

Clearly this index demonstrates that there is an established trend since June of this year.

If we look at this same data on the 5-year chart it makes for an even more bullish case, with a well-defined upward trend in which non-energy commodities as a whole have been taking out short-term resistance levels and steadily moving higher:

Source for these 2 charts: https://www.spglobal.com/spdji/en/indices/commodities/sp-gsci-non-energy/#overview

It’s important to note that because we are looking at commodity indices that reflect a number of different types of commodities, that not all commodity prices will rise equally. Agricultural products and say petroleum products could perform very different from one another, for example. But by hypothesizing a continued bull run in commodities as a whole, we may find specific investment opportunities that are more attractive than others.

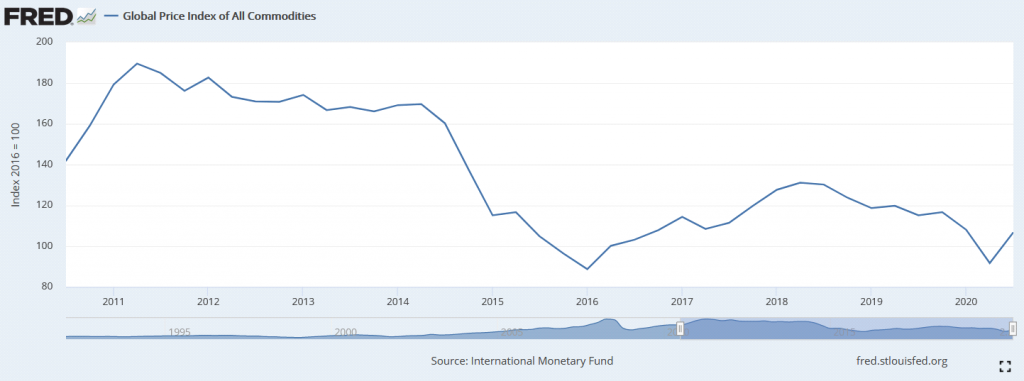

One last chart for commodities, this time from the IMF. This is the IMF All Commodity Price Index from 2010 until 2020. Note that this figure is reported quarterly. I wanted to include this as well because I believe it helps illustrate that commodity prices as a whole have plenty of room to run higher, and that personally I believe there is a strong bull case in both the short/medium term and in the long term:

I also want to briefly look at the approach of value investing vesus growth investing. If you are focused on the value investment approach, your aim is to invest in companies that are undervalued relative to the market. With a growth investment approach, your focus is to put your capital to work by investing in companies which are growing revenue, earnings and cash flow. Of course one can adjust their investment approach over time based on market conditions.

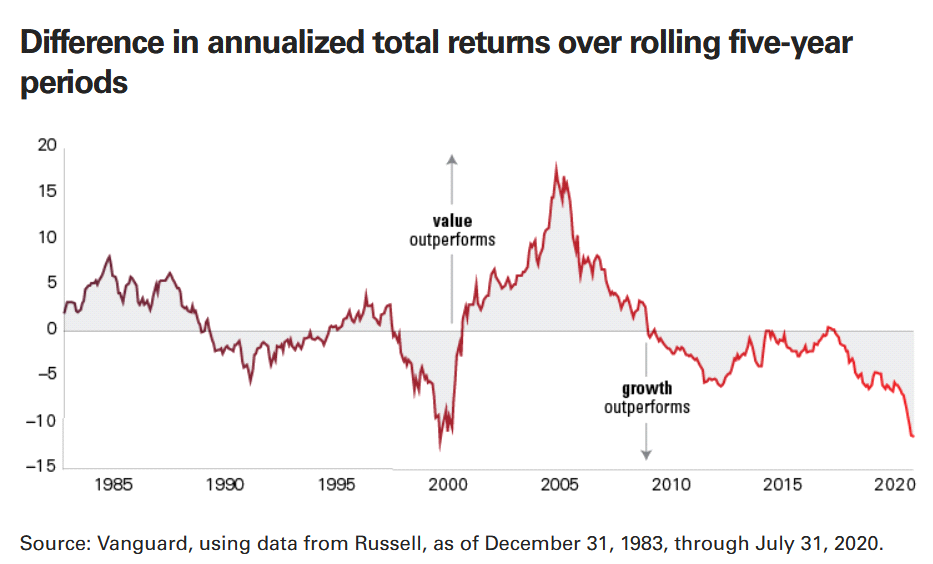

The next chart compares annualized total returns between the Russell 1000 Value Index as compared to the Russel 1000 Growth Index. In this chart, it’s obvious that growth investing has produced better annualized returns than value investing over the past 4 years or so (as well as during other periods in the past 35 years):

To me, this chart is very telling. The pendulum appears to swing from one extreme to the other (most notably from around the year 2000 until 2005).

Without fundamental support, if valuations continue to move higher for a given sector (in this case, in tech or growth stocks), it becomes less likely that someone entering a position now will be able to produce similar returns as the past few years. As John has talked about before, you make your money when you buy something (based on the price at which you bought it)… the purchase price of an asset is the main factor that determines your potential profit later on.

So from a 20,000-foot view, I think we are gearing up for the continuation of this market rotation from growth into value, and am confident that we will see value stocks outperform growth in the coming years.

Identifying solid companies that are currently undervalued, particularly in the commodities sector, should provide a nice opportunity over the next several years.

Progress is cumulative in science and engineering, but cyclical in finance – James Grant

______________________________________________________________________________

Additional Links & Information:

Goldman Sachs Commodity Index (also known as the S & P GSCI):

- A composite index consisting of 24 commodities from all commodity sectors: energy products, industrial metals, agricultural products, livestock products and precious metals

- Note that the GSCI is energy heavy (the tradingeconomics link below even says “its exposure to energy sector is much higher than other commodity price indices”)

Chart & Information Source: https://tradingeconomics.com/commodity/gsci

S & P GSCI Non Energy Charts & Information Source: https://www.spglobal.com/spdji/en/indices/commodities/sp-gsci-non-energy/#overview

Investopedia: Mean Reversion Definition:

https://www.investopedia.com/terms/m/meanreversion.asp

Vanguard Article: Growth vs. Value: Will the Tides Change?

DISCLAIMER: None of this content should be construed as financial advice, I’m not a financial advisor of any sort and you should always do your own due diligence. Never invest if you cannot financially afford to lose your investment.

IMF All Commodity Price Index Chart Citation:

International Monetary Fund, Global Price Index of All Commodities [PALLFNFINDEXQ], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PALLFNFINDEXQ, December 27, 2020.