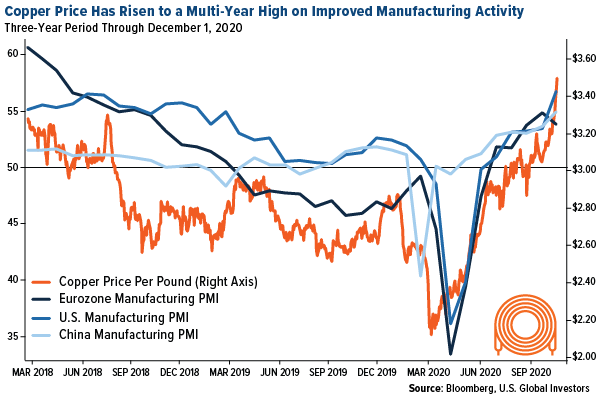

“Dr. Copper,” so named for the metal’s ubiquitous use in many different applications, has been ripping higher since its 52-week low in March, thanks to a number of factors including promising economic data. Copper rose 12.24% in November, its best month in four years. Today it was trading as high as $3.52 per pound, or $7,679 per ton, its highest level since March 2013.

The rally is due in large part to higher demand from manufacturers in the U.S., China and eurozone. For the month of November, the IHS U.S. Manufacturing PMI hit 56.7, up significantly from 53.4 in October. The month-to-month increase was the sharpest since September 2014, according to IHS Markit.

This week, a senior executive at BHP, one of the world’s top copper producers, said that copper output would need to double over the next 30 years to meet surging demand for green renewable energy.

Reflecting on the copper bull run, which has lifted the metal’s price some 72% since the March low, one money manager believes this rally could be one for the history books. Says Luke Sadrian, chief investment officer at Commodities World Capital, copper is “looking like it did in ’04 and ’05, and the world didn’t get the memo.”

One of the copper stocks in the AIA portfolio has been making new multi-month highs as the copper price charges higher.

We don’t even have most economies in recovery yet and the copper price is surging. What happens as all of the liquidity being created by central banks finds iteslf into these commodity markets?

Interested in knowing how I translate the information in these articles into investment ideas?

Consider a subscription to my paid newsletter “Actionable Intelligence Alert”. You can check it out by going to:

actionableintelligencealert.com/subscribe

I have started up a Patreon account for those that wish to help support my work. Check it out here:

https://www.patreon.com/JohnPolomny

If you pledge at least $5.00 I will send you the current months stock pick (one time only). This way you can sample the “Actionable Intelligence Alert” newsletter and see if it is for you.