As commodities rip higher across the board, gold and silver continue to lag.

Am I ready to throw in the towel on precious metals?

Not yet unless I think gold and silver will not do what they have always done. Protect investors from government and central bank overspending and monetary malfeasance.

With the recent passage on Friday of a $1.9 trillion dollar COVID “stimulus” bill and an upcoming $3 trillion dollar infrastructure bill that is all being deficit financed, I would suggest that gold will soon reassert itself as a protector of wealth as the US has crossed the monetary Rubicon of fiscal responsibility.

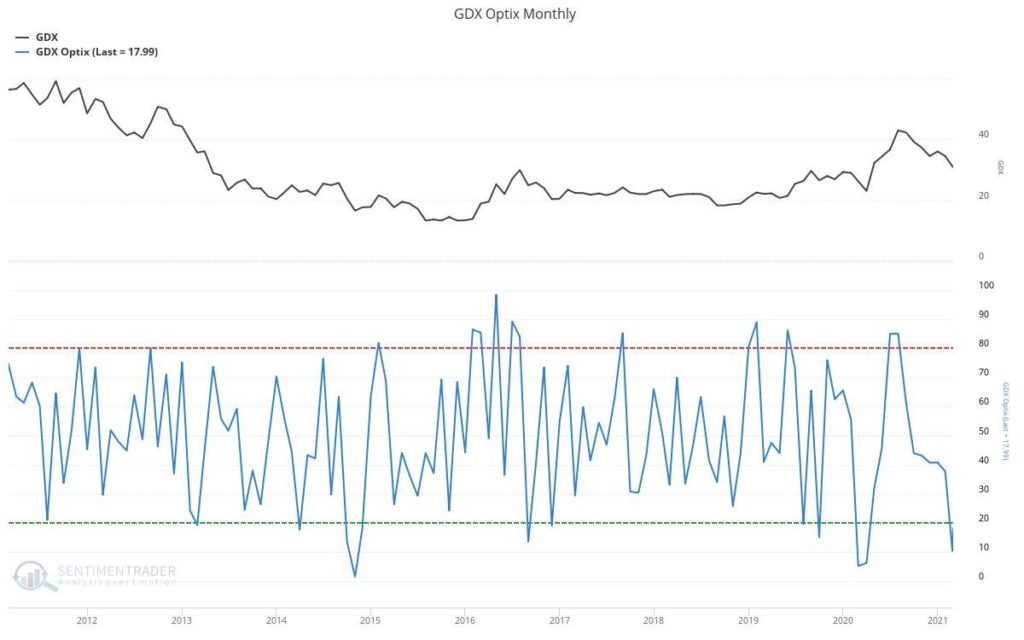

As can be seen from the above chart investor sentiment towards gold stocks is at the third lowest level it has been at in the last ten years.

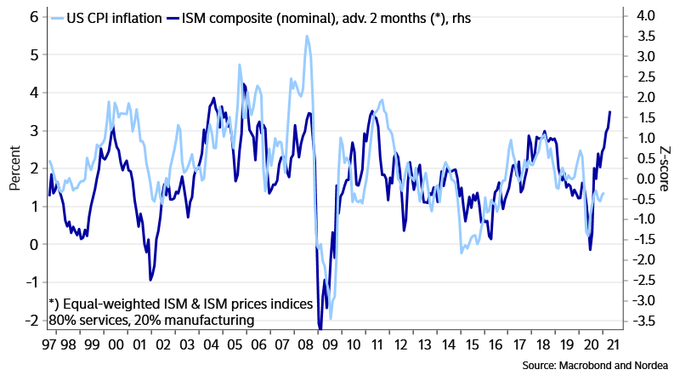

As I have pointed out in previous emails and videos real rates drive the price of gold long term. As rates on the 10-year Treasury bond have moved higher recently (as the bond market anticipates potential upcoming inflation) real rates have moved higher as the inflation statistics are a lagging indicator.

I would suggest that with the recent blow out ISM numbers that we will see inflation readings coming in hot over the rest of the year. (see chart below). This should push rates well back into negative territory and gold should resume its move higher. Gold stocks being extremely oversold should benefit massively.

Gold has had a typical correction in an ongoing long term bull market. Investor sentiment is low and conditions for a higher gold price have never been better.

Got gold?

Follow me on Twitter: @JohnPolomny

Interested in knowing how I translate the information in these posts into investment ideas?

Consider a subscription to my paid newsletter “Actionable Intelligence Alert”. You can check it out by going to:

actionableintelligencealert.com/subscribe

I have started up a Patreon account for those that wish to help support my work. Check it out here:

https://www.patreon.com/JohnPolomny

If you pledge at least $5.00 I will send you the current months stock pick. This way you can sample the “Actionable Intelligence Alert” newsletter and see if it is for you.