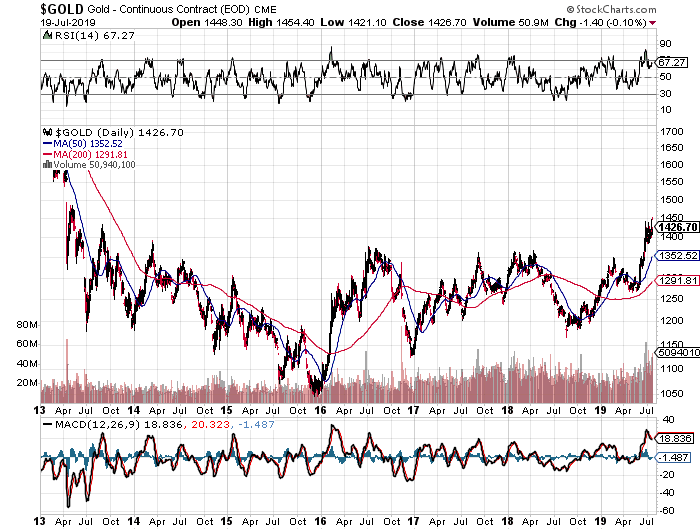

Gold recently broke the $1400 barrier, something it hasn’t done since 2013.

Gold has basically been dead money for years. This recent powerful rally in gold has led to a massive breakout from a year’s long trading range.

I was initially a bit skeptical about the breakout because we have seen false breakouts in the past. However, after the initial breakout the gold price consolidated and then put in another new high.

Now I am not a technical analyst. However, I do like to look at charts to determine if confirmation of my fundamental analysis is correct. It appears gold was able to hold the breakout and has recently moved higher.

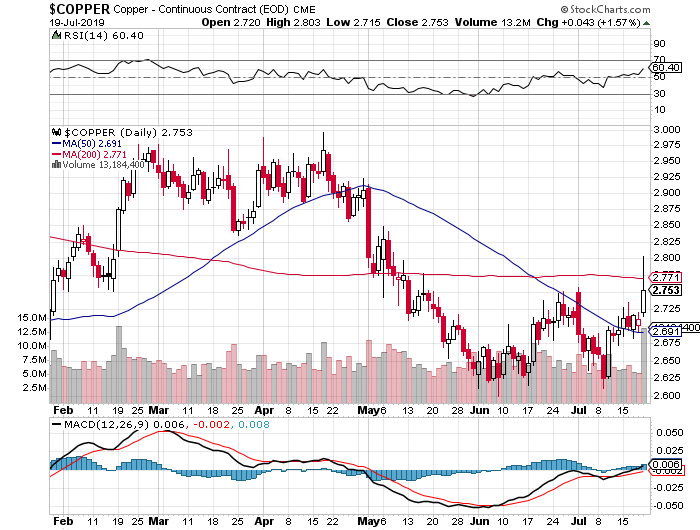

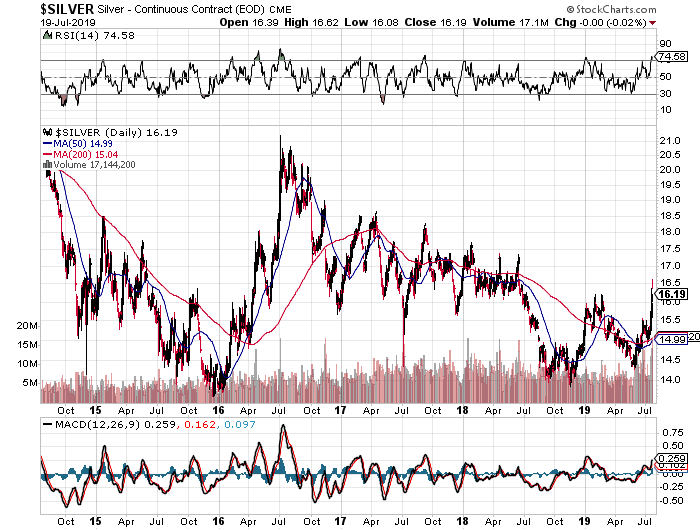

I have said in recent videos that I think we are in a new gold bull market. Not only that, I believe that we are entering a new resource bull market. This might seem counter intuitive as the news media is constantly been hyping a weakening economy and trade war that will presumably lead to lower commodity prices.

So why am I becoming bullish on gold and other commodities. Simple, the US and for that matter most other countries around the world have accumulated massive amounts of debt.

In fact, the US Federal government has over $23 trillion dollars of debt and is accumulating approximately $1 trillion dollars in new debt each year. This is happening during a so-called economic expansion! What happens when we eventually have a recession? The deficits will easily be over $2 trillion per year.

You can blame it on Trump but both Obama and Bush 2 both doubled the debt while in office. The fact remains that voters in the US and other countries want government services and benefits but do not want to pay for them.

This is not a political screed, but the fact remains politicians only respond to what voters who elected them want.

The problem is that too much money goes out and not enough comes in. The difference is made up with debt and the can is kicked down the road for someone else to deal with.

After the 2008 GFC governments and central banks decided that instead of dealing with the underlying issues that caused the crisis they would buy government bonds and mortgage securities and drive down rates by printing trillions of currency units. This led to gold hitting an all-time high in 2011.

We have now been in a zero-interest rate environment for years. This has done several things. It has led to a ton of malinvestment into enterprises that are not economic and would not exist otherwise. The so-called shale revolution is an example of this. $300 billion in high yield junk rated debt was issued to allow this so-called revolution.

This low rate environment has encouraged governments and companies to take on even more debt because rates are being artificially held lower by central banks. This has allowed debt service to decrease even as total debt has increased!

As economies around the world, especially in the US, Japan, Europe and China slow down the governments will do what they have always done. Lower interest rates and create trillions of currency units. They will do this to “stimulate” their economies and to weaken their currencies relative to their trading partners in attempt to gain an advantage in exports.

The US will also cut rates later this month. Why is the US cutting rates while unemployment is at all-time lows, the stockmarket is at all-time highs, and the economy is s presumably still growing? Because if it doesn’t and everyone else does then the value of the dollar will soar. That would lead to lower US exports and possible other negative effects in emerging and frontier market debt.

We are now entering a new phase of worldwide rate cuts and massive money printing.

The reason gold and other commodities are rallying is because they sense this fact. Remember markets trade on anticipation of events not actual events (buy the rumor sell the news).

Just because central banks can with a click of a button create trillions of currency unit’s does not mean that the supply of resources can be raised at the same rate. More currency chasing the same amount of resources leads to higher prices.

Couple the fact that global central banks are poised to enter a new phase of unprecedented money printing with the fact that we have witnessed almost of a decade of lack of investment into new resource supply and I think we will see a massive bull market in resources.

This is not a mainstream view, but I believe it will become one over the next several years as we enter uncharted central bank waters where all kinds of wacky monetary policies will be attempted to stave off a debt deflation.

Ray Dalio recently published an article on LinkedIn entitled “Paradigm Shifts”. It can be accessed here. Below is a quote from the article:

“To me, it seems obvious that they (central banks) have to help the debtors relative to the creditors. At the same time, it appears to me that the forces of easing behind this paradigm (i.e., interest rate cuts and quantitative easing) will have diminishing effects. For these reasons, I believe that monetizations of debt and currency depreciations will eventually pick up, which will reduce the value of money and real returns for creditors and test how far creditors will let central banks go in providing negative real returns before moving into other assets.”

(skip)

I think that it is highly likely that sometime in the next few years, 1) central banks will run out of stimulant to boost the markets and the economy when the economy is weak, and 2) there will be an enormous amount of debt and non-debt liabilities (e.g., pension and healthcare) that will increasingly be coming due and won’t be able to be funded with assets. Said differently, I think that the paradigm that we are in will most likely end when a) real interest rate returns are pushed so low that investors holding the debt won’t want to hold it and will start to move to something they think is better and b) simultaneously, the large need for money to fund liabilities will contribute to the “big squeeze.” At that point, there won’t be enough money to meet the needs for it, so there will have to be some combination of large deficits that are monetized, currency depreciations, and large tax increases, and these circumstances will likely increase the conflicts between the capitalist haves and the socialist have-nots. Most likely, during this time, holders of debt will receive very low or negative nominal and real returns in currencies that are weakening, which will de facto be a wealth tax.

If central banks increasingly make cash worthless as a store of value people will eventually wake up and move into anything that can preserve some value. That is why I am bullish on gold.

Interested in knowing how I translate the information in these articles into investment ideas?

Consider a subscription to my paid newsletter “Actionable Intelligence Alert”. You can check it out by going to:

actionableintelligencealert.com/subscribe

I have started up a Patreon account for those that wish to help support my work. Check it out here:

https://www.patreon.com/JohnPolomny

If you pledge at least $5.00 I will send you the current months stock pick. This way you can sample the “Actionable Intelligence Alert” newsletter and see if it is for you.