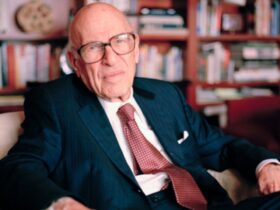

I am a long-term follower of Louis Gave’s work. He had said a few months ago that he expected China to open up its economy around this time. In this interview, he follows up with his view on China reopening and what he expects from other emerging markets.

When you look at 2023, what are the most important developments from an investor’s perspective?

The most important macro event is China’s reopening. Granted, I’m a guy who spends his whole day looking at China. If to a hammer everything looks like a nail, to someone who spends his time looking at China, what happens there is important. I’m happy to acknowledge that bias. What we witness today is the second-biggest economy in the world opening up after having been on lockdown for three years. And we know how this plays out, we have seen this script when the US or Europe reopened: Pent-up demand causes a surge of consumption.

What will that mean for the economy in China and the world?

First, we’ll get a surge in consumption. You have to remember that it’s not three months, but three years of pent-up demand. Going into the pandemic, households in China had about 8 to 9 trillion RMB in cash in their bank accounts. Today that number is 15.5 trillion. It has gone up more than 50%, because for three years all that people did was work and go home. They are more cashed up than ever before. Plus, mortgage rates have just dropped 150 basis points. In the West, when people came out of the lockdown and saw that interest rates had fallen by 50 or 75 basis points, they decided to buy a new apartment or a new BMW. There was a surge of consumption driven by low interest rates. Well, in China, mortgage rates are at record lows today. The same goes for car loans. How big is the release of pent-up demand in China going to be? It’s going to be enormous.

I am also very bullish on emerging markets and we hold several stocks in the Actionable Intelligence Alert portfolio that are poised to take advantage of this trend.