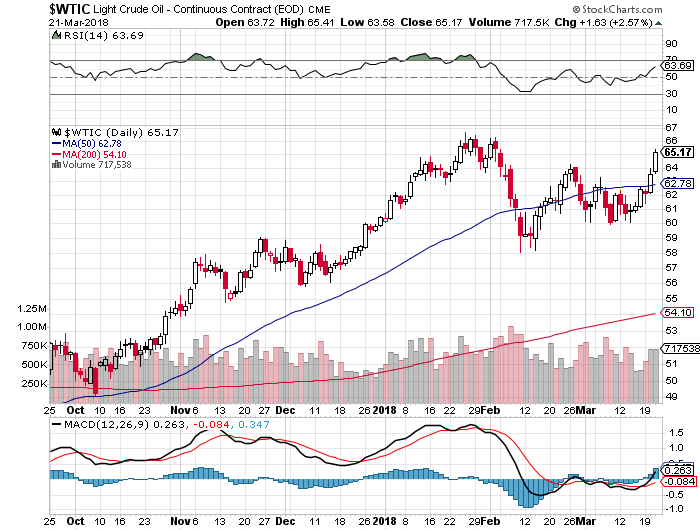

It looks like the oil market is getting ready to break higher. Take a look at the chart of WTI.

We need this to confirm by breaking through the previous highs back in January. I do not want to get too cocky yet.

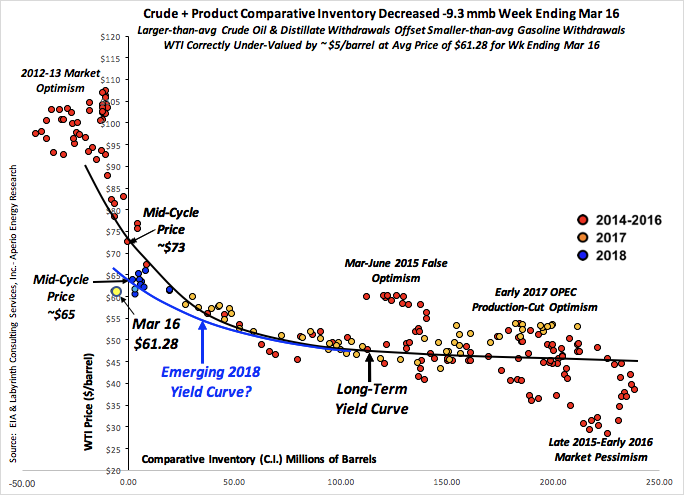

The fundamentals for oil are certainly looking bullish as comparative inventory continues to fall. Both the IEA and EIA are underestimating demand.

However, the market is still ignoring what is happening. In fact based on this chart and previous times when inventory dipped like it has recently WTIC should be trading $5 a barrel higher than it is! At some price $70, $80 a barrel money is going to realize the undervaluation in these oil stocks and oil service providers. When that happens a flood of cash will descend on this sector.

The market perception is still that the US shale plays will be an unending cornucopia of oil and that every time the price of oil gets above $65 a barrel the US will ramp up and flood the market with oil. I do not think this is the case.

US shale has been formidable but it cannot supply the whole world. The US is still a net oil importer. The refineries along the Gulf coast can’t even use this crude so it is exported. Our crude comes from places like Mexico and Venezuela!

Again the lack of investment in new resources over the last few years because of low prices will now cause the next supply shock as demand increases have been relentless. Especially from emerging market countries.

There will be a lot of catchup that will need to happen and my thesis is that a high oil price (over $100 a barrel within 12-18 months) and not FED rate hikes will be the cause of the next recession.

I will discuss this market in depth in this week’s video review.

Oh by the way cobalt made another new high today, now over $41/lb. Welcome to the commodity bull market!