Rates to charter oil tankers from the Arab Gulf, United Kingdom and the U.S. Gulf Coast to Asia surged to fresh highs on Friday as global oil traders grappled with a tanker shortage in the aftermath of U.S. sanctions on units of Chinese giant COSCO.

(skip)

Occidental Petroleum Corp tentatively chartered a supertanker to ship U.S. crude from the U.S. Gulf Coast to Asia for a record $15.8 million this week, three sources said on Friday.

(skip)

Occidental provisionally chartered the Very Large Crude Carrier (VLCC) Hong Kong Spirit for $15.8 million for departure to Asia next month, sources said. That does not mean the voyage will actually be completed.

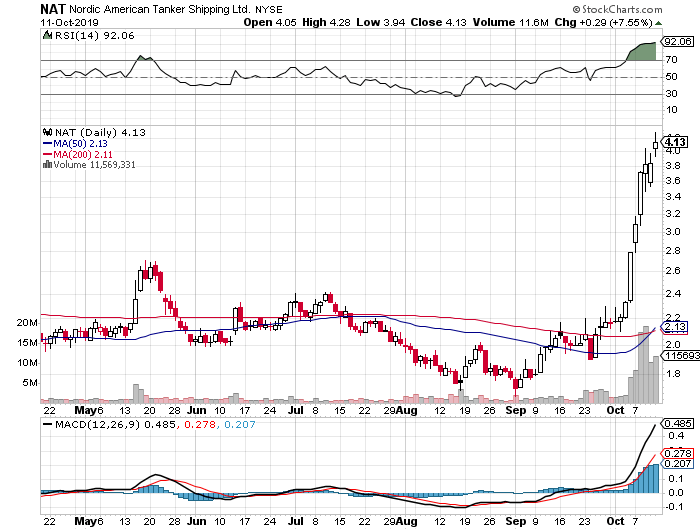

The rise in rates has translated into oil tanker stocks blasting off.

This is what can happen when events line up the right way for a specualtor. We have a business, oil tankers, that was in recovery along with the upcoming IMO 2020 regulations.

We then have President Trump issuing an executive order to sanction COSCO the Chinese shipping company for shipping Iranian crude. Removing the COSCO tankers from the global fleet was enough to push the oil tanker supply demand balance in favor of the shipping compnaies.

If you have 98 cargos and 100 ships you have bear market in oil shipping. Conversely if you 100 cargos and only 98 ships you have a bull market in oil shipping. Why?

Oil is the feedstock used in refineries. A refinery is a multiple billion dollar facility. It needs to run as much as possible in order to achieve the benifit of scale. Therefore the owners of refineries will pay up to ensure that there is suffcient crude oil to keep the refinery operating.

In addtion, these large crude carriers are moving million plus cargos of oil. Therefore charging millions of dollars for moving the amount of oil is spread over many barrels.

I think it is worth watching to see what happens with COSCO. Last Friday a deal was reached between China and the US on the trade front. I did not see that he sanctions on COSCO were lifted. Expect to hear more news on high charter rates until the sanctions are lifted. COSCO has something like 50 crude carriers which is a signifcant amount of the golbal fleet.

Even if the sanctions on COSCO are lifted the recovery in shipping is ongoing so I expect good things over the next year or so. NAT is way overbought and nothing goes straight up so buyer beware if you want to get in this sector.