If you are a true contrarian investor than mining companies have to look compelling at these low valuations.

Making a long-term bull case for miners, Bernstein Research analyst Paul Gait said the sector is being valued at a 100-year low.

“Our broad conclusion is that mining has never been cheaper than it is today, hence the current sector weakness represents an ideal entry point for any long-term investor,” Gait said in a Sept. 3 note.

Analyzing the sector’s cyclically adjusted price to earnings ratio, or CAPE, Gait found that the mining industry trades at 1.4 standard deviations under its long-term average value. This, Gait said, is the lowest recorded data point over the past century.

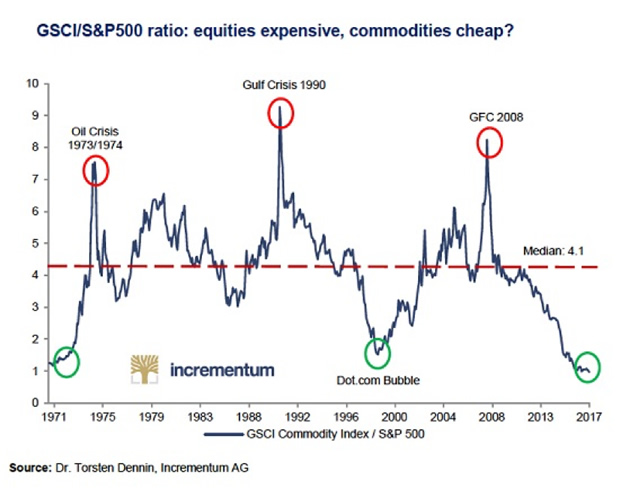

“The only comparable period in recent history was during the height of the dotcom bubble in the late 1990s, however even during the dotcom bubble the valuation disconnect was not as severe as it is now,” Gait said. “Over the four years between 1997 and 2001, the relative valuation averaged about 0.46x relative CAPE, during the period 2015 to present the average has been 0.31x relative CAPE!”

Everything we have and that we use starts out as either being mined or farmed. Most people forget this when resource stocks go out of favor. If you had to hold a stock for ten years would it be a great gold royalty company like Franco-Nevada or a money losing fad stock like Beyond Meat.

Based on the fundementals and how cheap resource stocks are I would rather own the royalty compnay as I think growth stocks with no earnings are near their highs for this cycle.

Your answer reveals alot about how you think about valuation and your biases.