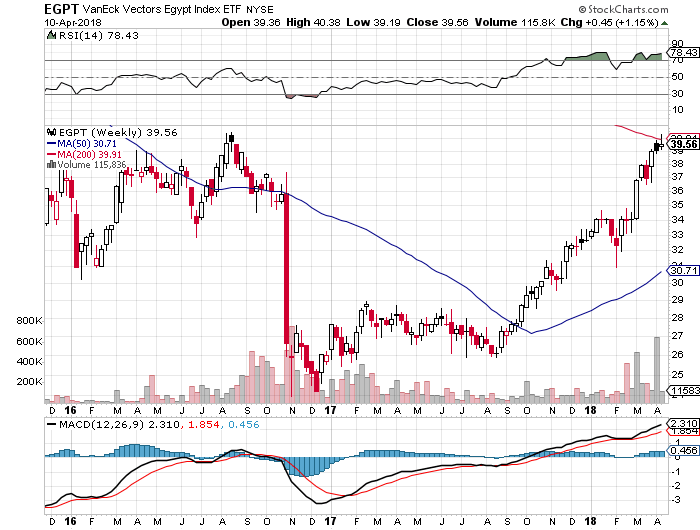

I closed out my position in the Egypt ETF (EGPT) yesterday and moved the funds into the Nigeria ETF (NGE). The gain on (EGPT) was 42% for a holding period of thirteen months.

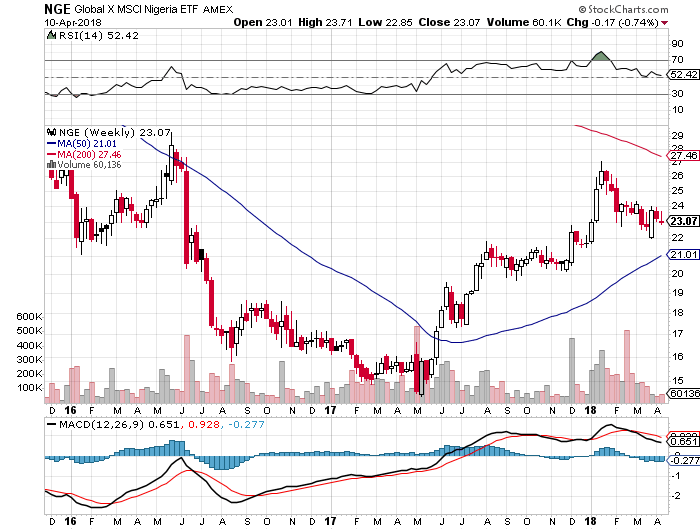

I am still bullish on Egypt in the medium to long term but the price of the ETF has moved significantly over the last several months and is relatively overvalued. Conversely, the valuation and upside potential in Nigeria appears to be greater at this time.

I was already looking at Nigeria as another cheap (based on CAPE) market that I was considering investing in when I watched an interesting video on RealVision TV this weekend.

By the way the RealVision paid subscription is well worth the price in my view. The segment production quality is top notch and the guests are all the top money managers that you would be familiar with. In addition, RealVision spends time deep diving the issues with the guests so you are spared the CNBC, Bloomberg, Fox Business two minute sound bite interviews.

There was a segment on frontier and emerging markets by Larry Seidel and he talked extensively about Nigeria and its prospects. A lot more going on there than most think and it is positive.

Nigeria is selling at a P/E of around 6% and the current dividend yield is around 3%. The political issues are calming down with Boko Haram and also the rebels in the Niger Delta, oil prodcution is increasing again. I can’t kiss all the girls so the prospects, in my view, for Nigeria look superior to Egypt currently. Mostly because I believe oil prices are heading higher. Nigeria is of course a member of OPEC and is a major oil producer and exporter.

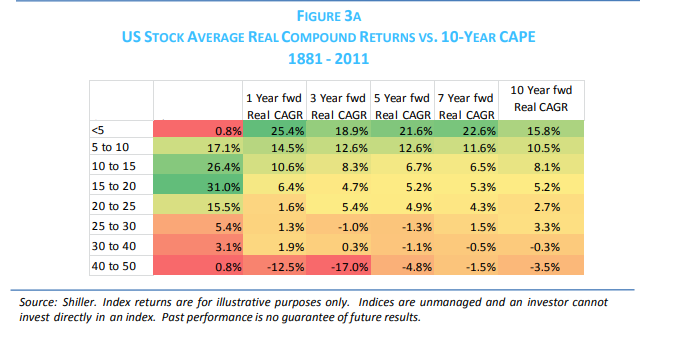

Someone asked me why I made this change in the comments of the recent CAPE video. As I said before CAPE is not a timing tool. That is correct but it is a valuation tool. I check the CAPE ratio’s every quarter and constantly tweak my CAPE portfolio. As I said above I still like Egypt and even Pakistan (which I sold in 2016 to buy Egypt) long term. It is just about relative valuation among the countries.

Regarding the CAPE ratio I still own Greece and Russia and have owned them for a couple of years as they are still the cheapest markets in the world.

You will notice if you look at CAPE return chart (this one is for the US but the principle applies to all markets) that the largest returns are typically captured in the first three years of the undervaluation period.

Again, as I said in the video, I do not get wedded to just one tool. I use CAPE as a starting point to get the 40,000 foot view and then drill down to see what catalyst is present or in progress that will get market sentiment to go from bad to less bad. Once sentiment changes money flow into the country happens and I make money.

Remember what I said in the video you can’t build a house with just a hammer. You need to use several different tools in order to build a house. The same principle is present in allocating capital. I use several different tools in order to determine the best place for capital at the current place in time.

I hope this exercise explains my method a bit better. If not comment and I will try and flesh it out some more.