As I have stated many times I like to try and follow billionaire investor Charlie Munger’s advice,

“I believe in the discipline of mastering the best that other people have ever figured out. I don’t believe in just sitting down and trying to dream it all up yourself. Nobody’s that smart.”

I try and identify serially successful people or people who have demonstrated mastery of their craft.

One of those people I have identified is Leigh Goehring of natural investment firm Goehring and Rozencwajg. Back in 1999 Leigh Goehring was featured in Forbes magazine where he predicted gold was on the verge of entering a new bullmarket that would carry it to $2500 per ounce.

We all know that gold topped out at approximately $1900 per ounce in 2011. Since then gold has sold off but has, I believe, entered a new bull market.

Goehring and Rozencwajg recently put out their 2019 second quarter research paper. I really look forward to this as it is around 30-40 pages of great research into various natural resource and commodity themes.

What grabbed my interest in the most recent paper was the call they were making on gold. G&R are calling a new gold bullmarket and lay out their reasoning why they have this view.

In addition, Leigh Goehring is forecasting that gold could possibly make it to $12,000 per ounce during this bullmarket. Here is a snippet from the report.

Next, we would like to turn to the gold-silver ratio. Since the US government ended the dollar’s gold peg back in 1971, the relationship between gold and silver has exhibited certain predictable patterns. In precious metal bull markets, the gold-silver ratio usually contracts as the price of silver rises faster than the price of gold.

On the other hand, during severe bear markets, the ratio expands as the price of silver falls faster than the price of gold. Since 1971, there have been five times when the gold-silver ratio has surpassed 80:1 (i.e., an ounce of gold buys 80 ounces of silver), and in four of those instances, it paid to accumulate significant positions in both metals. Last week, the gold-silver ratio hit 93:1–the second highest reading ever.

Now we cannot rely on just one indicator in order to make financial decisions but the success of this indicator in the past cannot be ignored. They go on to list various other reasons why gold is positioned to enter a new bull market.

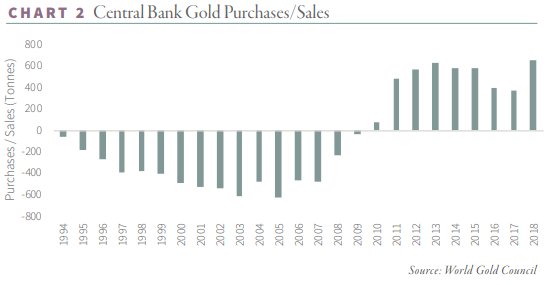

Some other factors include sustained central bank buying:

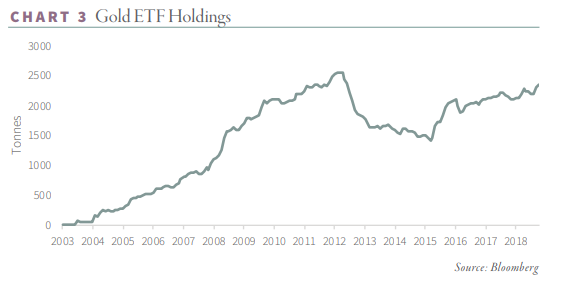

Along with sustained purchases by investors via the Gold Bullion ETF:

In addition, I have been talking about all the “monetary mayhem” that central banks are engaging in as they confront various financial issues and problems.

If you interested in deep value contrarian plays, then I strongly suggest following Goehring & Rozencwajg’s work. The best part is they post it all for free on their website.