How do you even begin to visualize $277 trillion?

If we convert it into seconds, 277 trillion is the equivalent of 8.8 million years. I’m not sure what was happening that long ago, but I guarantee you it didn’t involve people.

It’s been estimated that Jeff Bezos increases his net worth by about $321 million a day. At that rate, you’d have to work for close to 863,000 days, or 2,364 years, to reach $277 trillion.

You get the point. It’s an unfathomable sum.

(skip)

So how did we get here, and what can investors do to protect their own wealth?

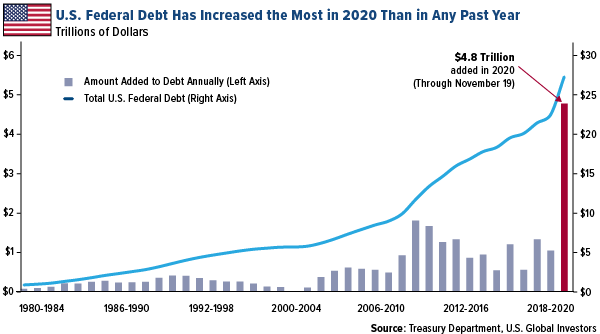

As you may expect, the economic fallout from the pandemic has dealt a huge blow to government coffers. So far in 2020, the U.S. has added more than $4.8 trillion to the federal debt, the most ever for a single year.

This has brought total federal debt up to a record $27 trillion, or 143% of U.S. GDP. Debt per U.S. taxpayer now comes in at a staggering $218,450.

$4.8 Trillion added to the US Debt this year with more to come. Who is going to buy all this debt? And the pols in DC are talking about more “stimulus” for heavans sake.

History teaches that these things don’t matter for years and then all of a sudden they matter over the span of a couple weeks.

I am not sure how the masters of the universe (so called policy makers) are going to get out of this. What I do know is that everyone should have a position in gold, hard assets, and even crypto currencies as a way to protect yourself for government and central bank malfeasance.

History shows that this is how great empires and civilizations get themselves tossed into the history bin. Not saying one has to panic but blissfully ignoring these numbers risks putting you and you family at tremendous risk.