100 to 1 returns On Your Money Is Possible

Last week I made a video where I reviewed the classic Thomas Phelps book “100 to 1 In the Stock Market”. The book details the many stocks that went up over 100 times in value over the previous decades of Phelps time in the markets.

Although the book was written in 1971 and most of the stocks chronicled were from the 1920’s, 30’s, and 40’s the principles that are common among these big gainers is the same today as they were back in the last century.

Phelps lays out the three items that lead to being able to capture these type of amazing stock market gains. He points out the following when buying stocks that will go up 100 times or more in value; “vision to select the right stocks, the courage to buy these stocks, and the patience to hold these stocks” over a long period of time.

Easy To Understand But Hard To Implement

Now that statement seems very easy to understand and it is. However, it is very difficult to implement for reasons I have detailed in other articles. Nevertheless we have irrefutable proof that this system works by looking at the track record of great investors like Warren Buffet and Prem Watsa.

Let’s examine Buffet’s record; this link will take you to the most recent Berkshire Hathaway annual letter to shareholders. You will note that the first page details the returns on a per year basis for book value and share value of Berkshire Hathaway stock. Go to the bottom and note the total increase in book value per share (1,088,029%) and per share value (2,404,748%).

Now do you understand why Albert Einstein declared compounding to be the greatest force in the universe and the eighth wonder of the world.

Copy What The Pros Do

Let’s look at Prem Watsa’s returns. Watsa is not as well-known as Buffet because he operates in Canada. Mr. Watsa follows a similar investing methodology and some have dubbed him the Warren Buffet of Canada. His investment firm is known as Fairfax Financial. Here is a link to the 2017 annual report of Fairfax Financial. On page one the long term performance of the company is summarized. You will note book value has increased on average 19.4% per year and the share price has averaged growth of 18.1% per year.

These results are reflective of a long term strategy of buying companies with above average returns on capital and invested capital. After buying the correct companies the key is having the patience to just sit still and letting those companies reinvest their profits back into the company and letting that capital compound year after year for a long period of time.

Long Term Holding Beats Trading In and Out

I am not aware of any short term traders or personalities profiled on the various financial media shows that have achieved results like this. Trading in and out different stocks will not lead to these type of gains. You will note that holding through the various financial upheavals did not significantly dent the returns of these two investors.

In his book Phelps highlights a discussion with a very old and wise investor that came to his firm to transfer control of his very large stock portfolio to his son. Phelps asked the old investor how he managed to accumulate such a large stock portfolio ($15 million plus in 1940 dollars). The old man responded that he “never sold” any of his positions.

I don’t necessarily say you should never sell any stock you own as some companies do lose their mojo and need to be sold. Nevertheless you get the basic idea, buy right and sit tight as my hero Jesse Livermore said was the key o this success.

I think it is preferable to look for companies that have good managements that have consistently had above average returns in their businesses than it is worrying day to day about the market and alll the associated noise. These managements then must be consistent in being good stewards of capital by reinvesting the company’s profits back into the company’s business, rinse and repeat.

Another way to do this is to look for frontier and emerging economies that are setting up for decades of growth due to positive changes in policy and demographics.

Two Long Term 100 to 1 Ideas

I have two ideas that I will present to you today; the first being a Prem Watsa creation called Fairfax India. Mr. Watsa emigrated to Canada from India back in his early twenties. He built up Fairfax Financial over many decades and then decided to create an investment vehicle that could take advantage of the potential growth that he could see setting up in India. Here is what Mr. Watsa said in the initial letter to shareholders of Fairfax India back in 2016;

“Based on Fairfax Financial’s successful experience over many years of investing in India and our belief (discussed in more detail below) that India was on the verge of a long period of significant growth, the purpose of Fairfax India was to make long term investments of meaningful size in public and private equity and debt securities with a view to acquiring control or significant influence positions in India and Indian businesses or other businesses with customers, suppliers or business primarily conducted in, or dependent on, India.”

India Is Where China Was Twenty Years Ago

I encourage you to read the entire letter as it lays out the investment case for India in great detail. So the case I am making here is that Mr. Watsa has averaged returns of 18.1% in Fairfax Financial stock over the last twenty plus years. This was done in Canada and other developed markets.

He is now moving into India via the creation of Fairfax India Holdings. India is projected to enjoy decades of growth in the 7-8% plus range. If you are operating in an environment where the economy is growing every year at 7% and you speak the language and have contacts going back decades I would venture to say that you may be able to exceed an average return of 18% per year.

I can hear the retort, India? Are you nuts? What about the huge amount of poverty, lack of infrastructure, the caste system, the volatile nature of India’s democracy, and the corruption? My answer is yes to all of that but so what, the economy still managed to grow 7.5% last year.

These problems are all slowly but surely getting solved. The road will be winding and bumpy but the country under Mr. Modi’s leadership seems to be moving in the correct direction.

If the government just manages to continue to build roads along with other infrastructure and electrify the entire country that will raise productivity to levels sufficient to cause the country to have positive growth. I am betting that Mr. Watsa can replicate his previous success in Canada in his birth country of India. Over the last three years that has been the case as book value and the share price of Fairfax India have consistently climbed.

I am a shareholder of Fairfax India and I consistently buy shares when they periodically sell off.

My other idea is Myanmar, formerly known as Burma.

This is a country of 53 million situated in SE Asia adjoining Thailand. The GDP of the country is around 67 billion/year. By contrast next door neighbor Thailand is 68 million with a GDP of 406 billion/year.

Myanmar used to be a British colony known as Burma. After independence the country was taken over by a military junta that ran the country for decades. The junta decided to follow socialist policies which of course did not work. In addition to the crappy economy the military government was constantly violating human rights of the citizens of the country.

Eventually the military decided that they needed to move to liberalize the economy. This was done in a planned out way that also included free elections and freeing of political prisoners including Aung San Suu Kyi.

In 2015 elections were held and were deemed fair by the international community. Many economic sanctions that were in place have been lifted and the economy has been liberalized.

I am not going to sugar coat it but Myanmar is a poor country but they are now on the right track. Foreign direct investment has been coming into the country and the economy has been growing by about 6% per year over the last few years.

The country has a dilapidated transportation system, only 40% of the population has access to electricity, the northern states have persecuted Muslim populations which has drawn international criticism on the government of Myanmar due to its treatment of these people.

I would note that Myanmar is the world leader in methamphetamine production and is up there in opium production. I say this tongue in cheek but what I want to emphasize is that these places have all kinds of problems. But so does the US and Europe or any other country in the world.

Again as in India, Myanmar has all kinds of excuses to not invest there yet the economy continues to grow.

I was on this story back in 2012 and found a company that is based in Singapore but had been investing in Myanmar for years. The name of the company is Yoma Strategic Holdings. In its earliest life Yoma was mostly a real estate and property development company focused in Myanmar.

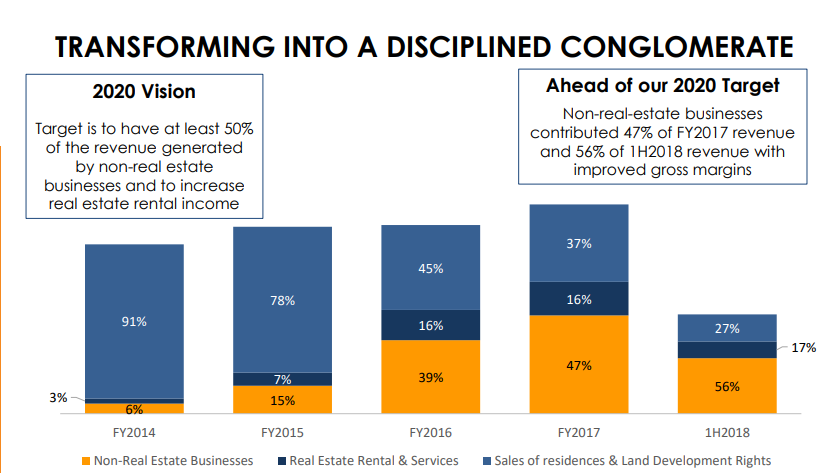

As the economy opened up the company understood that increased GDP growth over time would boost the population’s incomes. The company then decided to move into other businesses that would benefit from increased consumer purchasing power.

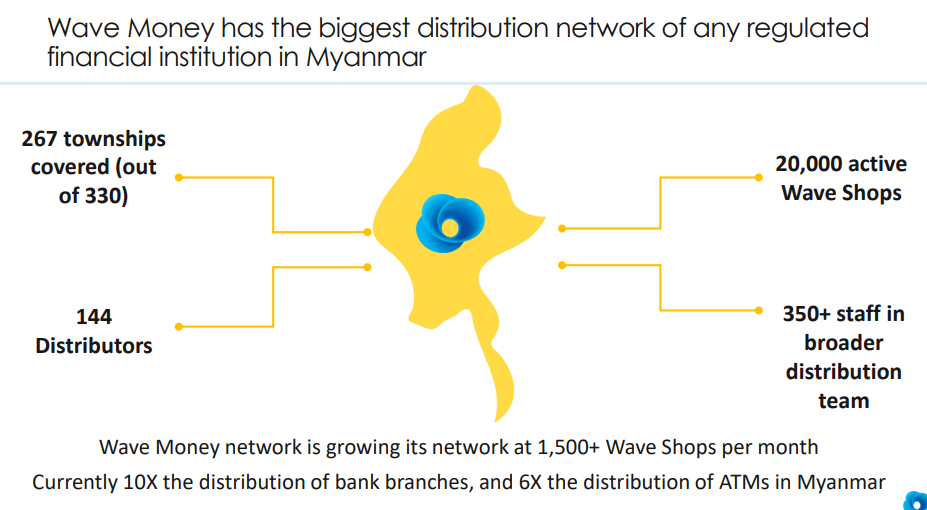

Yoma owns and operates KFC restaurants, cold storage and distribution, the New Holland tractor franchise, a car leasing business, and several other businesses. The company has just bought a large stake in mobile phone payment system called Wave Money. The management has said that they want the company revenue mix to be 50% or more in non-real estate businesses by 2020.

So the thesis is the same as India. Buy into a growing frontier market by partnering with people that have been there for decades and know how to operate in that country. Buy a decent size position and let the management grow my wealth by riding the growth of the Myanmar economy for years.

To sum it up all a person has to do is buy these type of companies and sit back for twenty years and I think you will surprised how much they will increase in value. The problem is that most people cannot sit on their hands and just ride out the fluctuations or they will sell out before the effects of the compounding fully vest. Phelps discusses this lack of patience in his book and points out that it is what trips up most investors. But as I have said before that is why most people never reach their financial goals.

This is how I invest for the long term and so far it has worked out well. However, I wish someone would have explained this to me several decades ago! I will continue to look for speculative opportunities in blown out commodity sectors like uranium and offshore drillers. However, I will also recycle a portion of those profits back into companies like those mentioned above.

I am long both Fairfax India Holdings and Yoma Strategic Holdings.