“People are always asking me where is the outlook good, but that’s the wrong question. The right question is: ‘Where is the outlook most miserable?’” – Sir John Templeton

“If people around you try to discourage you from taking a certain course of action, or ridicule your ideas, take that as a positive sign. Sure, it can be difficult not to run with the herd, but the truth is that most long-term success stories are written by folks who’ve done exactly that.” – Jim Rogers

I am becoming more and more bullish on coal. Why coal? Why now?

As I have discussed many times the current fashionable thinking is that hydrocarbons and coal, in particular, are not only dirty and polluting but literally evil.

The narrative in the west (US, Canada, and Europe) is that we need to transition to clean and green renewables and jettison hydrocarbons.

Not only do we need to make this change in power sources but we need to do it immediately or else we will suffer cataclysmic climate change. I am not going to get into that discussion in this letter. If you are morally opposed to hydrocarbons and coal then you should do as your conscience dictates. (people have canceled their subscriptions over my views on hydrocarbons)

That is fine with me. Tobacco stocks are some of the best-performing stocks of all time and are like ATM’s. Nevertheless, I do not invest in tobacco because consumption of this legal product contributes to 480k deaths in the US every year.

So, the charge is on to “electrify” the economy with green renewables. Governments, primarily western governments, are moving forward with huge infrastructure plans that will have large green energy components.

Banks, pension funds, university endowments, and other asset managers have fought to get to a microphone to announce how fast they will divest their portfolios of fossil fuel investments and how they will no longer provide funding for more of these evildoers.

This is the opportunity to my mind. Betting against the premise that is false.

What is the false premise? Coal is going away soon.

It is easy for us in the wealthy west to say we no longer wish to use fossil fuels (that will not happen in any near term by the way). However, developing countries do not have that luxury. There are huge populations in mostly developing countries that need cheap and reliable electricity. That will come in large part from coal.

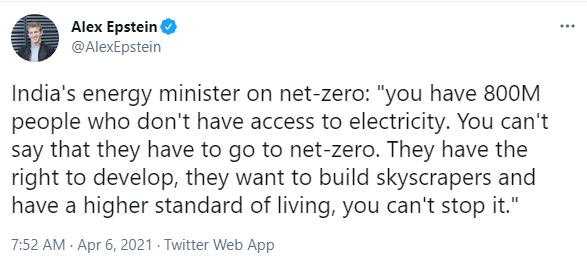

The Indian Minister of Energy said it plainly recently:

Yes, they do have the right to develop and are not swayed by people in the west telling them from on high that we got ours, screw you, no development for you because of climate change.

Indian politicians answer to Indian voters not environmentalists in the US or Europe.

What we have is a rapidly developing situation where demand for coal is going down in the developed world yet growing in the developing world.

Supply is being constricted by ESG mandates and the desire of corporate managements to burnish their green credentials by divesting of any perceived dirty fuels.

Yet the energy consumption of the world is forecasted to grow by a total of 30% by 2050 and electricity demand will grow by 50% according to various analysts. Most of this growth is going to come from the developing world.

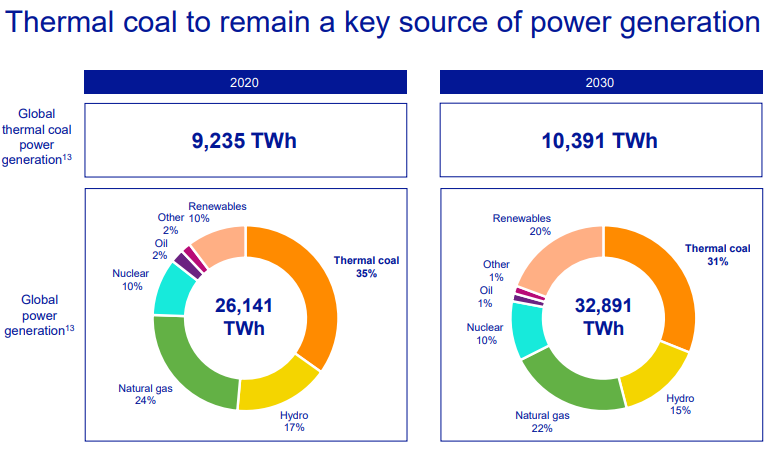

Coal will over time lose share as a percentage of the overall energy mix yet the amount of coal used will likely remain stable or slowly rise.

The investment thesis here is that supply will be constrained due to the demonization of coal as evil and the lack of investment and ability to expand or replace depleting assets sufficient to keep up with demand.

Ask yourself would you try and bring on a new coal mine in the US or Europe? Unless it was in a coal-friendly state like WV, WY, PA, or KY you would have a hard time getting a permit. Who would finance it?

Already many companies with profitable coal assets are selling them or spinning them off to polish up their green credentials and respond to shareholder demands they divest of dirty fuels like coal.

BHP to exit its thermal coal mines in two years.

Anglo-American to spin off thermal coal assets.

Here is a slide from the Anglo presentation that I think sums up the opportunity.

So far, I have made reference mostly to thermal coal which is used for power production in electricity generating plants.

The other type of coal is known as metallurgical coal and is used in making coke. Coke is used in the basic steelmaking process. Here is a video that gives a good explanation of how the steelmaking process works.

Met coal is a much harder and more carbon-dense type of coal and sells at a premium to thermal coal.

Unless you think steel is going away, which means you think civilization is going away, there will be a need for coking coal.

I am aware of test processes where engineers are trying to eliminate the use of coal in steelmaking but it is nowhere near commercial at this point.

Why coal now?

I think we are at peak pessimism on coal. Too many people think that the energy transition to electrification will happen in a year or two, a decade at most. They do not appear to have studied previous energy transitions. They take decades. If you are curious about how this will really play out you may be interested in Professor Vaclav Smil’s view on this subject.

How am I playing it?

We already have a met coal producer XXXXXXX in the portfolio.

Also, there is a met coal component to XXXXXXXXX’s royalty portfolio

I will be adding XXXXXXXXX to the portfolio to further take advantage of this.

Interested in knowing how I translate the information in these emails into investment ideas?

Consider a subscription to my paid newsletter “Actionable Intelligence Alert”. You can check it out by going to: