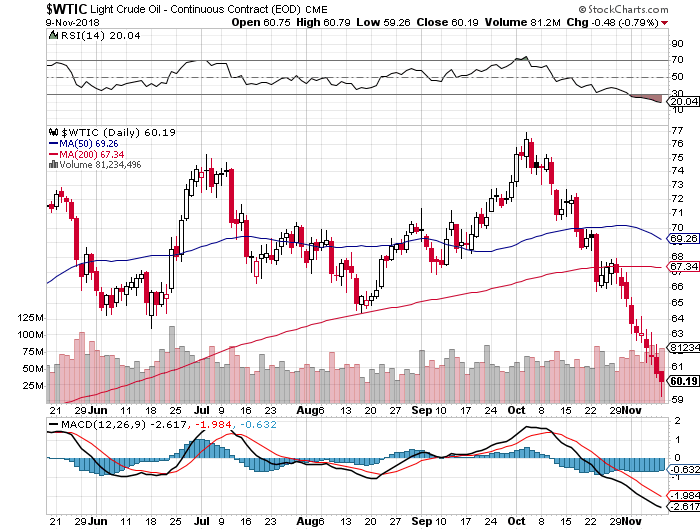

Oil has now been down ten trading sessions in a row. This has never happened before. Is this oil price collapse a warning of slower economic growth or a confluence of events that are temporary?

In this week’s market update video, I explain the reasons oil is down over the last several weeks and why I think a rebound is going to happen. I discuss the following:

-Greater than normal refinery maintenance season. This removed 500k/bpd of oil demand more than is normal.

-The deal between Saudi and other “friendly” oil producers to ensure the removal of Iranian oil from the market would not cause a spike in gas prices right before the midterm elections.

-How AI and programmed trading exacerbated the downward move and why volatility will be the new normal in the oil market.

-Why the long-term fundamentals for higher oil prices are still in place.

This recent correction presents an excellent entry point for astute investors that understand what is really driving oil markets. You can check out my free weekly market update videos by clicking the link below.