Here is a link to one of the people I follow with regard to the oil markets. They have a paid service but quite a bit of their work is free. They don’t get it 100% right all the time but who does?

HFI Research On Seeking Alpha

This Can Only Mean One Thing For The Oil Market Going Forward

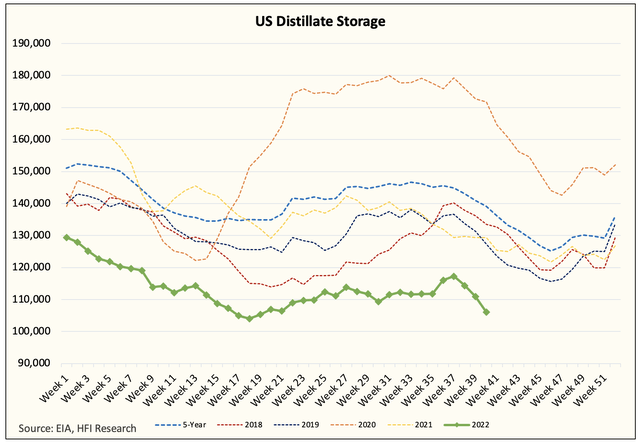

- The distillate market is going to be very tight going into winter.

- Refining margins are going roofing. Global refinery throughput is set to increase by ~4.7 million b/d by December according to Energy Aspects.

- Increase in throughput will run smack into lower crude exports from Saudi and Russia.

- Throw in the fact that the U.S. SPR release is ending at the end of November and U.S. shale oil production is disappointing to the downside, and you arrive at one conclusion.

- Oil prices are going higher.

Most people assume the FED rate hikes will lead to a recession and lower energy demand. I absolutely think we are heading for a recession but this is happening within the context of a shortage of energy.

The data do not lie. Diesel and distillates (heating oil and jet fuel) are in short supply. In order to make more of these fuels requires more crude oil. With OPEC+ cutting supply and sanctions on Russia, where does this supply come from?

Great article and a good analyst to follow.