Back in mid July I wrote an article “Why Zimbabwe Is Back On The Investment Radar” discussing the then upcoming elections in Zimbabwe. The gist of the article was that if the elections were conducted above board and the international observers signed off on them being relatively free and fair we could see a perception change by the international community.

This appears to be what happened. The elections were deemed to be relatively fair. Of course, there were some allegations of some improprieties but based on recent Zimbabwe electoral history the election was mostly okay.

Although the voting was relatively peaceful the aftermath of the voting was anything but. The parliamentary results were announced fairly quickly but it took a while for the Presidential results to be released and this led to the opposition MDC claiming the results were rigged.

The MDC party stated that they would not accept any result that did not show them to be the victors. Protests broke out in the capital of Harare and as is familiar in Zimbabwe the security apparatus was ordered to restore order.

In the end the irregularities and violence were not sufficient to derail this election. In fact, we have seen in recent days and weeks that various international organizations are now proposing debt relief packages and plans to sort out Zimbabwe’s international financial arrears.

As a longtime observer and on again off again investor in Zimbabwe this is the result I was hoping for. The IMF recently stated that it was ready to assist Zimbabwe in a “debt clearing strategy”.

“The IMF stands ready to help (Zimbabwe) design a reform programme that can help facilitate clearance of external arrears to international development banks and bilateral official creditors . . . that would open the way for fresh financing from international community.

“Supporting reforms will require a comprehensive stabilisation and structural programme from the (Zimbabwe) authorities and financial support from the international community to provide space for these reforms.

“We see that the new administration of President Mnangagwa has expressed commitment to strong economic reforms,” reads a statement by the IMF spokesperson.”

This is exactly what is needed to begin to clear the logjam that is impeding capital flows back into Zimbabwe.

The new government has actually been fairly aggressive in reversing some of the dumb policies that were put into place by the previous Mugabe government.

Yes many challenges exist but this is beginning to shape up as a situation that is going from bad to less bad. That can make us alot of money.

I do not think that current government led by President Mnangagwa is some kind of man of the people. He was after all one of Mugabe’s compatriots in the war against the white minority government and was one of Mugabe’s henchman for decades. His nickname is the “crocodile”.

However, I believe that President Mnangagwa is pragmatic and understands that if he is going to marginalize Mugabe factions and supporters, primarily Mrs. Mugabe, and hold onto power then the economy must be repaired and economic growth must be restored.

I hate to be to cynical but there is also more to steal if the economy is larger.

Nevertheless, this also opens up select opportunities for us as speculators and investors. I highlight one of those opportunities below.

Caledonia Mining: Surviving and Now Thriving

Caledonia Mining is, “an exploration, development and mining company focused on Southern Africa. Caledonia’s primary asset is a 49% interest in the Blanket Mine in Zimbabwe which produced 50,351 ounces of gold in 2016 at an All in Sustaining Cost of US$912/oz.

The Blanket Mine re-started production in April 2009 after a temporary shut-down due to the economic difficulties in Zimbabwe. In late 2010, Blanket successfully completed an expansion project which increased production capacity from 24,000 ounces of gold per annum to 40,000 ounces of gold per annum.”

I have followed Caledonia Mining for many years and have been impressed that not only were they able to survive in the Mugabe era of hyperinflation, government incompetence, infrastructure challenges, and general difficulty in doing business in a fustercluck nation, the company management was actually able to grow production and have a decent return on investment, including paying a dividend.

With the recent changes in government and potential changes in policy I believe that the company could be poised for a re-rating.

The company currently owns 49% of the Blanket gold mine. It is worth discussing this as the question must be asked why does the company only own 49% of the mine.

Back in 2012 the Mugabe government passed a law that foreign businesses and those particularly in mining would have to implement an indigenisation policy to supposedly rectify past wrongs against the black population.

This policy has been mostly rescinded by President Mnangagwa, with the exception of platinum mining, as it was finally realized that capital would not come into country if investors were going to have to cede large chunks of the upside to interests that were in many cases cronies of the government.

In Caledonia’s case they were quick to implement the empowerment policy and comply with the directive which resulted in a 49% ownership of the Blanket mine.

Since the policy was rescinded Caledonia has moved to capture more or Blanket mine’s economic potential by agreeing to buy one of the minority holders 15% position. This will raise Caledonia’s stake in the mine to 64%.

In addition to increasing the percentage of ownership of the mine the company this week announced that it had increased resources at the mine.

As I said earlier in the article Caledonia has profitably operated the Blanket mine under extreme economic duress. In fact, the company currently pays a dividend yield of 4%.

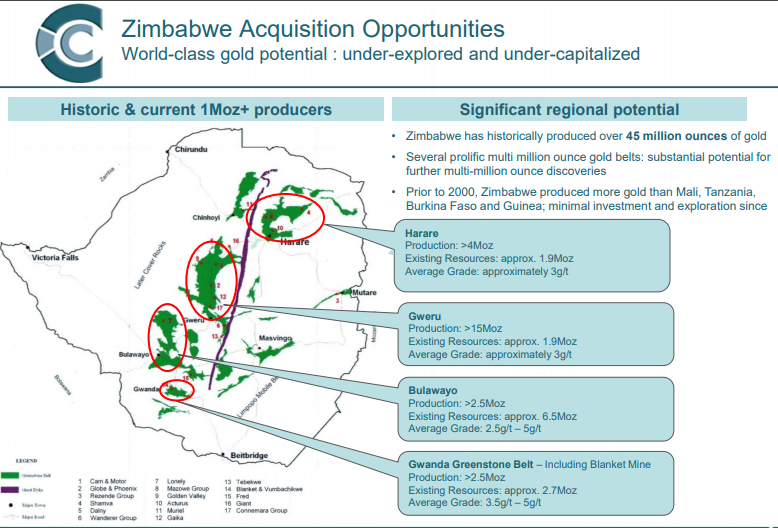

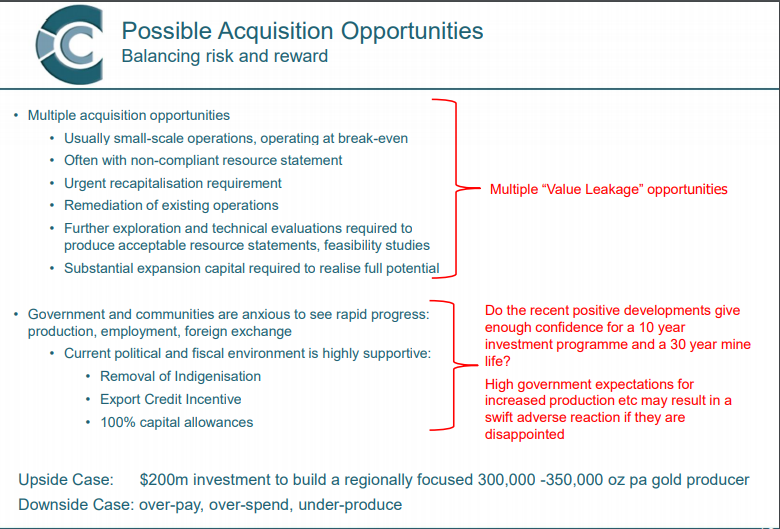

The company also possess optionality on to the upside. Because of the stupid policies pursued by the Mugabe government nobody in his right mind was putting any capital into Zimbabwe. This means there is a ton of upside exploration potential.

Now that the new government has been removing impediments to investing and is moving to a more incentivized policy with respect to gold mining we are beginning to see more interest and investment plans begin to develop.

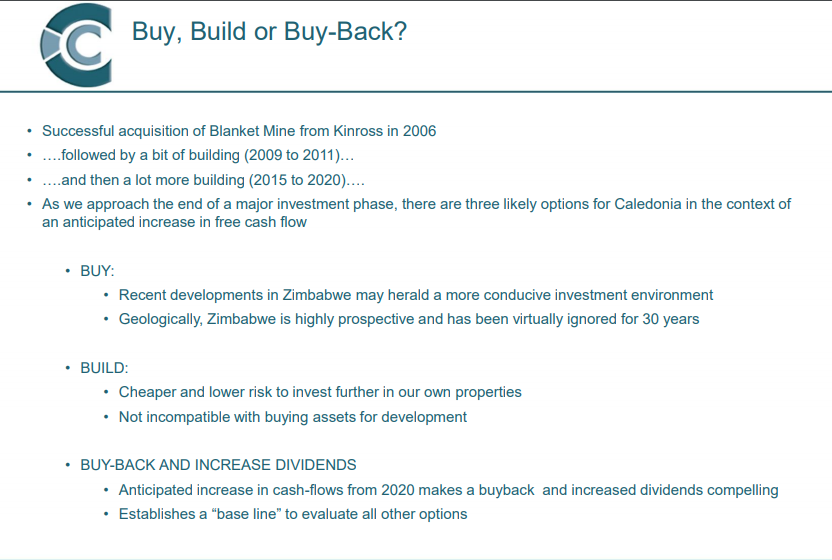

Caledonia management has commented about this fact. I have included a few slides from a presentation given in London in June of this year.

If you are partial to gold, and I am medium to long term, Caledonia Mining is in an outstanding environment as the political winds in Zimbabwe is moving from bad to less bad.

Caledonia Mining management has already demonstrated that they can be successful in adverse economic conditions. It will now be interesting to see what can be done as the economic policies of the country are aligned with business.

I am long Caledonia Mining shares.