Mongolia, Unrealized Potential

The best course of action when discussing Mongolia and its potential is to just get to the point. The country has a population of 3,121,772 and is sitting on an estimated $1.3 trillion in mineral wealth. That is just the total of mineral wealth that has been identified. I would suggest that as time goes by and more exploration takes place that will grow,

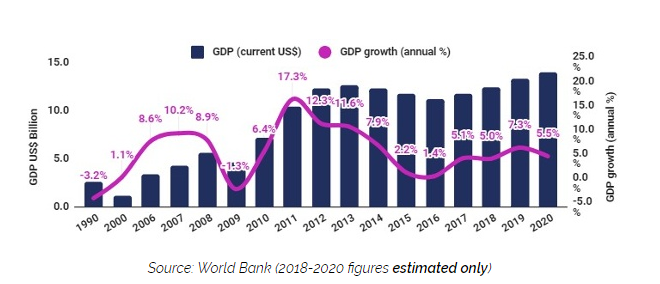

You would think that with type of wealth in the ground and a border with China, a large commodity importer, it would be boom times in Mongolia. It was back in 2011 as the Mongolian economy grew at an astounding 17%.

I am not going to re-hash the various political machinations, coupled with an economic slowdown in China between 2012-2016, that contributed to a slowdown in Mongolia’s economy. Mongolian economic growth declined to 1.4% in 2016.

Mongolia had to seek an IMF bailout last year as its finances had become a mess. Due to an increase in coal and copper exports the economy has begun to recover as GDP is projected to grow 5% this year.

The Mongolian government also seems to finally understand (I am hoping) that the country needs foreign direct investment and expertise to develop its huge mineral endowment.

I am a bit biased towards Mongolia as I have been invested there since 2010. I have seen the various ups and downs along with the disappointment due to unforced errors by the Mongolia government.

Mongolia Growth Group

The main vehicle I have used for investing in Mongolia is a company that I own quite a few shares in. The name of the company is Mongolia Growth Group.

Mongolia Growth Group was founded by hedge fund manager Harris Kupperman. Kupperman had traveled to China to look for opportunities and someone suggested he take a side trip up to Mongolia to check out its potential.

After he got there Kupperman became convinced of Mongolia’s future potential based on the previous described mineral endowment. He correctly gauged that trying to invest in an emerging markets resources was a no go due to the politics surrounding that business.

Instead he surmised that as the country developed its mineral wealth the price of property would increase. He started Mongolia Growth Group to buy high street retail locations with this idea in mind.

The company was able to raise a good chunk of money and started buying real estate around the capital Ulaanbaatar. The company also did a couple of re-development projects with the intention of raising the value of the properties. Unfortunately, the projects were over budget and did not achieve their goals.

Pivoting Away From Property

Unfortunately, because of the various economic and government issues I highlighted earlier in the article property values and rents really collapsed. This put the company in the position of not cash flowing sufficient to be cashflow positive. Management comments from recent quarterly report.

“Due to the surplus of space that is currently in the market, new supply coming to the market and reduced demand due to the ongoing economic crisis, rental rates have declined dramatically, with the largest declines witnessed in the residential market, followed by the office market. The Corporation expects that the current market environment will lead to increased declines in rental rates and hence overall property values in future years, unless there is a dramatic economic recovery to aid overall absorption.”

Management of the company has spent the last several years pairing back operations and cutting back on expenses. Nevertheless, there is an oversupply of real estate and the economy is not able to support higher rents. The company has been slowly selling off assets to allow itself to continue operations.

Here is a quote from the most recent quarterly report:

“During the quarter, we were unable to sell any property assets. To date, our primary focus has been to increase liquidity so that we can move the business forward—either through investments in public securities or the diversification of our business through the acquisition of all or part of a business that is not in Mongolia. That said, our primary focus is to first increase liquidity while keeping costs contained as that gives us the flexibility to act in the future.”

Transition To Publicly Traded Investment Fund?

I have met Harris Kupperman in the past. He is a hedge fund manager that ran a successful fund called Pretorian Capital. He is also a Ben Graham and Warren Buffet devotee. Based on the recent comments he has made in recent earnings discussions and his actions it is apparent that just sitting around and waiting for the Mongolia economy to turn around is not in shareholders best interest.

He is pursuing strategic divestitures and redeployment of capital including outside Mongolia and public acquisition of various securities in the public markets outside of Mongolia.

Considering he has shown himself to be a successful fund investor I am inclined to be positive about this change in strategy. As Lord Keynes said, “When my information changes I change my mind, what do you do sir?”

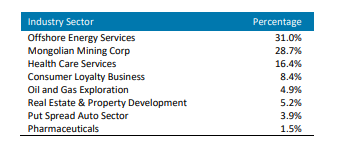

In the most recent quarterly report the company listed its publicly traded investment portfolio by industry. The total value of the portfolio was $$3,825,000.

What is interesting is that Harris also has a blog where he occasionally discusses various company’s he is interested in and has placed money.

We can determine from the blog where Kupperman is possibly deploying some of our capital:

Transocean stock and warrants

Mongolia Mining (this is specifically called out)

Tesla put spread

Aimia Inc.

Of course, this information is of 6/30/18 and so things could have and probably have changed. The point being that I like what Kupperman is doing and as he has been successful in the past I am on board.

MGG Trading At Substantial Discount To NAV

Another thing to like is that the net asset value of the company is well above the current share price. The company shows NAV as $.85 CAD per share and the shares are selling for $.30 CAD. The company has noticed this disparity and has been buying back shares.

During the quarter, the Corporation repurchased 119,000 common shares under its Normal Course Issuer Bid (NCIB) at an average price of $0.22(Q2 2017-230,000, $0.36 average). As at June 30, 2018, the Corporation held 26,500 shares in Treasury to be cancelled during the third quarter of 2018 (Q2 2017- 212,500).

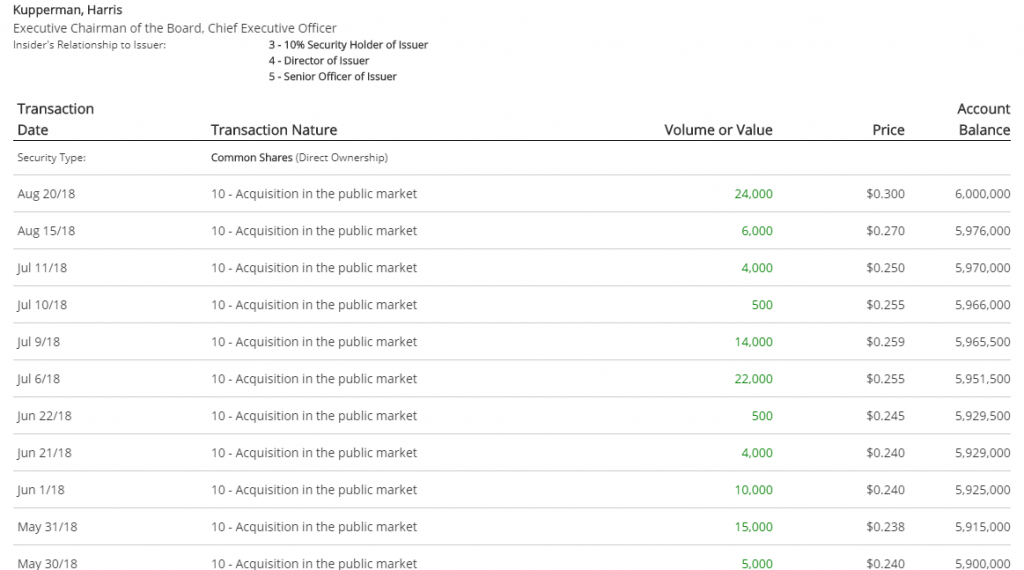

Insiders Are Buying A Lot Of Stock

What is even more encouraging is that Kupperman and the company CFO have been steadily buying shares in the open market. The site Canadian Insider website gives up to date information on share purchases by insiders. Here is a screen shot showing recent purchases of Mongolia Growth Group by the CEO. If you go on Canadian Insider you can see even more of the insider buying for MGG.

So basically, we have Mongolia Growth Group being turned into a publicly traded fund run by a guy who has successfully run a hedge fund in the past. The stock trades at about a third of its net asset value and the company along with company insiders are buying back stock.

The Mongolian economy appears to be improving and that could lead to additional opportunities and a recovery in the real estate market.

The other great thing is that Mongolia is totally washed out. Nobody cares about it and everybody has left. Just the type of situation that I love.

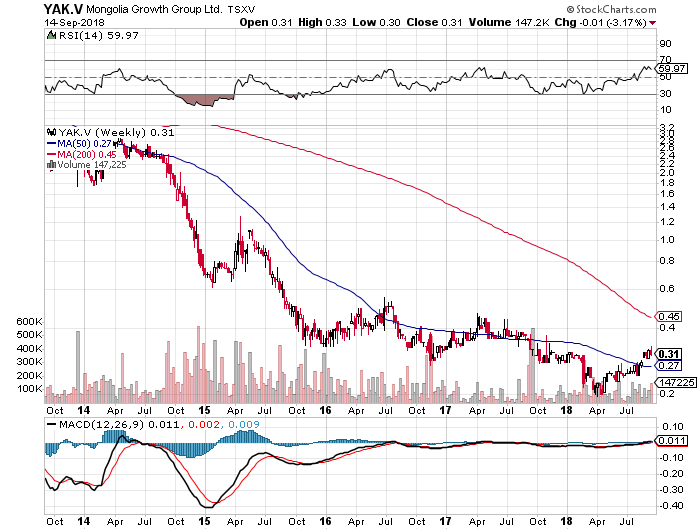

The stock has been moving higher recently after years of declines.

I have been adding to my position and will continue to nibble at more shares alongside insiders.