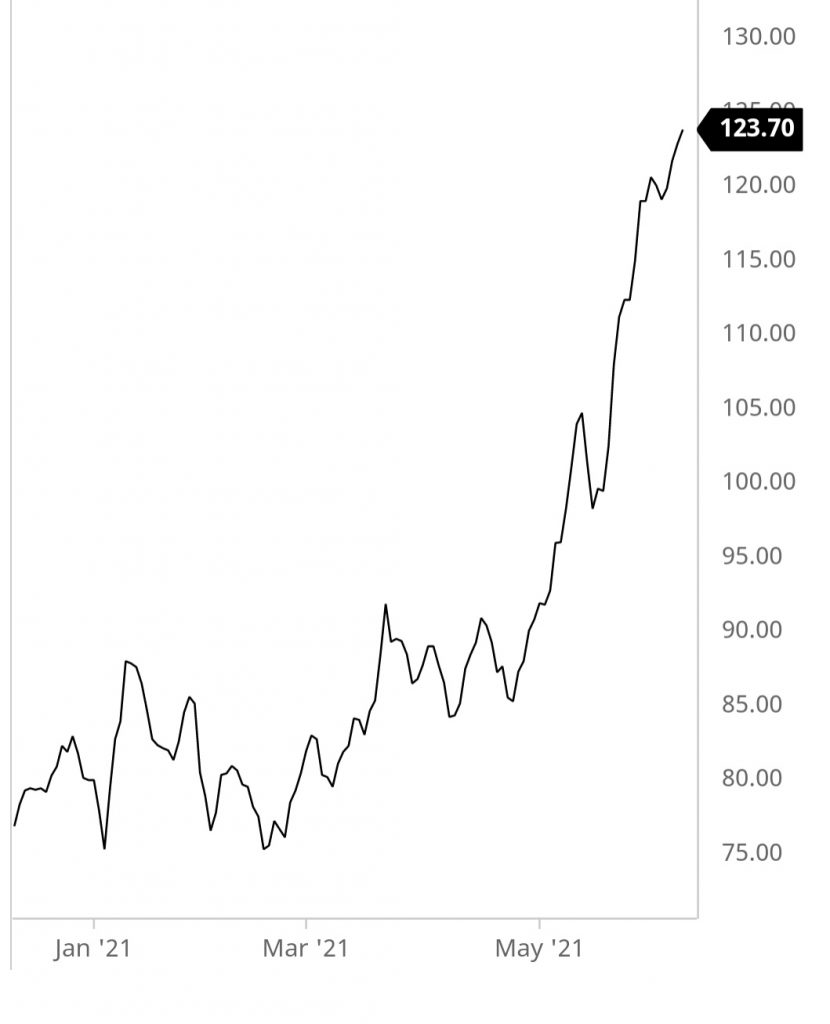

Below see the current chart for thermal coal out of Newcastle, Australia.

We have been told by the mainstream media that coal is dirty and is no longer needed because we are going to transition to full electrification of the economy powered by renewable (what I call rebuildable) energy.

That very well may be the case but in the interim coal is an important source of power generation for many countries particularly in emerging markets.

We see how important coal is to a country like China as it is considering rolling blackouts because they are short of coal.

More Chinese provinces are considering electricity rationing because of a surge in consumption and tighter coal supplies for power generation.

This comes after similar measures were introduced in the southern provinces of Guangdong and Yunnan last month, highlighting the severity of China’s coal supply shortfall, which has caused electricity generation costs to rise above the base tariff for coal-fired electricity in some regions. The country’s peak summer coal demand season has yet to start in earnest, potentially indicating that the shortage may worsen.

Contrary to what you have been told coal is and will continue to be an important part of the energy mix for years to come.

The opportunity in coal comes from the fact that demand is not going away but supply is being curtailed by government and ESG mandates along with capital starvation.

Try opening a new coal mine, especially in the west. Good luck getting it permitted or getting it financed.

These barriers to new supply will benefit existing coal miners as an artificial moat is being built around their businesses by government regulations and ESG activists.

Many of the coal miners I follow have seen their stock prices move off of decade lows. There is still time to take advantage of what I think will be a tremendous run in well-selected coal stocks.

Bet against the premise that is false. Coal is here to stay, at least for the foreseeable future.