With the continued growth in emerging market countries like China, India, Vietnam, etc… urbanization and industrialization will lead to more electrification of the world. This will require a tremendous amount of copper in order to achieve this.

Unfortuantely copper supplies are coming under increased strain as higher grade mines have been exploited and low exploration budgets have led to an upcoming shortage in copper and thus increased copper prices.

The biggest use of copper is in electrical distribution (transformers) and electrical equipment (motors and generators). I am a big believer in the emerging markets moving into the middle class and urbanization. This will require tremendous copper demand. Consider India.

It was reported late last year that the Indian government had met its goal to bring light to every village in the country.

“In particular, one of the greatest success stories in access to energy in 2018 was India completing the electrification of all its villages…India has been the star performer: in April 2018, the government announced that all villages in the country had an electricity connection, a huge step towards universal household access, it added.

In the next phase of its program, the Indian government is now in the process to ensure that power lines are connected with major institutions and administrative centers of every village as well as every household in the country.

However, a further review of this claim led to the embarrassing fact that what the government had achieved is that every village now had the ability to tap into the nations electrical grid. A school or government building may have electricity and that was counted as the entire village. As noted in the second paragraph above the government of India is now connecting households and other buildings to the grid.

High voltage transmission lines are not made from copper, but aluminum reinforced with steel.

In order to electrify the individual homes and businesses a transformer is required. A transformer steps down the voltage from the high voltage line to a voltage that can be used in your home. For example, the voltage in your home is 240/120V but the line out back with the transformer is 12,000V and the high-tension transmission lines are 345,000V.

I have included some pictures as a reference. The top picture is a pole mounted transformer that is stepping down voltage to a house. The bottom picture is a large transformer used in an electrical substation. These transformers require hundreds to thousands of pounds of copper each.

This is what the Indian government is now in the process of installing. In order to understand the scale of copper demand that this will take we can compare China to India.

India is basically where China was 15-20 years ago on its commodity demand curve or S curve as it is known.

Currently China’s installed base of copper is 175 lbs. per person. India’s is 14lbs per person.

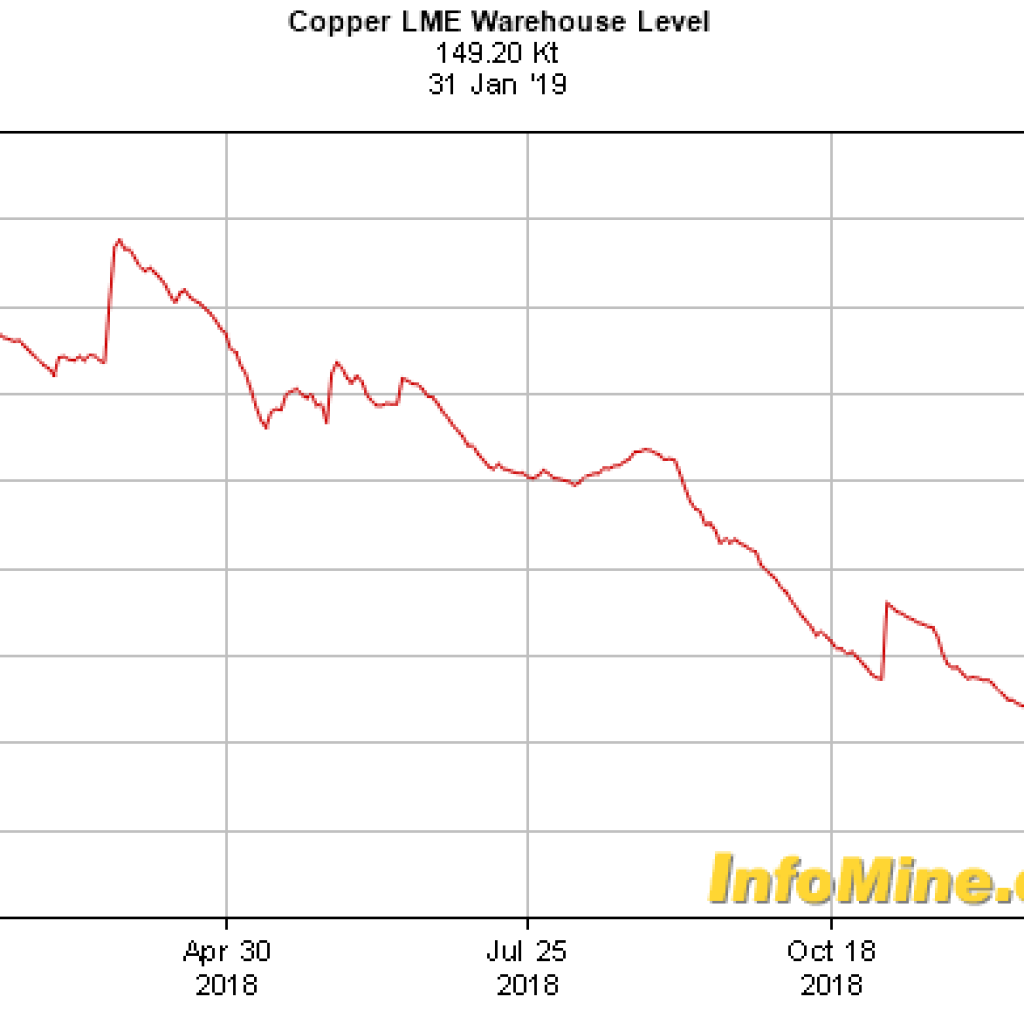

This continued electrification program of India along with continued growth in demand in China and other emerging markets has led to a big draw down in copper inventories.

I would also note that the continued shifting of electrical generation to renewables, primarily wind, and the growth of electric vehicles means even more demand for copper. Back in 2017 the CEO of BHP (a major copper producer) said,

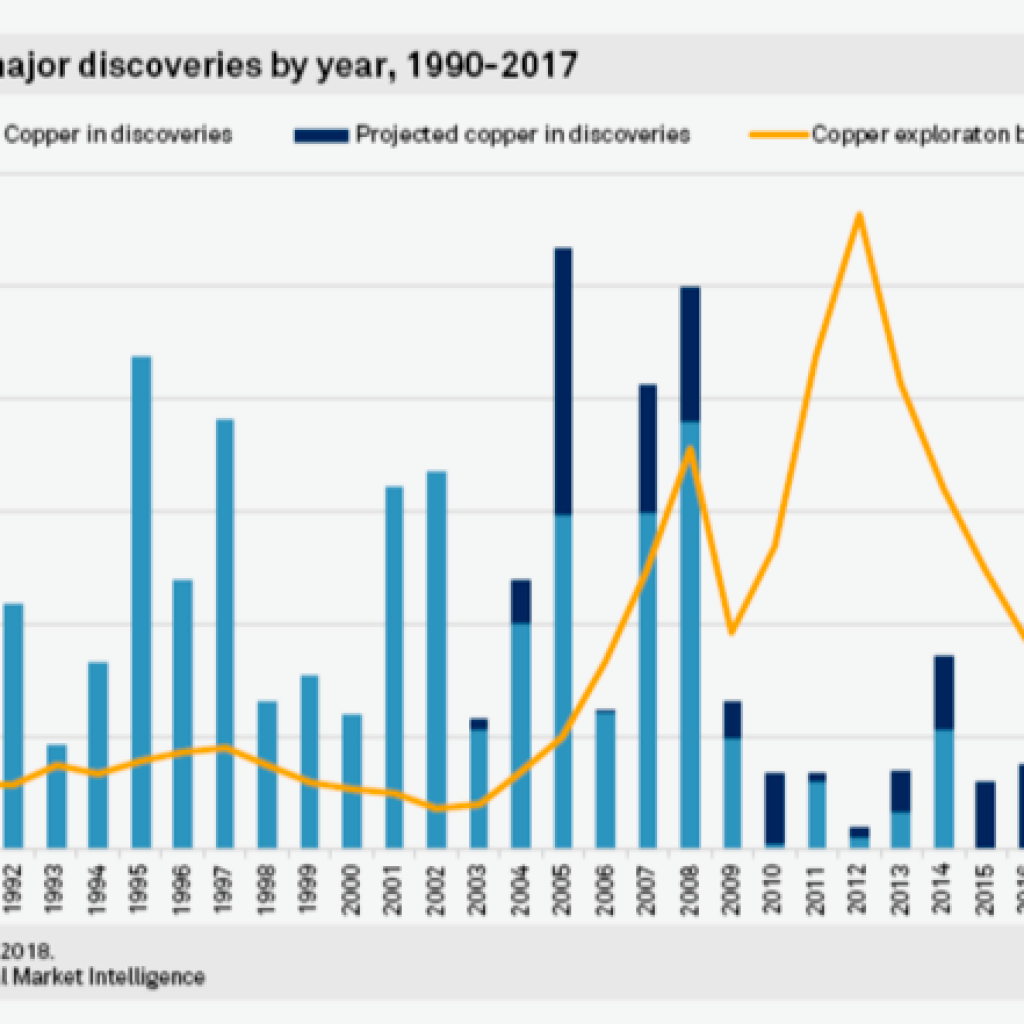

“2017 is the revolution year we have been speaking about. And copper is the metal of the future. Producers will first feel the effects of an electric boom in the copper market, where supply will struggle to keep up with demand. This represents an especially tricky situation, as most of the world’s biggest copper mines are aging, and there have been few major discoveries in the last 20 years.”

The demand picture seems solid for the next decade or so. Let’s switch to the supply side. It does not look good but that is the opportunity.

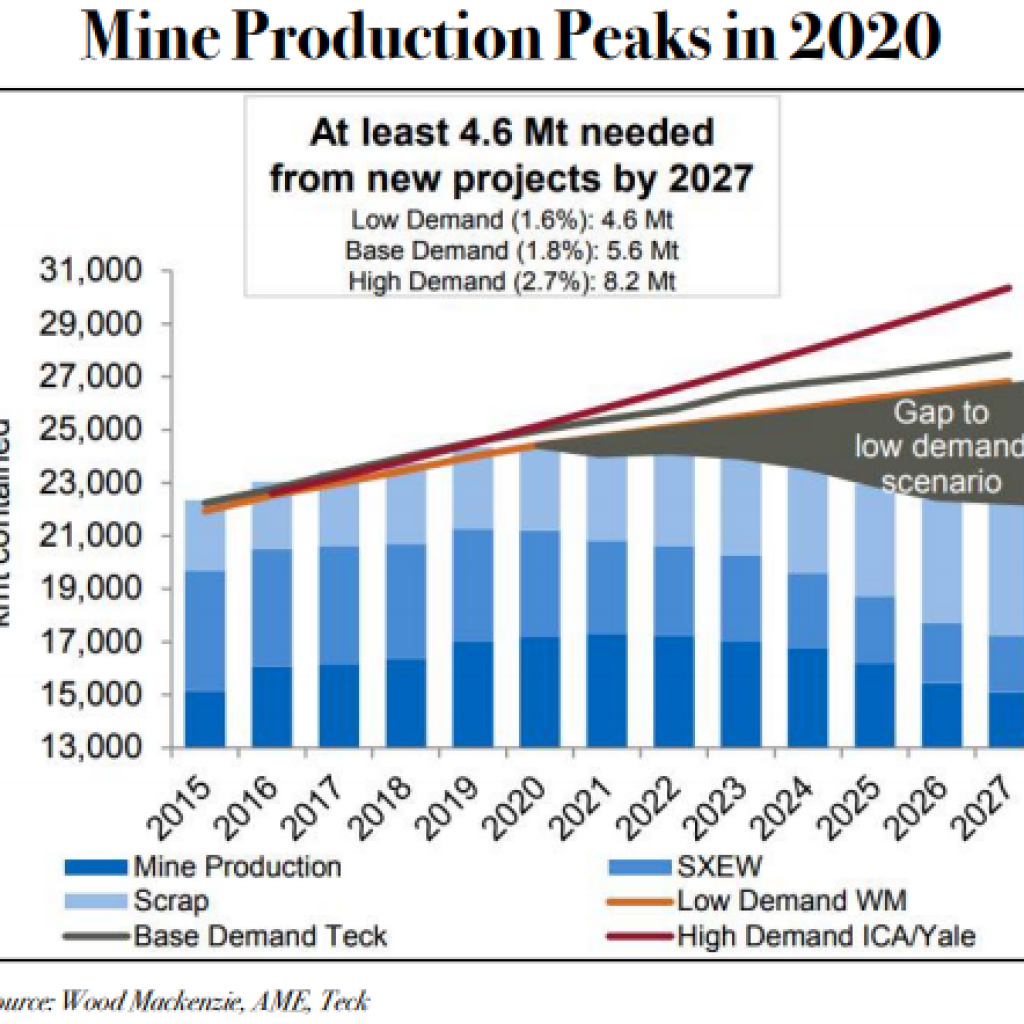

The top chart shows that copper production will peak in 2020 and then begin moving lower. This will be happening as demand will be increasing, as pointed out earlier.

The bottom chart shows that even though mining companies have been investing in trying to find new copper mines their efforts have not been rewarded with many new discoveries.

So, if present trends in the copper market continue, and barring a world depression they will, we are looking at stagnant copper supply growth in the context of increasing demand from emerging market electrification and the continued emergence of a transformation from ICE to EV cars.

Mining billionaire Robert Frieldand, who is developing huge copper mines in the Congo, has said that you will need a telescope to see how high the copper price will be in a few years.

I agree and have recently invested in a company who is expanding their copper production and lowering their costs. To find out the name of this company check out my newsletter “Actionable Intelligence Alert” which can reached at actionableintelligencealert.com/subscribe