The concept of compounding and how to make it work for you

Would you rather have a $1 million dollars right now or start with $.01 cent but have it double everyday for thirty days? Your answer will indicate your knowledge of simple math and the concept of compounding.

The knowledgeable and wise person would answer that they would rather have the one cent and have it double everyday for the next 30days. If one made that decision to defer gratification for one cent and have it double everyday one would have $5,368,709.12 at the end of thirty days as opposed to the unknowledgable person who selected the a one time payment of $1 million dollars.

A consistent return and time will yield exponential results as seen from my simplistic example:

Day Amount

1 $.01

2 .02

3 .04

4 .08

5 .16

6 .32

7 .64

8 1.28

9 2.56

10 5.12

11 10.24

12 20.48

13 40.96

14 81.92

15 163.84

16 327.68

17 653.36

18 1,310.72

19 2,621.44

20 5,242.26

21 10,485.76

22 20,971.52

23 42,943.04

24 83,886.08

25 167,772.16

26 335,544.32

27 671,088.64

28 1,342,177.28

29 2,684,354.56

30 $5,368,709.12

This is a crude example for illustration purposes as no one will compound their wealth by doubling it every year.

However, we can learn a couple of interesting things from this exercise. Allowing compounding to work takes time. You will note that even halfway through the month the total amount was only $163.84. The dramatic effects of the compounding take place in the latter part of the month. In fact as time goes on the returns will eventually go parabolic. You will note that the last three days of the month yielded the biggest increase.

You can play around with various scenarios using this compounding calculator.

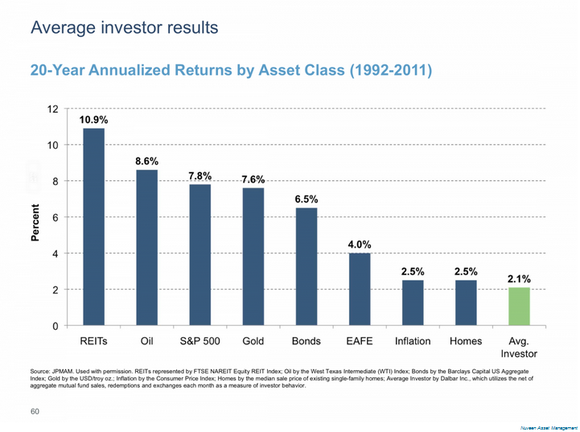

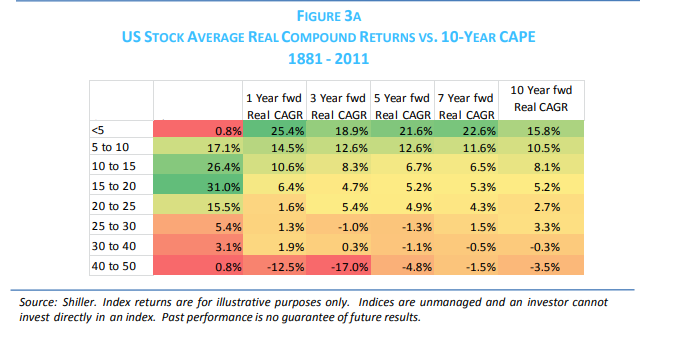

The same applies to our investments and why I advocate investing in common stocks over the long term. If we buy good businesses that grow earnings and cashflow every year and allow those businesses to reinvest in their business we can compound our capital and we can become rich.

This may seem like a simple concept and it is but then why don’t more people understand this method. One reason is because they are unaware of how compounding works. They do not teach this in school.

A real world example of this principle is to look at the investment returns of Fairfax Financial Corp. The company is run by Prem Watsa who is known as the Warren Buffet of Canada. Page one of the 2016 annual report shows the returns the company has had on its investments since 1985. One can plainly see how time and consistent returns create wealth.

Easy to Understand Hard to Implement

However, the most common reason is because most people do not have the conviction to stick with a long term plan. They will not defer near term gratification for a long term goaal. It is basically a time preference probelm.

Most people don’t have a plan for their life much less a financial plan. Therefore they do not take advantage of this simple principle.

If you want to be rich you must understand the power of compounding returns. Understanding the concept is the easy part, implementing the concept and staying consistent over long period of time is the key.