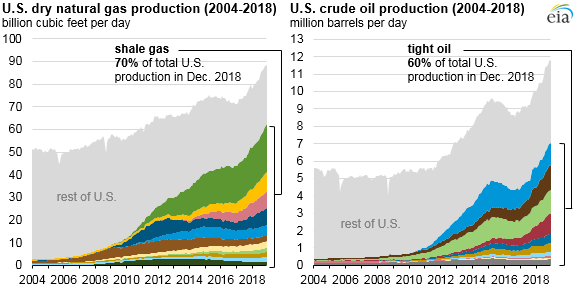

For the last several years we have seen oil and gas production from shale explode:

We have been told that this is a new era that will finally wean the US from foreign oil and allow the US to become energy independent. It is true that US oil and gas production has surged to new highs and has made the US the largest oil producer in the world.

This surge in oil production was enabled by a huge amount of debt. It has been estimated that the shale oil producers have run up over $300 billion dollars in debt.

This was enabled by investors and Wall Street private equity firms and hedge funds being seduced by the siren song of higher yields being offered by the shale producers. This was exacerbated by years of very low interest rates, and irresponsible central bank interest rate manipulation, that have enabled this malinvestment.

It now seems the chickens are coming home to roost.

The Dallas Federal Reserve Bank said on Friday that oil and gas activity in Texas is slowing:

Production was flat last quarter in the oil and gas sector after three years of growth, and many companies expressed pessimism moving into the third quarter, the Dallas Fed said Wednesday. A third of companies surveyed by the Fed said they are lowering their spending forecasts for 2019, while 36% said they are sticking to their previous spending levels. The remainder said they were increasing spending, but companies’ overall outlook on the future dropped sharply compared to the first quarter and uncertainty shot up to its highest level since 2017, the year that the Dallas Fed began indexing the companies’ responses.

We are also seeing former and current shale oil company executives saying the fracking boom is in trouble. The former CEO of EQT said the fracking revolution has been a “disaster for drillers and investors”.

Steve Schlotterbeck, who led drilling company EQT as it expanded to become the nation’s largest producer of natural gas in 2017, arrived at a petrochemical industry conference in Pittsburgh Friday morning with a blunt message about shale gas drilling and fracking.

“The shale gas revolution has frankly been an unmitigated disaster for any buy-and-hold investor in the shale gas industry with very few limited exceptions,” Schlotterbeck, who left the helm of EQT last year, continued. “In fact, I’m not aware of another case of a disruptive technological change that has done so much harm to the industry that created the change.”

“While hundreds of billions of dollars of benefits have accrued to hundreds of millions of people, the amount of shareholder value destruction registers in the hundreds of billions of dollars,” he said. “The industry is self-destructive.”

The CEO of Pioneer Natural Resources, one of the largest shale oil producers, is also doubting the previous grand shale oil production plans;

On Monday, the Wall Street Journal featured a profile of Scott Sheffield, CEO of Pioneer Natural Resources, whose company is known among investors for its emphasis on drawing oil and gas from the Permian basin in Texas using horizontal drilling and hydraulic fracturing, or fracking.

Back in 2014, Sheffield told Forbes that he expected Pioneer could produce a million barrels of oil a day from the Permian basin by 2024 – up from 45,000 barrels a day in 2011.

Now, Sheffield, who left the helm of Pioneer in 2016 and returned this February, says that those million-barrel-a-day plans are looking increasingly doubtful as the industry has struggled to prove to investors that it’s capable not only of producing enormous volumes of oil and gas, but that it can do so while booking profits rather than losses.

“We lost the growth investors,” Pioneer CEO Scott Sheffield told the Journal. “Now we’ve got to attract a whole other set of investors.”

Most of these companies have never been profitable, regardless of the oil price, much less even cashflow positive. They are now facing the prospect of funding for their activities being curtailed.

Considering the decline rates, which can be as high as 70% in the first year, how exactly are these companies going maintain production much less increase it?

Investors are telling these managements they want dividends and share buybacks. The time of drilling just for the sake of drilling appears to now be over.

This has implications for the entire oil industry because the view of many analysts and investors was that shale would just keep growing which would keep a lid on oil prices longer term.

If shale is not going to keep expanding, then what will make up the supply deficits? My thinking is and has been offshore oil production. Offshore oil supplies 30% of the daily demand of 100 million barrels per day. The industry is now emerging from the worst depression in its history and is being completely ignored.

You can buy offshore oil rigs and offshore service vessels for the value of their scrap steel. I am betting that oil demand is going to increase, oil depletion will continue, and the need for hundreds of billions of dollars of investment will be required to supply the oil that the world needs.

In my view this will eventually create a huge recovery in these depressed sectors.

Interested in knowing how I translate the information in these articles into investment ideas?

Consider a subscription to my paid newsletter “Actionable Intelligence Alert”. You can check it out by going to:

actionableintelligencealert.com/subscribe

I have started up a Patreon account for those that wish to help support my work. Check it out here:

https://www.patreon.com/JohnPolomny

If you pledge at least $5.00 I will send you the current months stock pick. This way you can sample the “Actionable Intelligence Alert” newsletter and see if it is for you.