A well-known oil and gas newsletter writer by the name of Keith Schaefer wrote an article about Jericho Oil and its prospects in the Oklahoma STACK play. Mr. Schaefer writes the well regarded Oil & Gas Investments Bulletin.

In his article which can be read here he says that he considers it the smallest company in the best oil play in the US. He also goes into the reasons why he believes Jericho will be a top performing stock in this oil cycle.

I of course agree and recommended the stock back in my Top Stocks to Buy in 2018 series I wrote several months ago.

Mr. Schaefer’s article echoes the reasons I have liked Jericho Oil for over three years.

The company management understands the cyclicality of the oil business. They used the previous downturn in oil prices to move into a prospective area and were able to put together a land package for cheap money. The management has stated several times since they started that this would be their strategy.

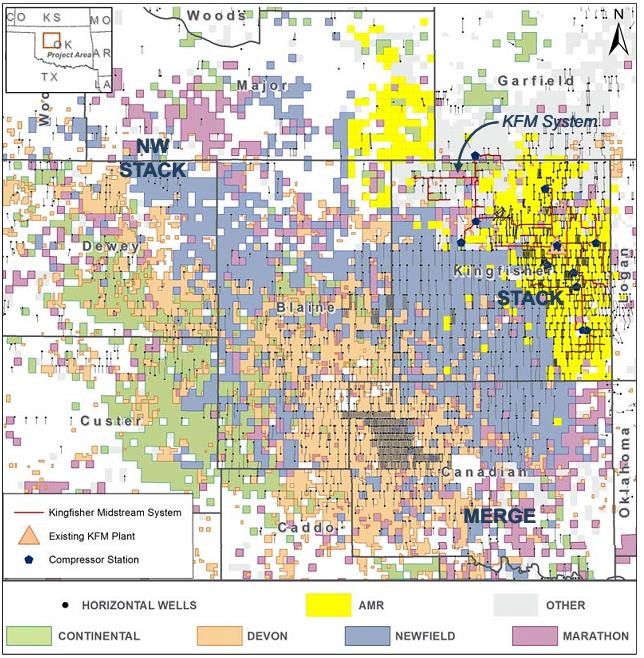

Jericho management was prescient enough to move into the STACK play in central Oklahoma. I was fortunate to have been building a wind farm in Kingfisher and Canadian county back in 2015 and saw firsthand how explosive the growth of this play was up close.

I originally was a shareholder of Newfield Exploration as they were the biggest player with the most activity in the area. When I discovered that Newfield was going to be putting $1 billion dollars into this play I knew it was for real.

My further research into the STACK play led me to discovering Jericho Oil a couple of years ago. Their management style, buying cheap and accumulating a land package during the downturn, indicated that they were true contrarian investors.

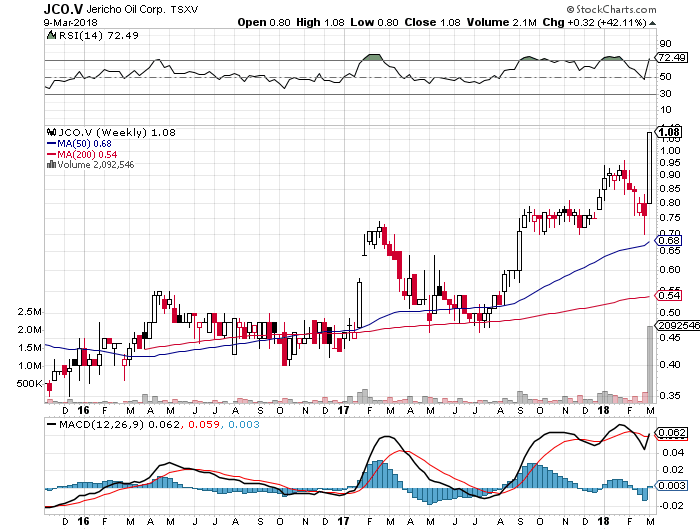

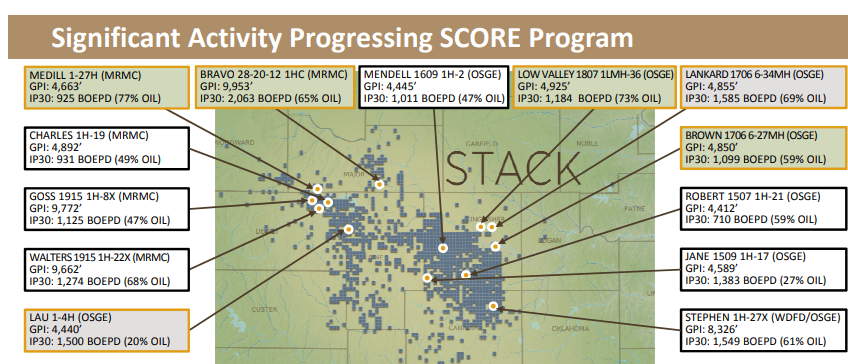

As can be seen from this chart I got from a recent Newfield presentation the area is definitely prospective for oil as Newfield has indicated. Although there are no guarantees, especially in this business, I suspect Jericho’s and will also be quite prospective.

We have been waiting patiently for Jericho to make its move and now that the land acquisition phase is over the company will now be moving into drilling and developing its land. The current plan is to go from the current 450/boe a day to 2000/boe by the end of 2018.

That is the kind of production growth that will get the stock moving. Not only will production be going higher but this particular play may have the best economics of any oil play in the US. A recent presentation by Continental Resources showed Internal rates of return of anywhere from 82-146% at $50 oil. We are at $60 oil and of course you know my view is that we are going higher.

So it looks like our patience is paying off and little Jericho Oil is beginning to draw investor attention. Hopefully the drill program will be successful and the price will move higher. I would not be surprised to see a buyout offer come our way this year as pretty much all the big acreage is now tied up. Anyone that wants in will have to pay up or we could see an offer from one of the larger operators which are surrounding out land.

If these are the types of gains that get your attention maybe it’s time to subscribe to my newsletter the Actionable Intelligence Alert. I find the unique, overlooked, and contrarian stocks that deliver market beating results. 12 issues $79/year. Subscribe by clicking here.