Are we looking at a repeat?

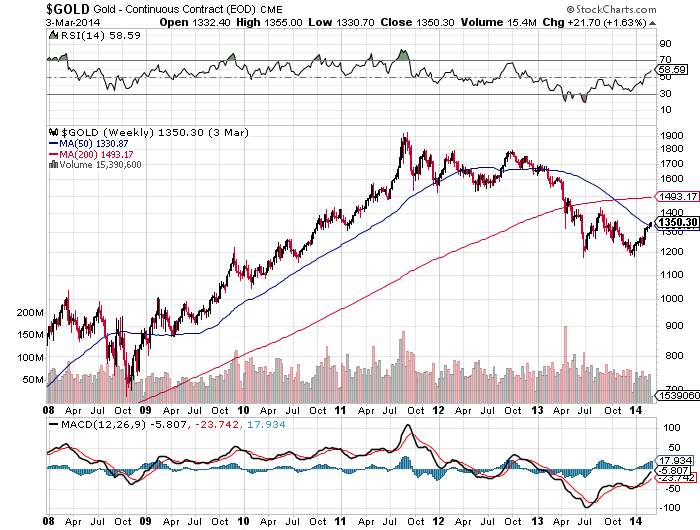

Gold responded by making new highs:

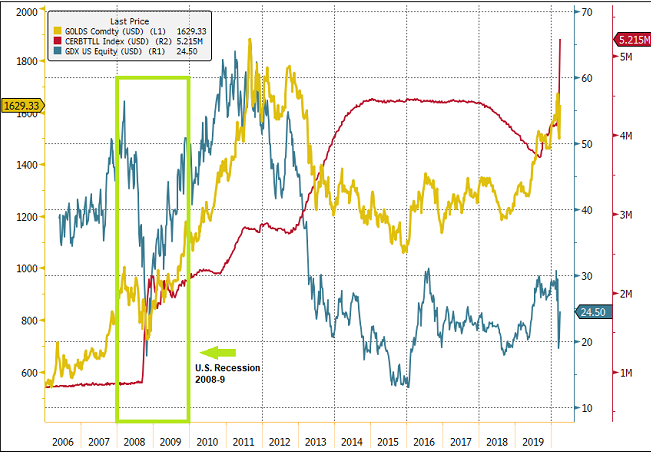

This chart is a bit busy but makes the point even better:

I am not saying that this necessarily means we are going to see new highs in the gold price as history does not repeat but it certainily ryhmes.

From the Washington Post:

Fed announces unlimited bond purchases in unprecedented move aimed at preventing an economic depression

In an effort to prevent the U.S. economy from spiraling into a depression, the Federal Reserve launched an unprecedented effort Monday to keep money flowing to companies, households and cities as this crisis threatens to surpass the Great Recession.

(skip)

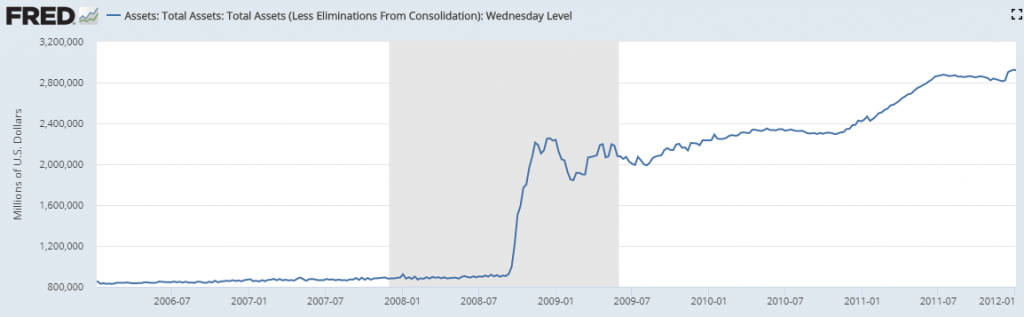

The Fed is attempting to resolve this by buying unlimited amounts of U.S. Treasurys and mortgage-backed securities, an extraordinary backstop for lending markets that goes much further than what the central bank did in the 2008-2009 crisis. Back then, the Fed injected nearly $4 trillion into the financial system over several years. Analysts say the Fed’s effort now could dwarf that in a matter of weeks, a testament to how much pain the coronavirus is causing the economy.

The Fed also announced it will buy certain corporate bonds for the first time in history. Get ready for the largest experiment in monetary theory ever. They will end up buying everything to keep this from sinking.

The FED’s balance sheet blew through $5 trillion last week and I see it going to at least $10 trillion before this is over. I also forecast gold will make new all time highs, and that the highs on gold will shock everyone.

Is the cure going to end up being worse than the disease?