One of the things I have noticed when interacting and corresponding with people who watch my videos and visit my site is that many of them do not have realistic expectations regarding expected investment returns.

What I mean by this is that many people think that achieving double or triple digit returns is the norm when investing. In fact, it is extremely difficult to beat the market averages on a consistent basis.

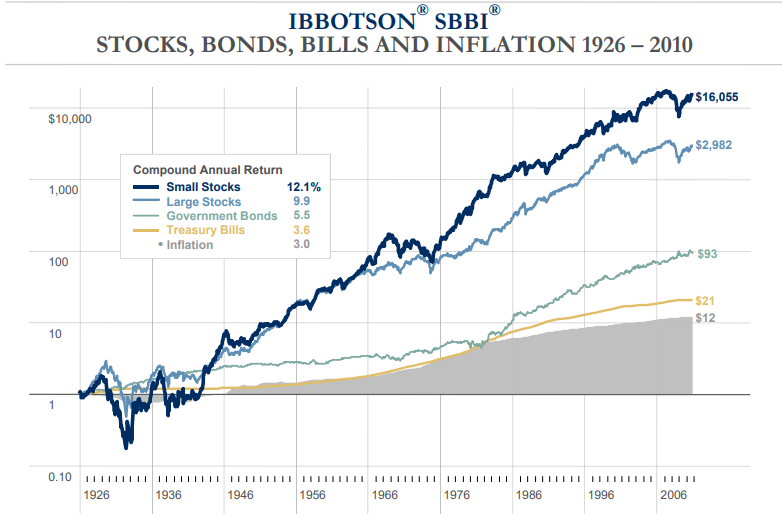

Take a look at the long term returns for various asset classes.

As can be seen from the above graphic the average compounded return on large capitalization stocks has been 9.9%. That is about the return on the S&P 500 over the last thirty or so years. Considering that inflation has grown at about 3% (per this chart) an investor would be left with a real return of around 7%.

An investor that invested $10,000 in year one and compounded that sum at 7% annually would have $149,000 after 40 years.

If the same investor started with $10,000 in year one and compounded at 7% but invested an additional $10,000 at the beginning of each subsequent year he would end up with $2.3 million dollars.

The reader can use any compounding calculator to run various scenarios using different contribution levels and rates of return. If you want to read more on compounding I have written an article about it also. Click this link.

$147,000 versus $2.3 million is a big difference and illustrates a couple of points:

- If you want to accumulate a large amount of wealth via stock investing it is important to have the discipline to begin your investment program early and stay consistent for a long period of time.

- You must educate yourself about the power of compounding. It is the key to creating a large pool of wealth via stocks.

- Time is so very important, you must not waste it. It is hard to make up the financial returns if you start late because the majority of the effects of compounding take place in the last few years.

These are just basic concepts that are not grasped by most investors. They are easy to understand (at least I think so) yet most people do not get it. If they do get it they choose to ignore these facts.

Several years ago, I was a manager over a group of mostly younger workers. One day HR called me and said that half of the people in my charge were not participating in the company 401k program.

The HR folks wanted me to talk with the employees and explain that the company no longer offered a defined benefit plan and that our 401k was a way to build long term wealth. I was asked to talk with everyone and explain how the plan worked and encourage the workers to reconsider enrolling.

I got everyone together and explained that the company was matching 100% of their contribution up to a max 6% of the workers contribution. I explained to the mostly twenty somethings that if they participated in the 401k they were literally getting a 100% return on the money they contributed as the company did a dollar for dollar match. I also put a compounding calculator up on the screen and explained how long-term investing and compounding of wealth works.

In addition, I pointed out the tax advantages of contributing and how dividends and capital gains were shielded in the 401k until the money was withdrawn later in life. I also explained that when contributing you lowered your taxable income for the year of the contribution.

I gave the speech and forgot about it. Six months later HR called and said there was no change in participation by my work group!

Fast forward a couple of years and I am on another job site and I am again working with a bunch of young guys from a wind turbine supplier. These guys are all twenty somethings, well educated, and cash flush as they were traveling construction reps for the wind turbine supplier and mostly single guys.

This job was during the bitcoin/crypto currency wackiness. It seemed like everyone of these guys were nuts about bitcoin. I would go to meetings about the job and I would have to tell these guys to focus on the job and stop talking about freaking bitcoin. It was tulip mania in real life.

I tried to point out that the whole thing was a bubble and that this was a pure speculation and not investing but zero effect on these guys. They all had visions of sugar plums in their eyes.

These two episodes taught me a couple of things that are related to investing and human psychology. Most people in the US are destined to not be wealthy. It is not because they are victims of society, racism, sexism, government policy, their parents, station in life, or whatever else they think ails them.

The reason most people struggle financially and will not be wealthy is because they are stupid.

Now that is a provocative statement. Let me define my term as it is important to define terms. People use all types of words and do not define them properly which leads to misunderstandings and not knowing what they are talking about.

When I say these people are stupid I do not necessarily mean they have a low IQ. I define stupid as, “an ability to see only the immediate and direct consequences of actions, not the indirect and delayed consequences.” An even better definition is an, “an unwitting tendency towards self-destruction.” Credit to speculating legend Doug Casey for these definitions.

Harsh but true in my experience. People ask me all the time for a “hot stock tip” or give them something they can “throw a couple of grand into”. I tell them that is not a prudent way to build wealth. I suggest a thorough review of their financial situation including debt, budget, and long-term financial plan. 99 times out of 100 they are not interested. I then laugh and tell them to go play the lotto or catch a weekend junket to Vegas. At least they will have some fun while losing their money.

Building long term wealth requires realistic expectations, time, planning, and discipline to stick with a plan. Get rich quick or easy money is a unicorn that craps skittles. It doesn’t exist regardless of what internet marketers and hucksters say.

If you are interested in creating long term wealth than consider some of my other articles that I have written on this topic.

Ultimate Guide to Getting Rich

Interested in knowing how I make huge profits in the financial markets? Try a subscription to my paid newsletter “Actionable Intelligence Alert”. You can check it out by going to actionableintelligencealert.com/subscribe