Uzbekistan may very well be the best under-the-radar investment story in the world today. But the transformation spearheaded by the country’s new president, Shavkat Mirziyoyev, from socialism to capitalism should put the $50 billion economy on investors radar screens.

Under the leadership of Mirziyoyev, who took the helm in 2016 following the death of former president Islam Karimov, Uzbekistan is now among the world’s fastest-growing economies. In just over two years, Uzbekistan has transitioned from an economic and social pariah to a free market economy. Mirziyoyev floated the exchange range, lifted capital controls and embarked on a privatization initiative to sell off the government’s interests in non-strategic businesses. Following such reforms, tourist arrivals more than double in 2018 and foreign direct investments increased four-fold in the first half of 2019 compared to a year ago, government data showed.

People often ask me why I invest money in obscure frontier markets like Myanmar, Mongolia, Kyrgyzstan, and now Uzbekistan.

The answer is quite simple.

First, many of these places are emerging from years of post-soviet economic thinking and/or statist and socialist policies. My go to phrase is “going from bad to less bad”.

The second reason is that these places are showing economic growth. Five to eight percent annual growth is not out of the question. The western developed countries are growing slowly if at all.

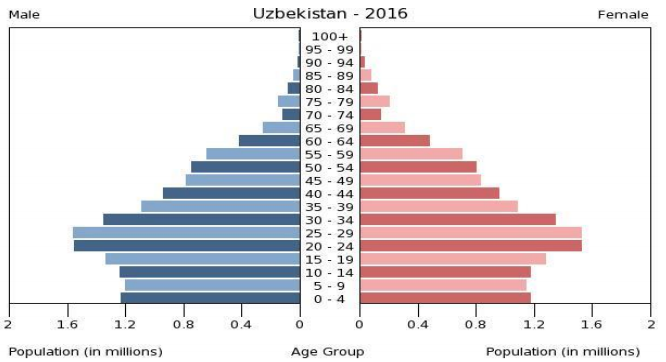

The third reason is that most of these places have young populations. Young people are building careers, businesses, and families and this leads to increases in consumer growth and spending on housing, cars, and babies.

The fourth reason I like many of these places is that for the most part they are pursuing economic liberalization. In many of these frontier markets you have a cadre of western educated businesspeople and technocrats. They understand the policy prescriptions that will lead to economic progress and wealth creation.

Let’s, take Uzbekistan for example:

While most of the Western world is overleveraged, Uzbekistan is under leveraged with a total debt to GDP ratio of 19.8%.

This will allow the government to borrow money for infrastructure improvements that will enhance productivity. They have the room to take on debt. Not to say that the country is some rundown dusty post-soviet hell hole in the first place. The country’s capital Tashkent has an awesome metro that the soviets built.

Why Should I Invest In Uzbekistan

The country also has the following going for it:

- Over $4 billion in FDI projected for 2019

- Sizable natural resource base (6th in cotton, 7th in production of uranium, 9th in gold production, 18th in natural gas,)

- 33 million consumers, 36% urbanization with 2030 target of 60%

- Inexpensive labor force accompanied by a domestic industrial manufacturing complex

- Foreign remittances of USD 3.8 billion in 9m 2018

Uzbekistan has been pursuing business friendly policies since the new market orientated leadership took over in 2016:

- Floating of the currency and elimination of capital controls

- No foreign ownership restrictions

- Foreigners can own property and companies with no Uzbek ownership/representative

- Drafting new, streamlined tax code, expected 30th September 2019

- Privatization of SOE’s (State Owned Enterprises) in financial services, construction, consumer goods and manufacturing sectors

- All banks required to comply with Basel III by 2020

- Uzbekistan working to enter the WTO and Eurasian Economic Union

- Government initiating an aggressive anti-corruption and digitalization campaign to ensure transparency

- Visa exemptions for foreign visitors, 3-year business/work visas

Plus, and one of the main reasons to invest is that the place is really cheap:

Many companies on the Tashkent Stock Exchange are trading at a P/E of less than 5 times and are offering dividend yields of up to 25%.

How To Invest In Uzbekistan

It is possible for a foreigner to open a brokerage account in Uzbekistan. However, if you are an accredited investor, I would recommend taking a look at the Asia Frontier Capital- Uzbekistan Fund.

The fund just started up back in March of this year. I went this route as I know the people at AFC and I have confidence that they will pursue a boots on the ground methodology as they seek out ways to deploy capital.

I know most people reading this will never even think about investing in a frontier market like Uzbekistan. However, these places are implementing positive policy changes that will, if consistently applied, lead to continued growth.

These places are typically not highly correlated to western markets. I admit if we have a psychotic break in the markets everything will go down. Nevertheless, who is investing with that scenario as their focus?

We have seen what 5-10% compounded annual growth from a low base can do if we look at some of the Asian Tigers like Thailand, Vietnam, Malaysia, and Korea back in its growth phase.

With returns in the west getting scarce and economic growth structurally slowing it is prudent to look at places that will allow diversification and give growth from a low base with very low valuations.