Why am I talking about Greece as possibly being on the investment radar? During last week’s EU Parliamentary elections, the center right New Democracy party trounced ruling Prime Minister Alexis Tsipras’ Syriza party by 9 points.

Tsipras is not up for re-election until this October but decided to call for snap elections in July as his and his party’s support is shrinking and would presumably slip even more by October.

It now seems likely that New Democracy will win the snap elections and be able to form a government with other parties if not win an outright majority.

This is being deemed positive for the Greek economy and Greek asset prices.

An Al Jazeera article noted the following about the Greek economy:

“Greece lost a quarter of its economic output during its eight-year depression. Unemployment peaked at 28 percent in 2013 and remains at 19 percent. Economists record it as the worst contraction of any developed economy since World War II. And although a recovery did begin under Syriza, it has been weak. The economy grew by less than two percent in 2018, a performance it is set to repeat this year.”

(skip)

New Democracy leader Kyriakos Mitsotakis has promised a restart of the economy. He says he will lower tax on businesses from 29 percent to 20 percent in two years and lower income tax on farmers from 22 percent to 10 percent.

He also says he will seek to create 700,000 new jobs in five years and has pledged to bring home at least half a million of the 860,000 skilled workers who, according to the Hellenic Statistical Service, have left the country since 2009.

What New Democracy will be able to accomplish will hinge on whether they get 40% of the vote and can rule without any coalition partners. Their plan will also depend on whether they can renegotiate repayment terms on their debt with the EU and IMF while being able to focus some of that money on rebuilding the Greek economy.

I do think they will be able to get some stalled economic projects moving and reduce taxes and regulations which will take some of the pressure off business.

In my view this is an excellent setup for a bad situation to goto less bad. When we have seen this happen in other places i.e.; the US after Trump’s election, India after Modi’s first election victory, and Argentina after Macri was first elected the result was a nice initial advance in those stock markets.

I would note that the Greek market is the most undervalued developed stockmarket in the world according to the CAPE ratio. If you are unfamiliar with the CAPE ratio here is a short article on how I use it to identify undervalued markets.

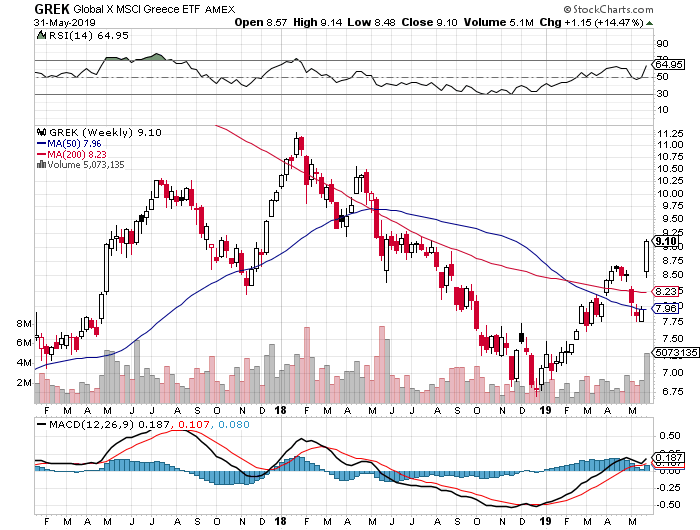

Based on what is likely to happen in the upcoming Greek elections we could see a nice move in Greek stocks over the next 6-12 months.

I am long the Greece ETF (GREK)

Interested in knowing how I translate the information in these posts into investment ideas?

Consider a subscription to my paid newsletter “Actionable Intelligence Alert”. You can check it out by going to:

actionableintelligencealert.com/subscribe

I have started up a Patreon account for those that wish to help support my work. Check it out here:

https://www.patreon.com/JohnPolomny

If you pledge at least $5.00 I will send you the current months stock pick. This way you can sample the “Actionable Intelligence Alert” newsletter and see if it is for you.