Longtime readers and subscribers know I am big into oil tankers as I think they are way undervalued and possibly entering a super cycle to the upside.

The reason I think this is because this is a commodity business and the supply of tankers is shrinking along with the proposed building of new tankers.

Great article from Shipbrief.com this week illustrates the point:

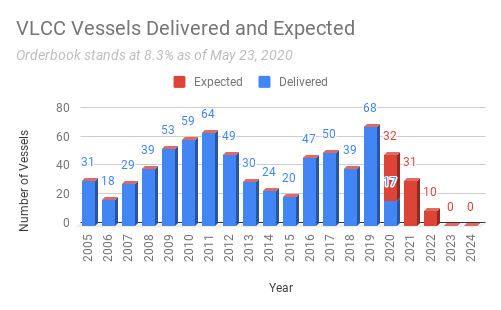

Typically an orderbook representing less than 15% of the current trading fleet is a good thing. Less than 10% is bullish given normal trading patterns.

Two exceptionally rare things are happening here; an orderbook if just 8.3% and zero deliveries scheduled for 2023.

In fact, the VLCC orderbook is at its thinnest mark this century.

You will note the current order book is at 8.3% of the fleet which is considered bullish for tanker rates going forward.

Given that the recent economic collapse has placed a premium on strong balance sheets (just look at broad market stock price performance for proof), newbuild orders may continue to take a back seat in favor of financial stewardship.

Aside from that we have seen the prospect of IMO 2030 coming into play which will likely address particulate matter and carbon emissions. Without clarity on that front owners may hesitate placing new orders out of the fear they may face expensive retrofits down the road. Retrofits that could have been addressed in the shipyard for much less during the newbuild process had they waited.

Finally, the average age of the tanker fleet continues to climb with Afras and Suezmaxes at 10 years and VLCCs approaching that same mark. This signals a decent number of demolition candidates which should help keep the market tight and also act as a relief valve during times of abnormally low charter rates.

Most people focus on the day to day or week to week reporting of new vessel charters and the rates that they are chartered at. This is a mistake in my view as the longer term supply/demand fundementals are mvong in favor of higher rates.

I believe that rates will be volatile along with tanker stock prices. Nevertheless, the longer term fundementals are definetly in our favor.